Embark on a Lucrative Journey into the Financial Markets

In the realm of finance, data has become an indispensable asset, illuminating patterns and predicting trends with unmatched accuracy. Data science, a discipline that harnesses the power of statistics, machine learning, and advanced computing, is revolutionizing the way traders navigate the complex world of options trading. With its ability to process vast amounts of data, identify hidden correlations, and forecast market behavior, data science empowers traders to make informed decisions and maximize their profit potential.

Image: www.financebrokerage.com

Delving into the Essence of Options Trading

Options, financial derivatives that grant the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price and time, have become an integral part of the financial landscape. They provide traders with a wide range of strategies, allowing them to hedge against risk, speculate on price movements, and generate income through premiums. Data science plays a crucial role in options trading, enabling traders to analyze market conditions, identify potential trading opportunities, and optimize their strategies.

Transforming Options Trading with Data Science

The integration of data science into options trading has transformed the industry, enhancing decision-making and improving profitability. Here’s how data science empowers traders:

-

Advanced Market Analysis: Data science algorithms can sift through vast amounts of historical market data, uncovering patterns, correlations, and anomalies. This enables traders to make informed decisions about option premiums, strike prices, and expiration dates.

-

Predictive Modeling: Machine learning models, trained on historical data and real-time market conditions, can predict future price movements with remarkable accuracy. This predictive capability allows traders to identify potential trading opportunities and optimize their strategies.

-

Risk Management: Data science techniques enable traders to assess and mitigate risks associated with options trading. By simulating market scenarios and analyzing risk-reward profiles, traders can make informed decisions to protect their capital.

-

Automated Trading: Data science algorithms can be integrated into automated trading platforms, allowing traders to execute trades based on pre-defined conditions. This eliminates emotions and biases from the trading process, resulting in consistent performance.

Expert Tips for Data Science Options Trading

To harness the full potential of data science for options trading, consider the following expert advice:

- Start by understanding the basics. Acquire a comprehensive understanding of data science fundamentals, including statistics, machine learning, and programming.

- Gain proficiency in a programming language. Python, R, and MATLAB are widely used for data science applications in finance.

- Build foundational analytical skills. Study probability, statistical modeling, and time series analysis to develop a solid foundation for data analysis.

- Seek industry-specific knowledge. Familiarize yourself with options trading strategies, pricing models, and risk management techniques.

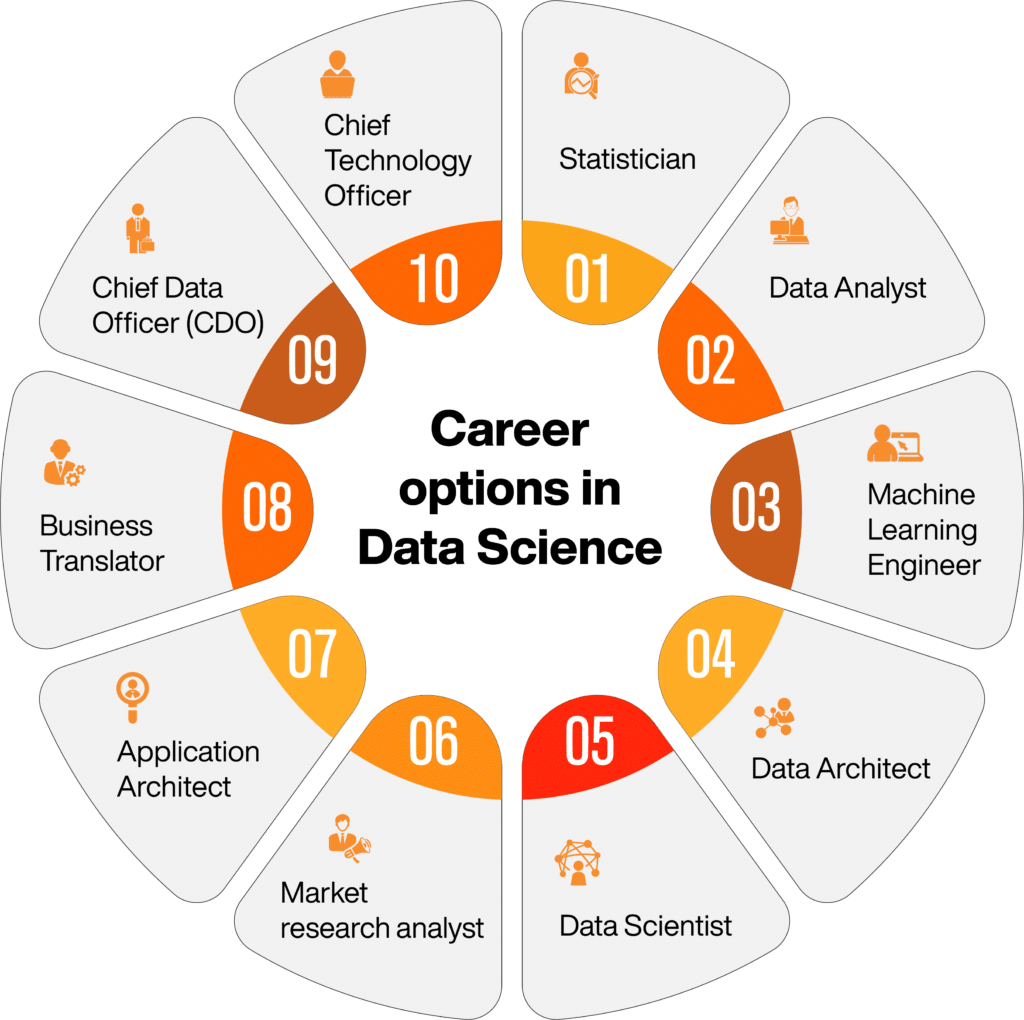

Image: www.onlinemanipal.com

Frequently Asked Questions (FAQs)

Q: How do I get started with data science for options trading?

A: Start by gaining a strong foundation in data science fundamentals, proficiency in a programming language, and deep understanding of options trading.

Q: What are some reputable resources for learning data science for options trading?

A: Coursera, Udemy, and edX offer specialized courses and certifications tailored for data science in finance.

Q: Is data science a viable career option in options trading?

A: Yes, data scientists with expertise in options trading are in high demand due to the crescente popularity and effectiveness of data-driven trading strategies.

Data Science Options Trading

Image: www.fitsnews.com

Conclusion: Unveiling a World of Opportunities

Data science has opened up a world of opportunities for traders in the options market. By harnessing its power, traders can gain an edge over the competition, make informed decisions, and maximize their profit potential. Are you ready to embrace the transformative power of data science for options trading? The journey begins with the first step.