Venturing into the realm of option trading often sparks questions about associated costs, and ETrade is a renowned platform among traders. Understanding the cost structure of ETrade’s option trading services is crucial for informed decision-making. This comprehensive guide delves into the various costs traders incur when executing option trades through E*Trade, empowering them to optimize their trading strategies.

Image: cogodi.blogspot.com

Demystifying E*Trade’s Option Trading Fees

ETrade’s option trading fees encompass two primary components: commissions and exchange fees. Commissions represent the charges levied by ETrade for facilitating the trade, while exchange fees are imposed by the exchanges where the trades are executed.

Commission Structure

E*Trade’s commission structure for options contracts is tiered based on the number of contracts traded per month. The tiers are as follows:

- 0-499 contracts: $0.65 per contract

- 500-999 contracts: $0.60 per contract

- 1,000+ contracts: $0.55 per contract

Exchange Fees

In addition to E*Trade’s commissions, traders are also subject to exchange fees, which vary depending on the exchange where the trade is executed. These fees typically range from $0.05 to $0.15 per contract.

Image: thebrownreport.com

Additional Costs: Option Assignment and Exercise

Option assignment and exercise, which involve taking ownership of or selling the underlying asset, respectively, also incur additional costs. Assignment fees range from $15 to $25 per contract, while exercise fees are typically $0.15 per contract.

Factors Influencing Option Trading Costs

Beyond the base feesoutlined above, several factors can influence the overall costs of option trading with E*Trade:

- Contract type: Equity options generally carry higher fees than index or ETF options.

- Volatility: Options with higher volatility tend to command higher fees.

- Market conditions: Market volatility and trading volume can impact exchange fees.

- Account type: E*Trade offers different account types with varying fee structures; traders should select the account that best suits their trading needs.

Minimizing Option Trading Costs with E*Trade

Strategic trading decisions can help traders minimize their option trading costs with E*Trade:

- Tiered pricing: Traders who frequently execute high volumes of contracts can benefit from E*Trade’s tiered pricing structure.

- Volume discounts: E*Trade offers volume discounts to traders who trade a significant number of contracts per month.

- Bundling: Combining option trades with other investment products offered by E*Trade can lead to cost savings.

How Much Etrade Cost For Option Trading

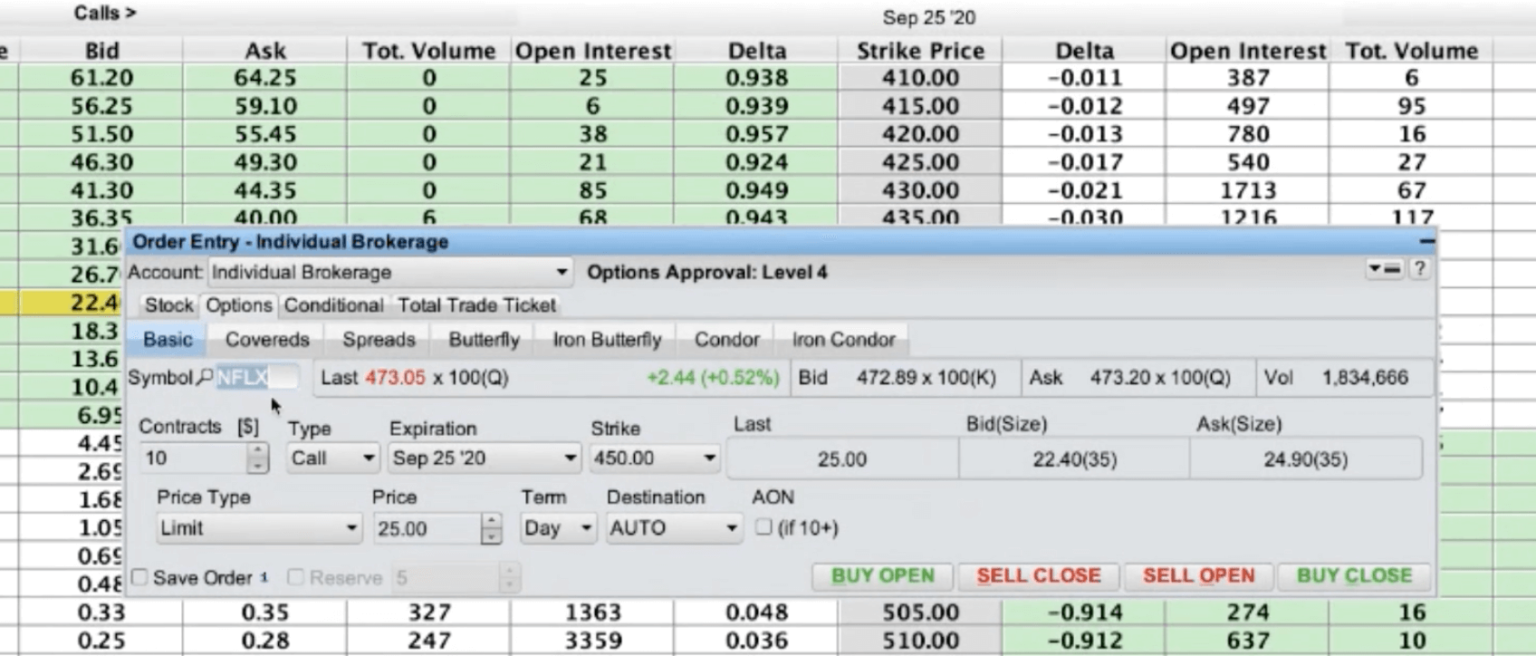

Image: www.fondazionealdorossi.org

Conclusion: Balancing Costs and Value in E*Trade’s Option Trading

Understanding ETrade’s option trading cost structure is essential for traders to make informed decisions and optimize their strategies. While fees are an unavoidable aspect of trading, traders can minimize their impact through careful planning and a thorough understanding of the cost structure. By balancing the costs against the potential rewards of option trading, traders can leverage ETrade’s platform to enhance their trading outcomes effectively.