In today’s dynamic financial landscape, the world of derivative trading holds immense potential for investors seeking amplified returns. Future and option trading, facilitated by platforms like Zerodha, has emerged as a game-changer, enabling traders to mitigate risks, capitalize on market opportunities, and unlock a world of financial freedom.

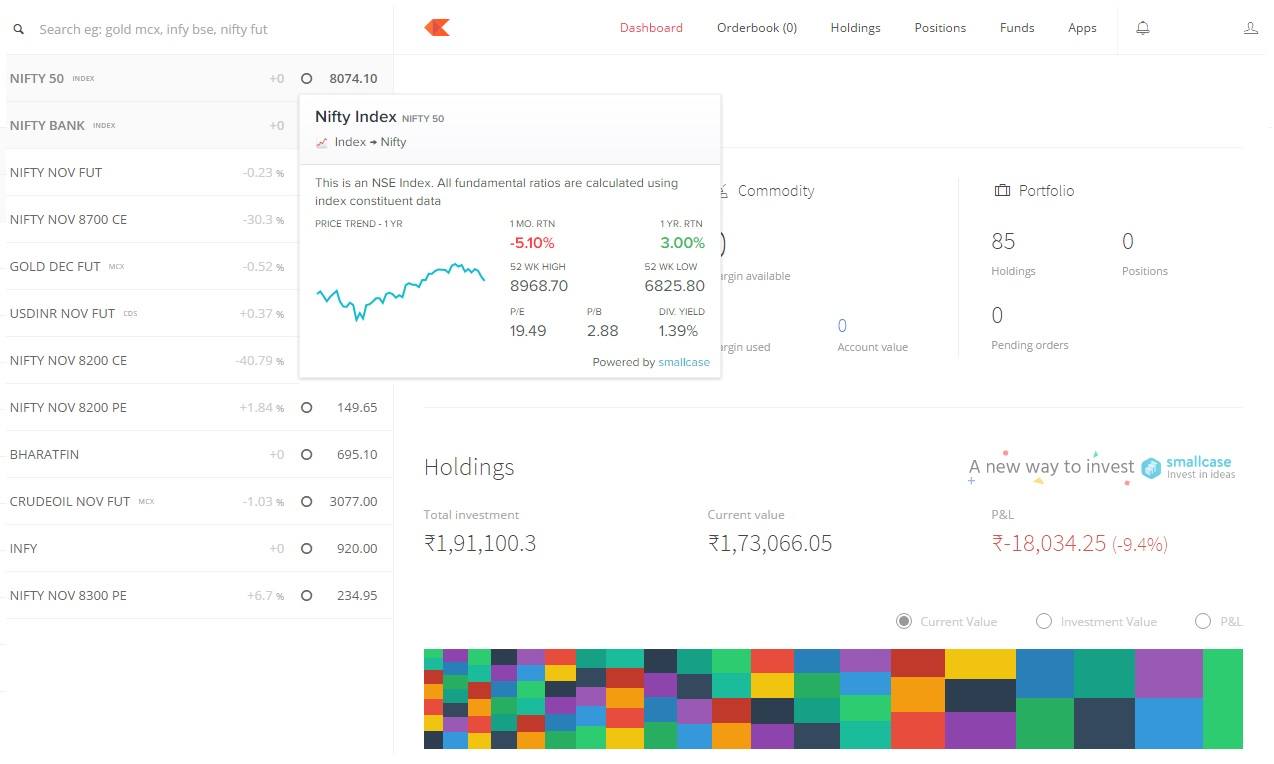

Image: kite.trade

This comprehensive guide aims to illuminate the intricacies of future and option trading with Zerodha. Whether you’re a seasoned trader or just exploring this exciting domain, this article will arm you with the knowledge and strategies to navigate the markets with confidence.

Understanding Future and Option Trading

Futures are standardized contracts that obligate the buyer or seller to buy or sell an underlying asset at a predetermined price on a specified future date. They provide investors with a means to hedge against market volatility or speculate on price movements.

Options, on the other hand, grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a fixed price within a certain time frame. They provide a flexible approach to risk management and offer potentially lucrative opportunities for income generation.

Why Zerodha for Future and Option Trading?

Zerodha has revolutionized the trading landscape in India, offering a cutting-edge platform tailored to the needs of both novice and experienced traders.

- Ultra-low brokerage: Zerodha’s brokerage fees are amongst the lowest in the industry, significantly reducing trading costs and enhancing profitability.

- Advanced trading tools: The Zerodha platform boasts a suite of advanced trading tools, including charting software, technical indicators, and backtesting capabilities, empowering traders to make informed decisions.

- Excellent customer support: Zerodha provides unparalleled customer support through multiple channels, ensuring timely assistance and resolving queries promptly.

Essential Concepts in Future and Option Trading

To delve into the realm of future and option trading, it is imperative to grasp certain fundamental concepts:

1. Contract Size: Each futures or options contract represents a specific quantity of the underlying asset. Understanding contract sizes is crucial for managing position sizes and calculating potential profits or losses.

2. Premium: For options, the premium refers to the price paid to acquire the right to buy or sell the underlying asset. Premiums are influenced by factors such as the strike price, time to expiry, and market volatility.

3. Expiration Date: Futures contracts have a fixed expiration date, while options contracts typically expire on a monthly or weekly basis. Understanding expiration dates is essential for timely contract closure and avoiding any potential liabilities.

Image: forexmoneyrate.blogspot.com

Strategies for Future and Option Trading

The realm of future and option trading offers a wide array of strategies, each with unique risk and reward characteristics. Popular strategies include:

1. Scalping: A short-term trading strategy that focuses on making numerous small profits by capitalizing on intraday price fluctuations.

2. Day Trading: A more aggressive approach where traders enter and exit positions on the same trading day, aiming to profit from short-term price movements.

3. Swing Trading: A medium-term strategy that seeks to capitalize on price trends that span a few days or weeks.

Benefits of Future and Option Trading

Future and option trading offer a multitude of benefits for discerning investors:

- Enhanced Leverage: Futures and options provide leverage, allowing traders to control a larger position with a smaller investment, amplifying potential profits.

- Risk Management: Options, in particular, offer unparalleled risk management tools. Traders can utilize various option strategies to mitigate downside risks and protect their capital.

- Unlimited Profit Potential: Unlike traditional trading, futures and options have theoretically unlimited profit potential, enabling traders to capitalize on substantial market moves.

Future And Option Trading Zerodha

Image: www.fity.club

Conclusion

Future and option trading with Zerodha empowers investors to navigate financial markets with greater control and precision. By understanding the fundamental concepts, utilizing innovative trading strategies, and leveraging the advantages of Zerodha’s platform, traders can unlock a world of financial opportunities.

Whether you seek to enhance your risk management, amplify your returns, or explore new avenues for wealth creation, future and option trading with Zerodha offers a compelling path forward. Embrace the future and seize the potential that lies within this dynamic and rewarding domain.