Understanding Implied Volatility: A Key to Unlocking Options Trading Success

In the realm of financial markets, implied volatility (IV) plays a crucial role in the pricing of options contracts. Options, derivative instruments that provide the right, but not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date, derive their value from the underlying asset’s price and IV. By understanding the concept of IV and its impact on options pricing, traders can make informed decisions that enhance their trading strategies.

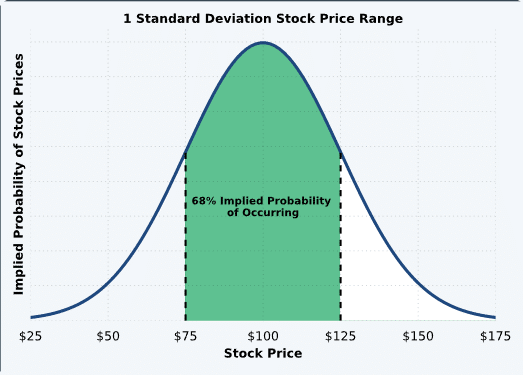

Image: www.projectfinance.com

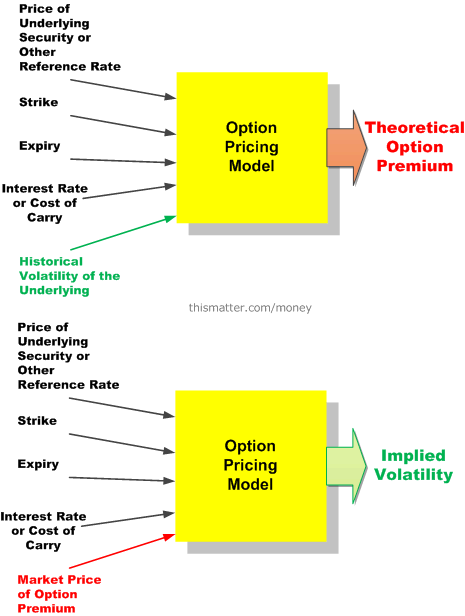

Implied volatility is a forward-looking measure of the expected price movement of the underlying asset within a specific time frame. Calculated using complex mathematical models, IV encapsulates market participants’ expectations regarding the volatility of the underlying asset, serving as an indicator of the perceived risk and uncertainty associated with it.

Leveraging Implied Volatility in Options Trading

The significance of IV in options trading lies in its direct impact on option premiums. Options with higher implied volatility command a higher premium, reflecting the market’s anticipation of significant price movements. Conversely, options with lower IV carry lower premiums. This relationship between IV and option premiums opens up avenues for traders to craft strategic trading strategies:

Capitalizing on IV Expansion:

When implied volatility increases, option premium rises. Traders can capitalize on this situation by purchasing call or put options on the underlying asset, anticipating that its price will move accordingly. As IV expands, so does the option’s premium, allowing traders to potentially reap significant profits.

Hedging against Potential IV Contraction:

Implied volatility can also decrease, leading to a decline in option premiums. Traders can hedge against this potential by selling call or put options, betting that the underlying asset’s price will remain relatively stable. If IV contracts, the premiums they collect will outweigh any potential losses stemming from price movements.

Image: cafeforexvn.com

Trading Implied Volatility: A Standalone Strategy:

Some traders choose to trade implied volatility itself, speculating on its direction rather than the underlying asset’s price. They buy volatility-tracking exchange-traded funds (ETFs) or engage in options strategies that seek to profit from changes in IV.

Monitoring and Forecasting Implied Volatility

To effectively leverage IV in options trading, it’s essential to monitor and forecast its movements. Several factors influence implied volatility, including:

- Historical volatility: Past price fluctuations of the underlying asset

- Current market conditions: Economic data, news events, and prevailing market sentiment

- Time to expiration: Options with shorter expiration dates typically have higher IV than long-dated ones

- Open interest: The number of outstanding options contracts affects IV

Traders can use historical data, technical analysis, and market news to form their IV forecasts. By carefully considering these factors, they can make informed decisions about when to enter or exit options trades based on IV expectations.

Trading Options With Change In Implied Volatility

Image: thismatter.com

Conclusion

Implied volatility is a fundamental concept in options trading that provides traders with a valuable tool to understand market expectations and position themselves for potential profit. By understanding the factors that influence IV, monitoring its movements, and integrating it into their trading strategies, traders can navigate the complexities of options markets more effectively and increase their chances of success. As implied volatility continues to shape the options landscape, it empowers traders to make informed decisions and unlock the full potential of this versatile financial instrument.