As an avid trader, I’ve encountered a wide array of platforms, each with unique pricing structures. When it comes to options trading, E*TRADE stands out as a popular choice, offering a comprehensive platform with competitive costs. In this article, I’ll delve into the intricacies of E*TRADE’s options trading fees, providing a detailed overview to empower your investment decisions.

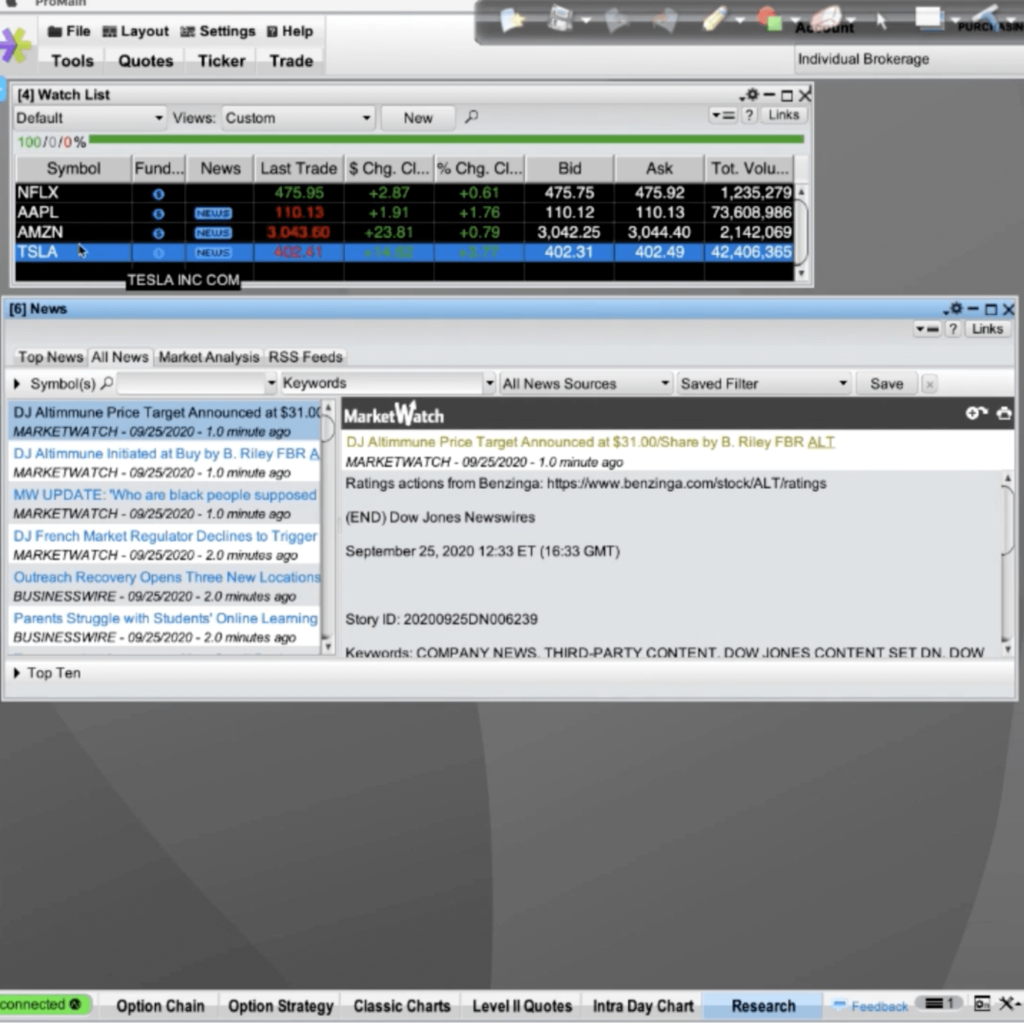

Image: thebrownreport.com

Options trading involves granting contracts that bestow the right, but not the obligation, to buy or sell a stock at a predetermined price on a specified future date. These contracts carry a premium, which represents the cost of acquiring the option.

Understanding E*TRADE’s Options Trading Fees

E*TRADE employs a straightforward pricing structure for options trading, comprising two primary components: commissions and exchange fees.

Commissions

Commissions are charged for each trade executed. E*TRADE offers a tiered pricing system based on monthly trade volume:

- 0-499 trades: $0.65 per contract

- 500-999 trades: $0.60 per contract

- 1,000+ trades: $0.50 per contract

For example, if you execute 100 trades in a month, you’ll pay $0.65 per contract, resulting in a total commission of $65.

Exchange Fees

In addition to commissions, E*TRADE also passes through exchange fees. These fees are paid to various options exchanges where trades are executed. Exchange fees are typically $0.05 per contract, but they may vary depending on the exchange and the type of option traded.

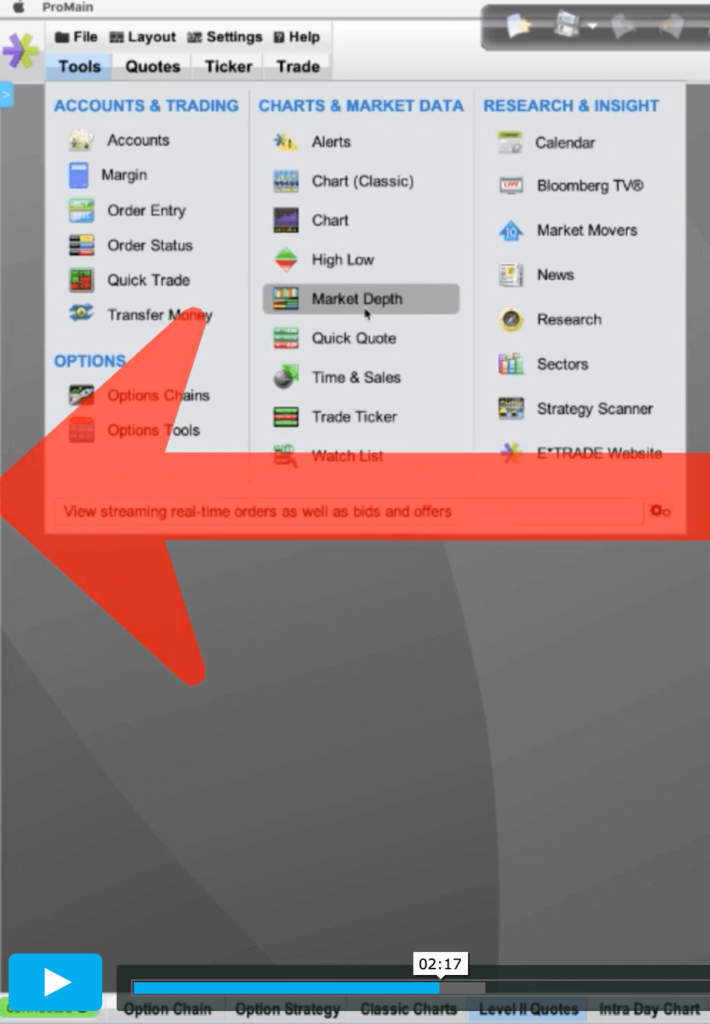

Image: thebrownreport.com

Total Costs

To calculate the total cost of an options trade on E*TRADE, simply add the commission and exchange fee. For instance, if you execute a 100-contract trade with a monthly trade volume of 500-999, the total cost would be:

Commission: 100 contracts x $0.60 = $60

Exchange fee: 100 contracts x $0.05 = $5

Total cost: $60 + $5 = $65

Tips and Expert Advice

Here are a few tips to optimize your options trading costs on E*TRADE:

- Increase trading volume: Trading more frequently qualifies you for lower commission rates.

- Negotiate lower commissions: If you’re a high-volume trader, you may be eligible for negotiated commissions.

- Consider alternative pricing plans: E*TRADE offers commission-free options trading for certain account types.

Frequently Asked Questions (FAQs)

- **Q: How are options trading fees calculated?**

- A: Fees are determined by the commission rate and exchange fees, which vary based on monthly trade volume and the exchange where the trade is executed.

- **Q: How can I reduce my options trading costs?**

- A: Increasing trade volume, negotiating lower commissions, and considering alternative pricing plans can help reduce fees.

- **Q: Does E*TRADE offer commission-free options trading?**

- A: Yes, certain account types qualify for commission-free options trading on E*TRADE.

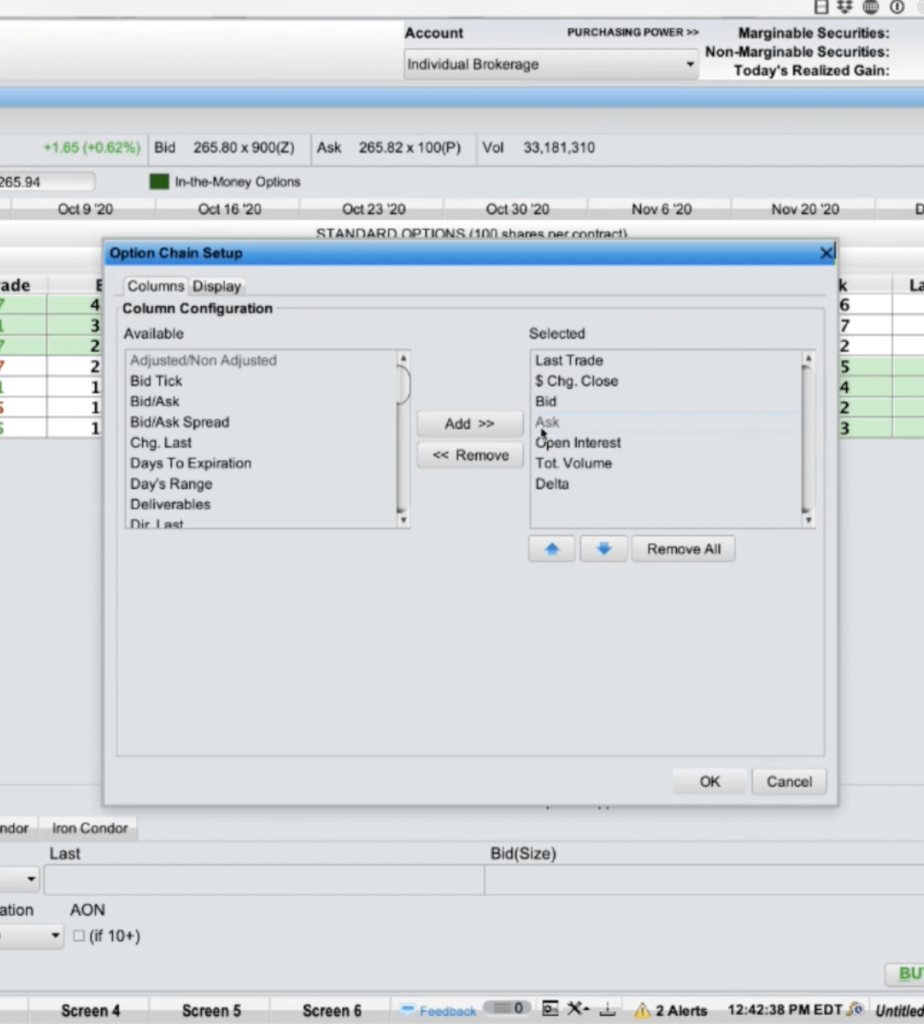

Etrade Options Trading Cost

Image: thebrownreport.com

Conclusion

E*TRADE’s options trading costs are transparent and competitive, making it a viable choice for both beginner and experienced traders. By comprehending the fee structure and implementing the tips provided, you can optimize your options trading strategy and maximize your profit potential. If you’re considering venturing into the world of options trading, I highly recommend exploring E*TRADE’s platform for its user-friendly interface, extensive educational resources, and cost-efficient pricing.

Are you interested in learning more about options trading and E*TRADE’s fees? If so, I encourage you to explore the E*TRADE website or consult with a financial advisor for further guidance.