Trading options is a popular way to speculate on the future price movements of an underlying asset. Options traders can use a variety of strategies to profit from price changes, including buying and selling options, writing options, and using options to hedge other positions. One of the most common option trading strategies is gamma option trading.

Image: tradeproacademy.com

What is Gamma Option Trading?

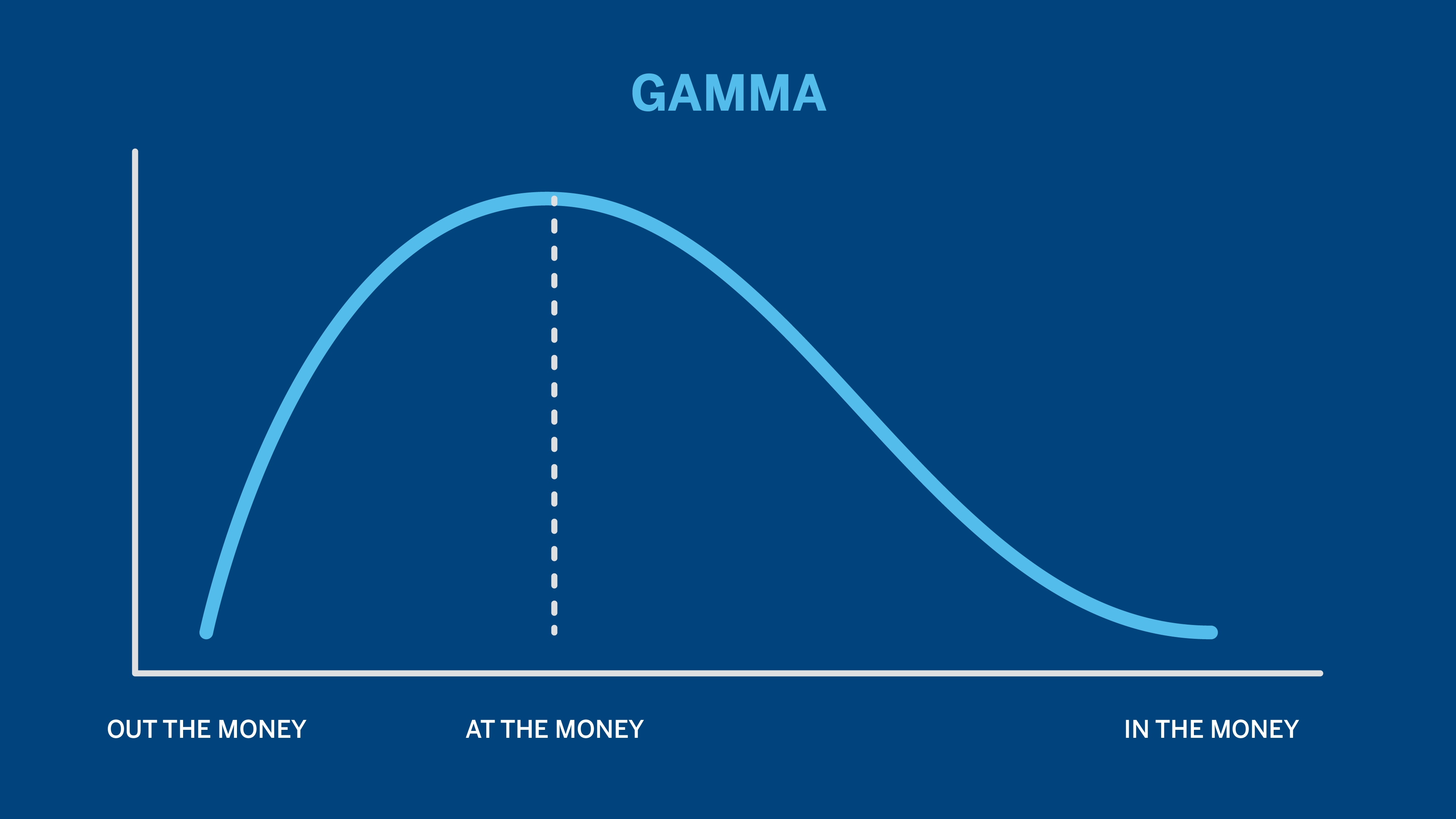

Gamma trading is a neutral option trading strategy that seeks to profit from changes in the delta of an option. The delta of an option measures the rate of change of the option’s price relative to the price of the underlying asset. When the delta of an option is high, the option’s price will move more than the price of the underlying asset. When the delta of an option is low, the option’s price will move less than the price of the underlying asset.

Gamma traders typically buy options with high delta and sell options with low delta. This allows them to profit from both increases and decreases in the price of the underlying asset. For example, if a gamma trader buys a call option with a delta of 0.8 and sells a call option with a delta of 0.2, they will profit if the price of the underlying asset increases. This is because the delta of the call option they bought will increase, while the delta of the call option they sold will decrease.

Benefits of Gamma Option Trading

There are a number of benefits to using gamma option trading strategies. First, gamma option trading can be used to profit from both increases and decreases in the price of the underlying asset. This makes it a more versatile strategy than strategies that only profit from one type of price movement.

Second, gamma option trading can be used to hedge other positions. For example, a trader who is long a stock may buy a put option with a high delta to hedge against the risk of a decline in the price of the stock.

Third, gamma option trading can be used to generate income. Gamma traders can sell high delta options and collect the premium from the sale. This premium can provide a steady stream of income, even if the price of the underlying asset does not move.

Risks of Gamma Option Trading

There are also a number of risks associated with gamma option trading. First, gamma option trading can be more complex than other option trading strategies. This is because gamma traders need to understand how the delta of an option changes in response to changes in the price of the underlying asset.

Second, gamma option trading can be more risky than other option trading strategies. This is because gamma traders are exposed to the risk of both increases and decreases in the price of the underlying asset.

Third, gamma option trading can be more expensive than other option trading strategies. This is because gamma traders often need to buy and sell multiple options to create a gamma trading strategy.

Image: www.cmegroup.com

Tips for Gamma Option Trading

Here are a few tips for gamma option trading:

- Start with a small position size. This will help you to manage your risk if the price of the underlying asset moves against you.

- Choose options with high delta. This will help you to maximize your profits if the price of the underlying asset moves in your favor.

- Use limit orders to enter and exit your positions. This will help you to prevent your orders from being executed at unfavorable prices.

- Monitor your positions closely. This will help you to identify any potential problems and take action to protect your profits.

FAQ on Gamma Option Trading

- Q: What is gamma option trading?

- Q: What are the benefits of gamma option trading?

- Q: What are the risks of gamma option trading?

- Q: What are some tips for gamma option trading?

A: Gamma option trading is a neutral option trading strategy that seeks to profit from changes in the delta of an option.

A: The benefits of gamma option trading include the ability to profit from both increases and decreases in the price of the underlying asset, hedging other positions, and generating income.

A: The risks of gamma option trading include complexity, volatility, and expense.

A: Some tips for gamma option trading include starting with a small position size, choosing options with high delta, using limit orders, and monitoring your positions closely.

Gamma Option Trading

https://youtube.com/watch?v=kJzU3ysv0YM

Conclusion

Gamma option trading is a powerful strategy that can be used to profit from both increases and decreases in the price of an underlying asset. However, it is important to understand the risks involved before trading gamma options. Please share with us in the comment section below if there is any topic you want to read more about, we’d be happy to shed some light on it for you and explain complicated concepts in simple terms.

We would also love to hear from you if you are interested in learning more about gamma option trading or other related topics. Don’t hesitate to contact us with any questions!