Trading platform option costs – they’re the hidden gem of the trading world, often overlooked but critically important in shaping your trading performance. Just as a skilled cook understands the subtle nuances of spices, a successful trader masters the intricacies of trading platform option costs to make informed decisions and maximize returns.

Image: www.tradestation.io

Defining Option Costs: Unlocking the Trading Potential

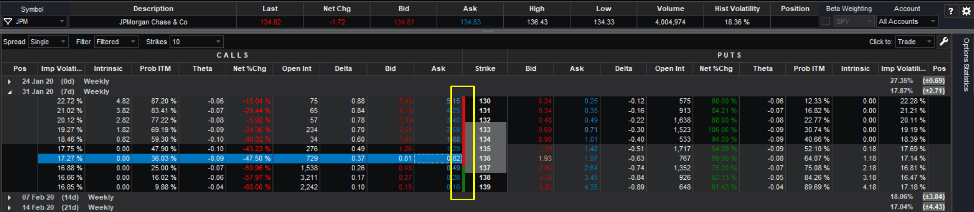

An option cost, or transaction cost, is the fee associated with buying or selling an option on a trading platform. These costs include commissions, exchange fees, regulatory fees, and clearing fees, which collectively determine the overall trading expenses you incur. Understanding option costs is crucial because they significantly impact the profitability of your trades and the overall effectiveness of your trading strategy.

Breaking Down the Fee Structure: A Guided Tour

Commissions are one of the primary components of option costs. They are calculated as a fixed amount or a percentage of the trade value and are charged by the broker or trading platform for facilitating the trade. Exchange fees are charges levied by the exchange where the option is traded, often based on the number of contracts bought or sold. Regulatory fees are imposed by government agencies to cover the costs of oversight and regulation within the financial markets. Clearing fees are incurred during the settlement process to ensure the seamless execution and recording of trades.

Navigating the Cost Landscape: Trading Platform Variations

The cost structure of trading platforms varies significantly, and it’s essential to research and compare different platforms before making a decision. Some platforms offer tiered pricing based on trading volume or subscription levels, while others charge a flat fee per trade. By carefully evaluating the fee schedules of potential trading platforms, you can identify the option that best aligns with your trading style and budget.

Image: www.hotelgurupokhara.com

Minimizing Costs for Maximum Returns: A Trader’s Guide

There are several strategies you can employ to minimize trading platform option costs and enhance your profitability. First, consider negotiating with your broker to secure lower commissions or explore platforms that offer competitive pricing models. Second, take advantage of bulk discounts or volume-based pricing, often provided by platforms to incentivize larger trades. Third, consolidate your trades on a single platform instead of spreading them across multiple platforms to reduce the overall fees incurred.

Real-World Applications: The Impact of Option Costs in Action

Option costs have a tangible impact on trading profitability. Let’s consider an example: Suppose you buy 10 contracts of a stock option with an underlying price of $100 and a premium of $5 per share. If the trading platform charges a commission of $2 per contract, you will incur a total option cost of $20 (10 contracts x $2). This translates to a reduction in your potential profit. Therefore, it’s crucial to factor in option costs when calculating your risk-reward ratio and potential returns.

Emerging Trends: The Future of Trading Platform Option Costs

The trading industry is evolving, and with it comes a shift in trading platform option costs. The rise of electronic trading platforms and the proliferation of online brokers have intensified competition and led to a gradual decline in commissions. Additionally, the introduction of new technologies, such as blockchain and artificial intelligence, promises further efficiencies and cost reductions in the future.

Trading Platform Option Costs

Image: diohysba.blogspot.com

Conclusion: Embracing Cost Control for Trading Success

Trading platform option costs are an integral part of the trading equation, directly influencing your profitability and success. By understanding the cost structure of trading platforms, employing strategies to minimize fees, and embracing the latest industry trends, you can unlock the full potential of option trading. Remember, it’s not just about buying and selling options but also about making informed decisions that optimize your returns and set you on the path to trading mastery.