Introduction

In the realm of financial markets, options trading provides investors with an array of opportunities to manage risk and enhance returns. AJ Bell, a leading investment platform in the UK, offers comprehensive options trading services, catering to the needs of both seasoned and novice traders. In this guide, we delve into the intricacies of AJ Bell options trading, exploring its advantages, features, and strategies.

Image: brokerchooser.com

Options, in essence, are derivative instruments that grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified date. Options trading adds an element of flexibility and leverage to investment strategies, enabling traders to speculate on future price movements, hedge against market volatility, and generate income through premiums.

Weighing the Advantages of AJ Bell Options Trading

AJ Bell’s options trading platform offers several advantages that make it an attractive option for traders:

- Access to a Wide Range of Markets: AJ Bell provides access to a diverse selection of global markets, enabling traders to trade options on stocks, indices, commodities, and currencies.

- Competitive Pricing: AJ Bell’s competitive pricing structure, including low commissions and transparent fees, allows traders to maximize their returns.

- Advanced Trading Platform: The user-friendly AJ Bell trading platform offers advanced features such as real-time charting, customizable watchlists, and risk management tools.

- Educational Resources: AJ Bell recognizes the importance of education and provides comprehensive resources, including webinars, tutorials, and market insights, to empower traders of all experience levels.

Unveiling the Features of AJ Bell Options Trading

AJ Bell’s options trading platform boasts a range of robust features:

- Vanilla Options: AJ Bell offers access to vanilla or standard options, which are the most common type of options, giving traders the flexibility to speculate on the direction of underlying asset prices.

- Option Spread Strategies: Advanced traders can utilize option spread strategies to potentially enhance returns and manage risk. AJ Bell provides the tools and resources to execute these strategies.

- Automated Trading: AJ Bell’s automated trading feature allows traders to set up predefined trade plans that are executed when specific market conditions are met.

- Option Pricing: The platform offers real-time option pricing and Greeks, enabling traders to accurately assess the potential value and risk of options contracts.

Strategies for Options Trading with AJ Bell

Successful options trading requires a well-defined strategy. Here are some effective approaches to consider:

- Covered Call: This strategy involves selling a call option against a stock position, generating income from the premium while capping potential gains but also reducing potential losses.

- Long Straddle: This strategy involves buying a call option and a put option with the same strike price and expiration date. Traders profit from large price movements in either direction.

- Protective Put: This strategy involves buying a put option to protect a stock position against potential declines in value. The put option acts as insurance, limiting potential losses.

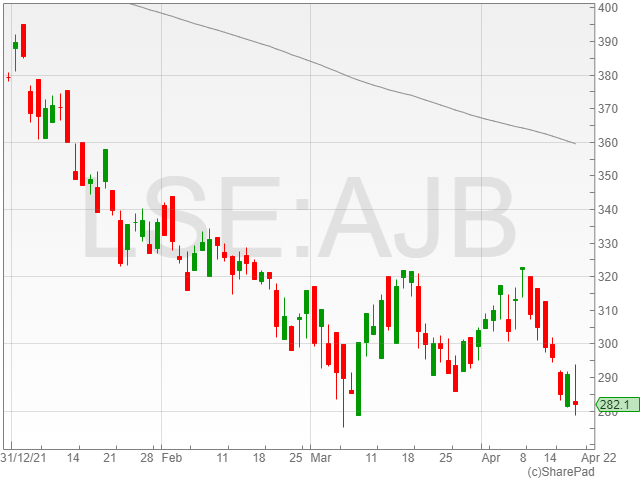

Image: ukinvestormagazine.co.uk

Tips and Expert Advice for Enhancing Your Options Trading

To optimize your options trading experience with AJ Bell, consider the following expert advice:

- Understand the Risks: Options trading involves inherent risks, and it’s crucial to thoroughly understand the potential for losses before engaging in this activity.

- Set Realistic Targets: Avoid overextending yourself by setting realistic profit targets and managing your risk appetite effectively.

- Monitor Market Conditions: Keep abreast of market news and events that may impact option prices and underlying asset valuations.

- Leverage AJ Bell’s Support: AJ Bell provides a dedicated support team to assist traders with any queries or challenges they may encounter.

FAQs on AJ Bell Options Trading

Q: What is the minimum amount required to open an options trading account with AJ Bell?

A: There is no minimum account balance requirement for options trading with AJ Bell.

Q: What types of options orders can I place with AJ Bell?

A: AJ Bell allows you to place a variety of options orders, including market orders, limit orders, and stop orders.

Q: How do I calculate my profit or loss on an options trade?

A: AJ Bell provides real-time profit and loss calculations on the trading platform for your convenience.

Q: What are the risks associated with options trading?

A: Options trading involves significant risks, including the potential for complete loss of capital.

Q: How can I get started with options trading with AJ Bell?

A: Open an AJ Bell investment account, complete the options trading application form, and fund your account to start trading.

Aj Bell Options Trading

Conclusion

Unlock the potential of AJ Bell options trading to expand your investment strategies and enhance your financial acumen. With its diverse market access, competitive pricing, advanced features, and expert support, AJ Bell empowers traders of all experience levels to leverage options effectively. Embrace the insights provided in this comprehensive guide and embark on a profitable options trading journey.

Are you ready to explore the world of AJ Bell options trading and unlock its potential rewards?