Introduction

Imagine a scenario where you can exponentially amplify your trading profits by manipulating the sensitivity of options instruments. This concept, known as gamma options trading, empowers traders with an unparalleled level of control over their positions, opening up avenues for remarkable returns. Gamma options trading holds immense significance in the financial realm, enabling investors to hedge risks, generate lucrative premiums, and profit from market volatility. In this comprehensive guide, we will delve into the intricacies of gamma options trading, exploring its history, fundamental principles, and practical applications. We will also unlock the secrets of successful gamma trading strategies, providing invaluable insights from industry experts to enhance your trading prowess.

Image: optionshawk.com

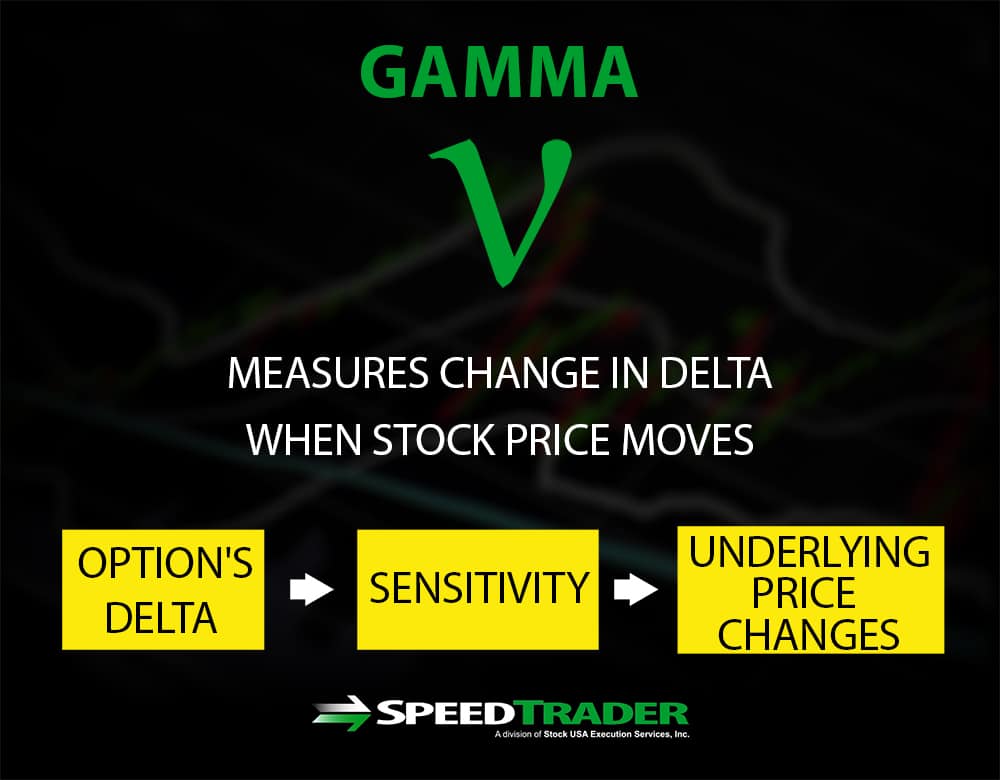

Understanding Gamma

Gamma measures the rate of change in an option’s delta, which represents the sensitivity of an option’s price to changes in the underlying asset’s price. In other words, gamma quantifies how much the delta of an option changes for each unit change in the underlying asset’s price. Higher gamma indicates greater sensitivity, while lower gamma indicates lesser sensitivity. This concept is crucial for understanding how options behave and how traders can exploit these dynamics to their advantage.

Positive vs. Negative Gamma

Gamma can be either positive or negative. Positive gamma means that the delta of the option increases as the underlying asset’s price increases. This is typically associated with long calls and short puts. Conversely, negative gamma means that the delta of the option decreases as the underlying asset’s price increases. This is usually observed with long puts and short calls. The sign of gamma determines how an option’s price will respond to price movements in the underlying asset.

Gamma Trading Strategies

Gamma trading involves employing strategies that capitalize on the sensitivity of options. One common strategy is the gamma squeeze, where traders buy or sell a significant number of options with high gamma to force market participants to adjust their positions, leading to price spikes and potential profits. Another popular strategy is delta hedging, where traders dynamically adjust their option positions to maintain a desired level of delta exposure, reducing risk and enhancing returns.

Image: speedtrader.com

Expert Insights on Gamma Trading

Renowned options trader Mark Sebastian emphasizes the importance of understanding gamma and its implications. He advises that traders should “be aware of the gamma of their positions and how it will affect their profit and loss as the underlying moves.” Financial commentator Jim Cramer also highlights the potential of gamma trading, stating, “If you’re going to trade options, you need to understand gamma. It’s one of the most important concepts in options trading.”

Real-World Applications

Gamma options trading finds applications in various scenarios. For instance, traders can use it for hedging against price fluctuations, generating income through premium selling, and profiting from expected volatility or market uncertainty. Moreover, gamma trading can be integrated with other trading techniques to create complex strategies that maximize returns while minimizing risks.

Gamma Options Trading

Conclusion

Gamma options trading offers traders a potent tool to enhance their trading capabilities and unlock new avenues for profitability. By comprehending the concept of gamma and its applications, investors can effectively navigate market fluctuations, implement innovative trading strategies, and achieve remarkable returns. It is crucial to approach gamma trading with knowledge, caution, and a thorough understanding of its potential risks and rewards. By leveraging the insights and guidance provided in this article, individuals can confidently harness the power of gamma options trading to propel their financial success.