Introduction:

Image: www.projectoption.com

In the realm of financial markets, options trading plays a crucial role in managing risk and enhancing returns. At the heart of options trading lies implied volatility, a concept that gauges the market’s expectations of future price movements. Understanding implied volatility is pivotal for traders seeking to make informed decisions and maximize their earnings. This comprehensive guide will delve into the intricacies of options trading implied volatility, empower you with practical tips, and equip you with the knowledge to navigate these complex waters.

Understanding Options Trading Implied Volatility:

Options, financial instruments derived from underlying assets like stocks or commodities, grant traders the right (but not the obligation) to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) within a specified period (expiration date). Implied volatility measures the market’s anticipation of how much the underlying asset’s price might fluctuate by the expiration date. It is expressed as an annualized percentage and serves as a key indicator of market sentiment.

Factors Influencing Implied Volatility:

Implied volatility is influenced by several factors, including:

- Historical Volatility: Past price fluctuations of the underlying asset serve as a guide for implied volatility. Higher historical volatility typically leads to higher implied volatility.

- Current News and Events: Market-moving news and events, such as earnings reports or economic data, can impact implied volatility.

- Time to Expiration: Implied volatility tends to be higher when there is a longer duration until the expiration date.

- Supply and Demand: Higher demand for options (call buying or put selling) can result in elevated implied volatility.

- Sentiment: Market optimism or pessimism can influence implied volatility.

Applications of Implied Volatility:

Grasping implied volatility offers numerous advantages for traders:

- Gauging Market Expectations: Implied volatility provides insights into how the market perceives the future price trajectory of an underlying asset.

- Pricing Options: Traders use implied volatility to calculate the fair value of options contracts, ensuring they purchase or sell at reasonable prices.

- Developing Trading Strategies: Implied volatility data helps traders devise tailored strategies, such as volatility-based spreads or theta decay plays, to exploit market conditions effectively.

- Hedging Positions: Implied volatility assists portfolio managers in hedging against price swings and managing risk.

Expert Insights and Actionable Tips:

Renowned trader Mark Douglas emphasizes the need to:

- Understand Volatility Skew: Different strike prices and expiration dates can exhibit varying implied volatility levels, offering opportunities for astute traders.

- Monitor Implied Volatility Regularly: Tracking changes in implied volatility can provide valuable indications of market shifts and potential trading signals.

- Stay Disciplined: Implied volatility is a dynamic measure, and traders must adhere to their trading plans rather than succumbing to emotional impulses.

Conclusion:

Unveiling the secrets of implied volatility in options trading opens up a wealth of opportunities for traders. By studying historical patterns, gauging market sentiment, and leveraging the insights of experts, you can enhance your decision-making, optimize trades, and ultimately achieve your financial goals. Remember, the market is constantly evolving, so continuous learning and adaptation are essential traits in the realm of options trading.

Image: www.educba.com

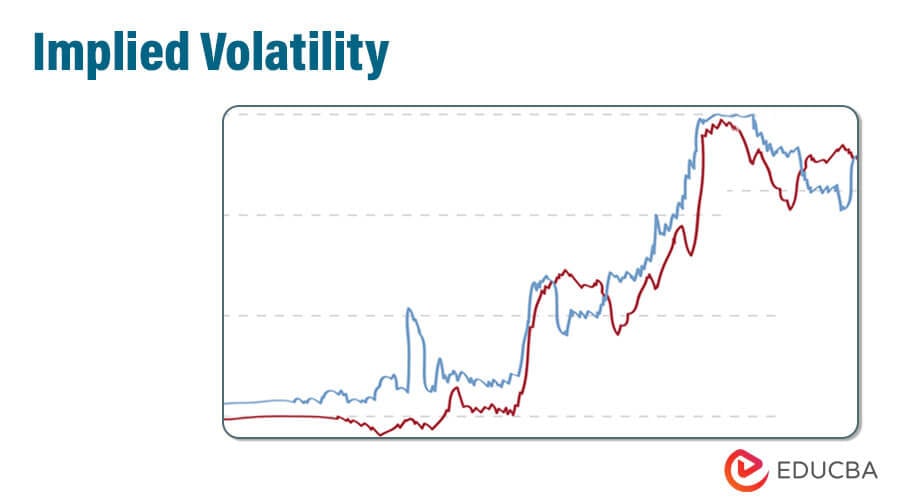

Options Trading Implied Volatility