In the ever-evolving landscape of finance, optionality trading stands as a cornerstone of sophisticated investment strategies. By harnessing the power of options, traders unlock a realm of financial possibilities that can both enhance returns and manage risks effectively. This guide delves into the intricacies of optionality trading, providing a comprehensive understanding of its mechanisms, potential benefits, and prudent application.

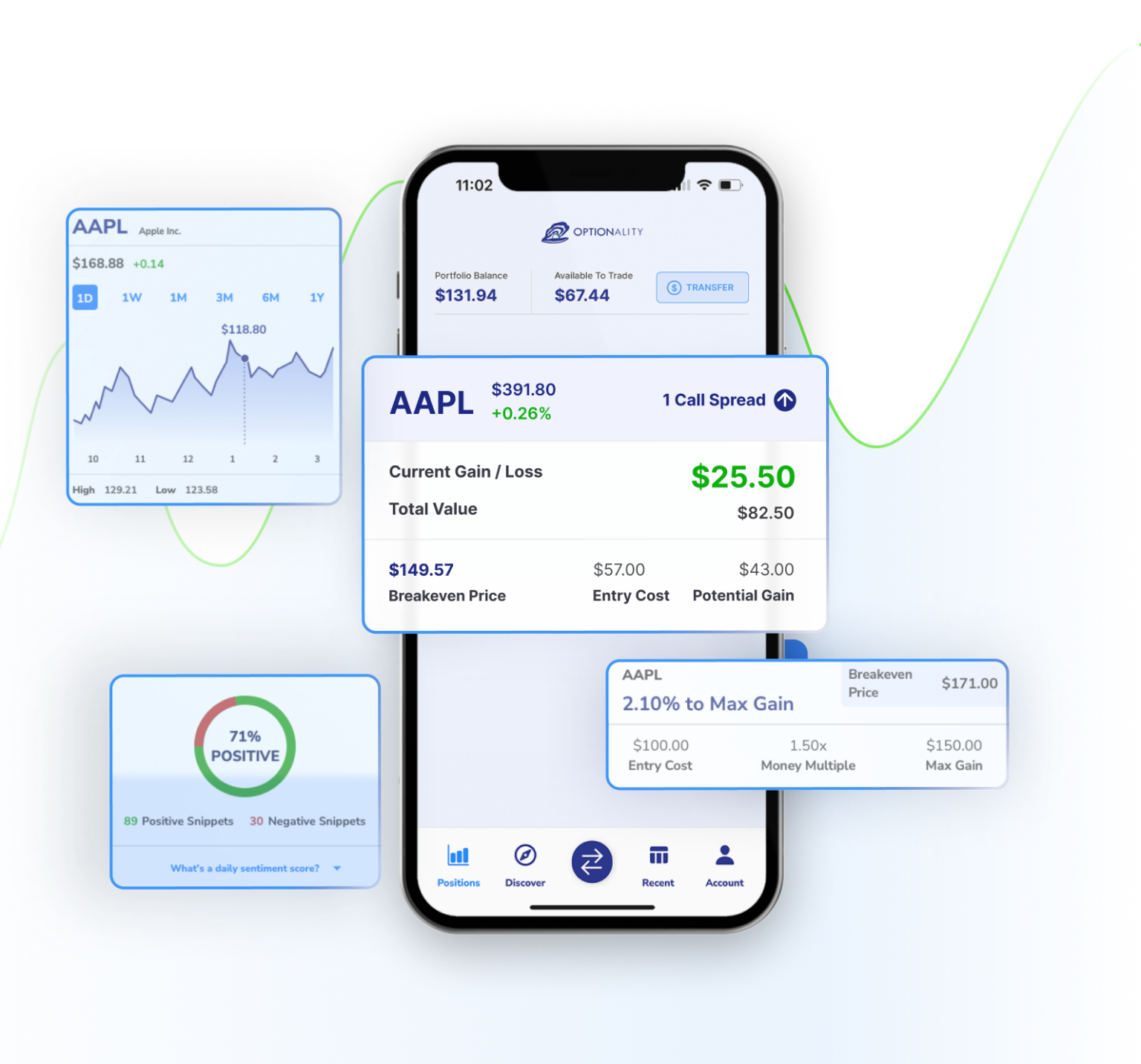

Image: optionalitytrading.com

Unveiling the Essence of Optionality

Options, financial instruments derived from an underlying asset, grant the holder the “option,” not the obligation, to buy (call option) or sell (put option) that underlying asset at a predetermined price (strike price) within a specified period (expiration date). This flexibility empowers traders with the ability to capitalize on market movements, hedge against potential losses, and generate income through strategic option strategies.

Understanding the Mechanisms of Optionality Trading

When embarking on optionality trading, it’s crucial to grasp the fundamental mechanisms at play. A buyer of an option pays a premium to acquire the right, but not the mandate, to execute the option. The premium represents the cost of the option and varies based on factors such as the underlying asset’s price, volatility, time to expiration, and interest rates.

In contrast, the seller (or writer) of an option receives the premium and incurs the obligation to fulfill the option contract if the buyer exercises their right. The seller’s potential profit or loss is contingent upon whether the option is exercised and the subsequent market dynamics.

Harnessing Optionality for Multiple Investment Strategies

The versatility of options empowers traders to pursue diverse investment strategies tailored to their risk tolerance and financial goals.

-

Speculation: Options trading offers ample opportunities for speculation, enabling traders to wager on the future price direction of underlying assets. Call options are employed when anticipating price appreciation, while put options are utilized for profiting from price declines.

-

Hedging: Options serve as potent tools for risk mitigation. By purchasing options with strike prices opposite to their market positions, traders can effectively minimize potential losses or protect profits in adverse market conditions.

-

Income Generation: Options trading presents a venue for income generation through strategies like covered calls or cash-secured puts. These techniques involve selling options against owned assets or cash, allowing traders to collect premiums while maintaining varying degrees of exposure.

Image: optionalitytrading.com

Navigating Optionality Trading with Prudence

While optionality trading offers immense opportunities, it’s imperative to approach it with prudence and a thorough understanding of the inherent risks.

-

Time Decay: Option premiums erode over time, posing a challenge for traders who hold options for extended periods. This time decay underscores the importance of precise timing and strategic execution.

-

Implied Volatility: Volatility, a measure of price fluctuations, influences option premiums. Higher volatility generally translates to higher premiums but also amplifies potential losses.

-

Risk Management: Optionality trading involves inherent risks, and effective risk management is paramount. Traders must meticulously calculate potential profit and loss scenarios, employ stop-loss orders, and diversify their portfolio to mitigate potential setbacks.

Empowering Traders with Expert Insights

Delving into the world of optionality trading demands a foundation of knowledge and a keen eye for market dynamics. Seasoned experts in the field provide invaluable insights and practical advice to enhance trading acumen.

-

Mark Cuban: The renowned entrepreneur and investor advocates for prudent optionality trading, emphasizing the significance of thorough research, risk management, and a disciplined approach.

-

Karen Finerman: The accomplished hedge fund manager and CNBC contributor underscores the power of options in portfolio diversification and risk mitigation strategies.

-

Larry Hite: The founder of LJH Global Investments highlights the importance of understanding the nuances of option strategies and managing risk effectively.

Optionality Trading

Embracing Optionality Trading for Financial Empowerment

Optionality trading empowers traders with a comprehensive suite of financial tools to navigate market complexities, pursue strategic investment objectives, and amplify their potential for success. By embracing the principles outlined in this guide, investors can unlock the transformative power of optionality to enhance returns, minimize risks, and achieve lasting financial prosperity.