Introduction

Image: www.bank2home.com

In the realm of financial markets, options trading has emerged as a powerful tool for astute investors and sophisticated traders. With its potential for sizable returns and precise risk management, options trading has attracted widespread interest. However, navigating the complexities of options trading can be daunting for individuals lacking a solid understanding of the underlying concepts and mechanics. An options trading Excel sheet template can serve as an invaluable asset, providing a systematic and efficient way to analyze, execute, and track options strategies.

Understanding the basics of options trading is paramount. An option is a financial contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date (expiration date). The buyer of an option pays a premium to the seller, who incurs the obligation to fulfill the contract if the buyer exercises their right. This exchange of rights and obligations creates unique opportunities for profit and loss based on predicting the movement of the underlying asset.

Understanding Options Trading Excel Sheet Template

An options trading Excel sheet template is a pre-designed spreadsheet that automates complex calculations and analysis related to options trading. It typically includes features such as:

-

Option Pricing Models: The template incorporates popular option pricing models, such as the Black-Scholes model, to calculate the fair value of an option based on its characteristics. This allows traders to make informed decisions about option premiums and potential returns.

-

Implied Volatility: The template calculates implied volatility (IV), a key indicator of market sentiment towards the underlying asset and its expected price movement. Traders can use IV to gauge market volatility and adjust their trading strategies accordingly.

-

Greeks: The template provides real-time calculation of Greeks, which are sensitivities that measure how the price of an option responds to changes in various parameters, such as the underlying price, time decay, and interest rates. This information is crucial for risk assessment and portfolio management.

-

Profit/Loss Analysis: The template simulates option payoffs across a range of prices for the underlying asset and presents profit/loss scenarios. This enables traders to visualize the potential outcomes of different trading strategies before committing capital.

Benefits of Using an Options Trading Excel Sheet Template

-

Time Efficiency: The automated calculations and analysis provided by the template save traders a significant amount of time and effort that would otherwise be spent on manual computation. It allows for quicker analysis and more informed decision-making.

-

Accuracy: The template eliminates the risk of errors associated with manual calculations and ensures precise results. This accuracy is especially critical when dealing with complex options strategies involving multiple variables.

-

Customization: Spreadsheets can be customized to meet individual trading styles and preferences. Traders can incorporate their own formulas, adjust default settings, and create tailored dashboards for quick access to key information.

Conclusion

An options trading Excel sheet template is a valuable tool that simplifies and enhances the process of options trading. It empowers traders with the ability to quickly and accurately analyze option prices, assess risk, and optimize their trading strategies. Whether you are an experienced trader or just starting out, an options trading Excel sheet template can provide the essential support to navigate the complex and rewarding world of options trading. By leveraging this powerful resource, traders can gain a competitive edge and make more informed decisions to maximize their returns.

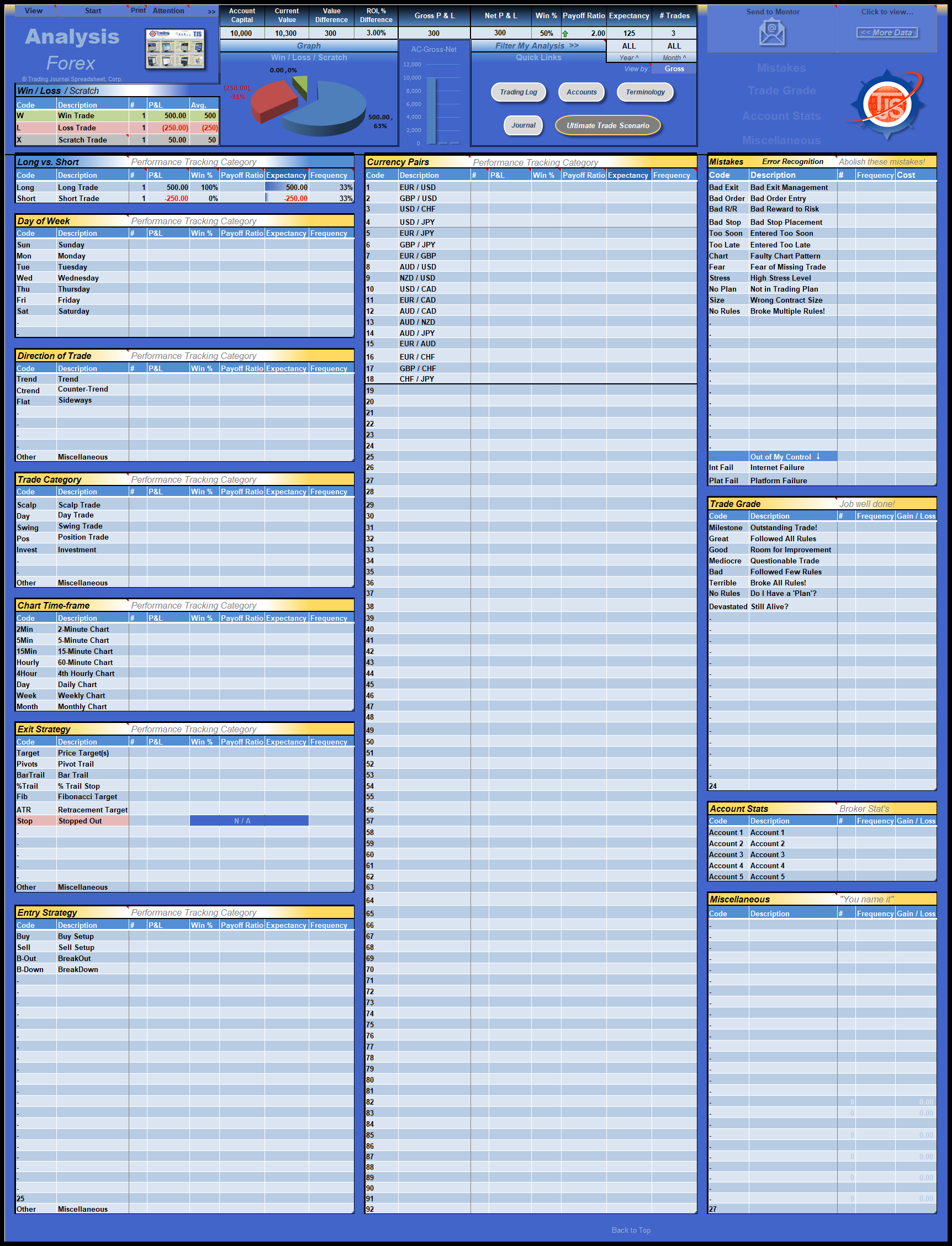

Image: trading-journal-spreadsheet.com

Options Trading Excel Sheet Template

Image: peacecommission.kdsg.gov.ng