Imagine a financial chameleon that can adapt to anticipate market movements with uncanny precision. This is the essence of implied volatility (IV) trading, where traders harness the expectations embedded in option prices to navigate the ever-shifting tides of financial markets.

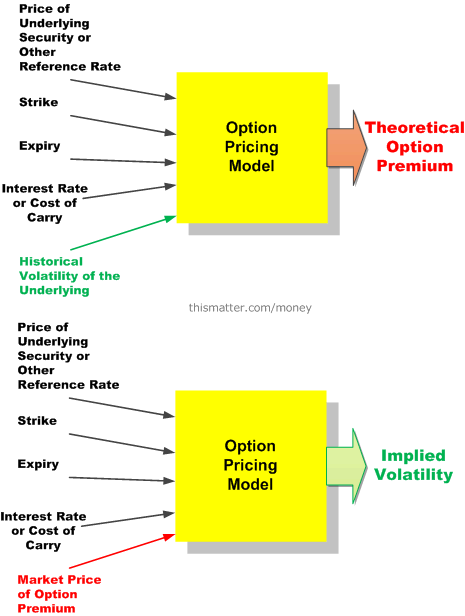

Image: thismatter.com

What is Implied Volatility (IV)?

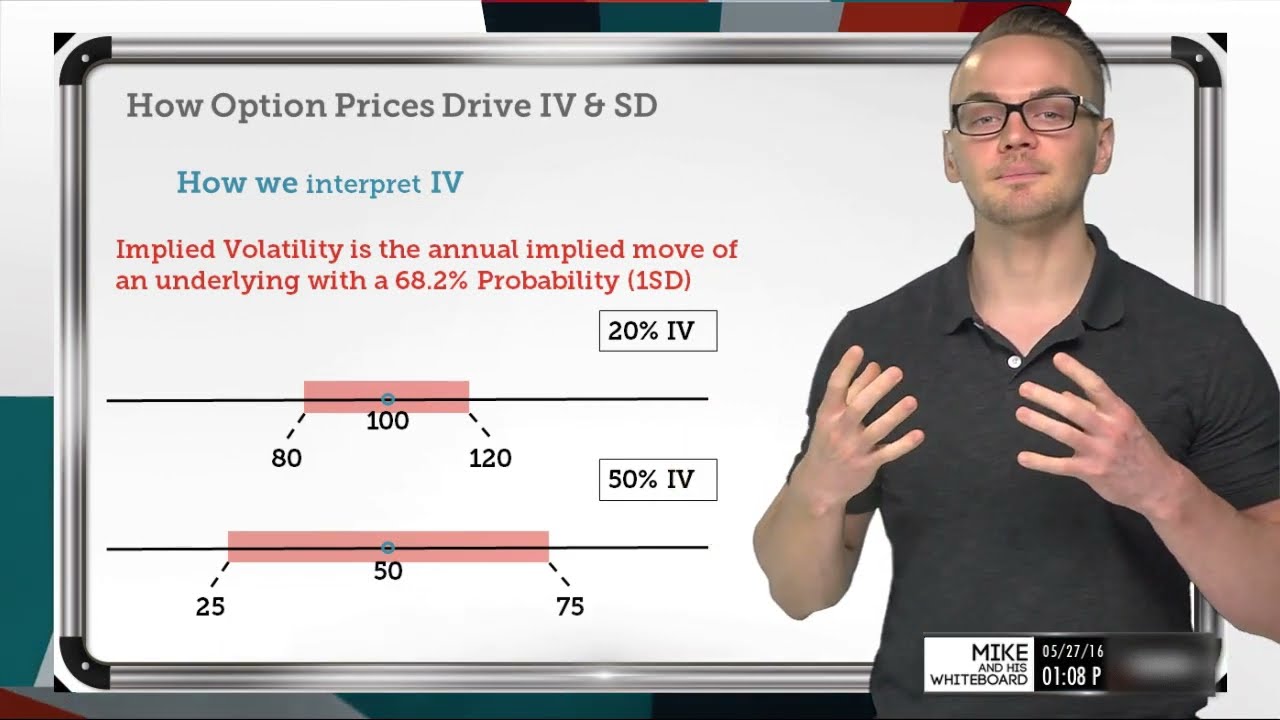

IV is a measure of the market’s perceived volatility of an underlying asset, such as a stock or currency. It is inferred from the prices of options contracts, which grant buyers the right to buy (call options) or sell (put options) an asset at a specific price (strike price) on a certain date (expiration date).

A higher IV indicates that the market anticipates greater price fluctuations in the future. Conversely, a lower IV suggests a calmer outlook, implying narrower trading ranges.

The Role of IV in Option Pricing

IV plays a crucial role in determining option premiums, the prices paid for purchasing an option contract. Higher IV results in higher premiums, reflecting the potential for larger price swings. This relationship arises because options provide leverage, amplifying both gains and losses as the underlying asset’s price changes.

The Art of IV Trading

Traders capitalize on IV by exploiting its impact on option valuations. Here’s how it works:

- Selling IV: When IV is inflated relative to realized volatility (the actual price volatility), traders sell options to capitalize on the overvaluation. If volatility remains low, the options will expire worthless, resulting in a profit for the seller.

- Buying IV: Alternatively, when IV is unusually low, traders buy options, banking on a rise in volatility. If volatility surges, the options will appreciate in value, leading to a potential profit for the buyer.

Image: www.youtube.com

Strategies for Successful IV Trading

Successful IV trading requires a combination of analytical precision and market timing. Key strategies include:

- Historic Volatility Analysis: Studying past volatility patterns helps traders identify potential IV over- or undervaluations.

- Implied Volatility Skewness: Different strike prices and expiration dates often have different IVs, creating skewness in the volatility curve. Savvy traders exploit this asymmetry.

- Event-Based Volatility: News and events can significantly impact IV. Traders monitor these factors to anticipate and profit from short-term volatility spikes.

Implied Volatility Trading Options

Image: www.youtube.com

Conclusion

Implied volatility trading options is an advanced trading technique that empowers traders to leverage market expectations. By understanding and exploiting IV dynamics, traders can unlock new opportunities and enhance their risk management strategies. As always, it’s crucial to conduct thorough research and exercise caution when trading options.