Introduction

In the realm of investing, stock options present a compelling opportunity to potentially amplify returns and hedge against risk. However, navigating the complex world of options trading can be challenging, especially when seeking to identify undervalued assets. This comprehensive guide delves into the concept of finding stock options trading at a discount to NAV, empowering savvy investors with a structured approach to unlocking these hidden gems.

Image: club.ino.com

NAV, or Net Asset Value, refers to the value of an option’s underlying asset. It represents the current market price of the shares, minus any liabilities and expenses. When an option trades below its NAV, it indicates that the market is undervaluing the option’s potential. This undervaluation can create an opportunity for investors to acquire options at a favorable price, maximizing their chances of potential profit.

Identifying Discounted Options

Uncovering stock options trading at a discount to NAV requires a systematic approach. Here are some key factors to consider:

1. Assess the Underlying Asset:

Begin by evaluating the underlying asset of the option. Consider its historical performance, industry outlook, and overall financial health. A strong underlying asset with growth potential increases the likelihood of option undervaluation.

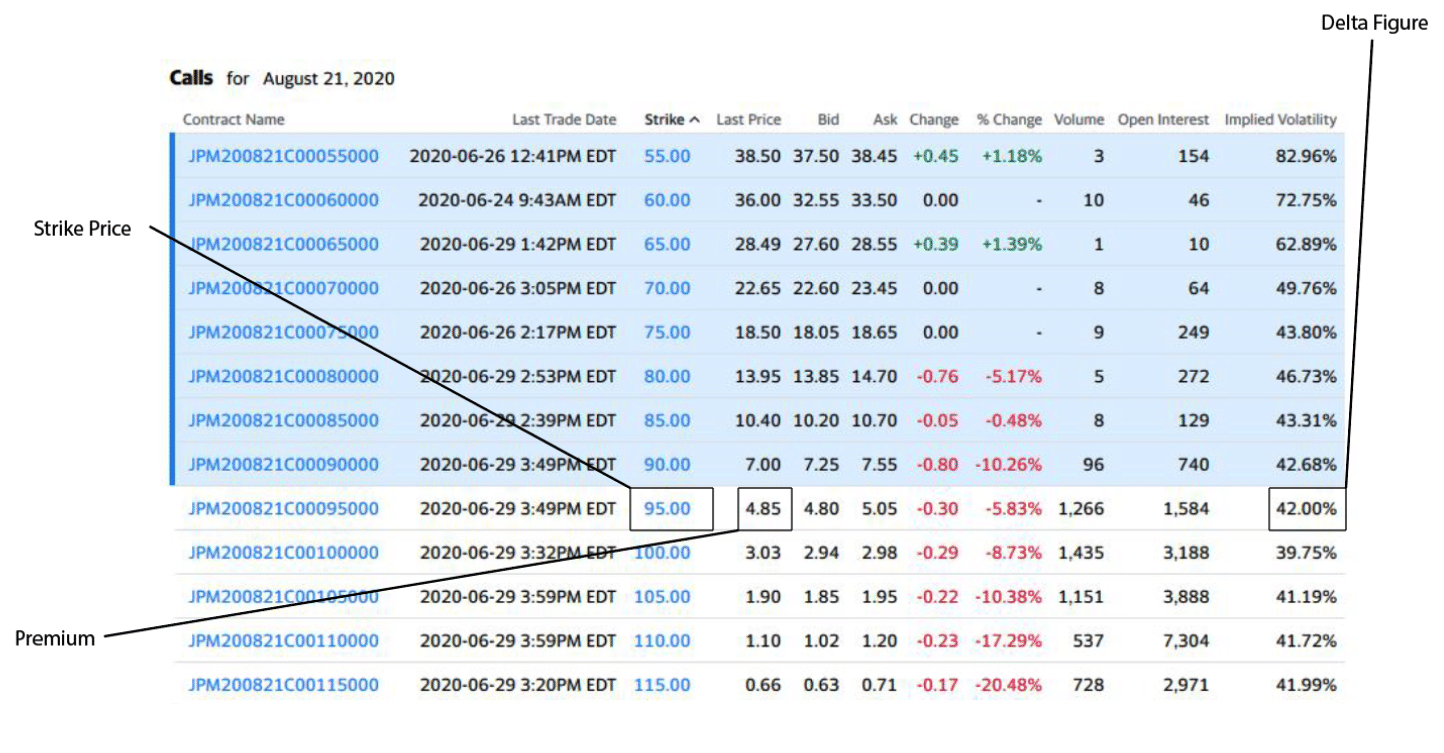

2. Analyze Option Premiums:

Option premiums represent the price investors pay to acquire an option. Compare the option’s premium to its NAV. A significant difference suggests a potential discount. However, it’s crucial to consider factors that influence premiums, such as volatility and time to expiration.

Image: stewdiostix.blogspot.com

3. Estimate Fair Value:

Determine the fair value of the option using valuation models, such as the Black-Scholes model. Compare the fair value to the current market price. A notable discrepancy indicates a potential undervaluation.

4. Monitor Market Sentiment:

Keep abreast of market sentiment towards the underlying asset and the option itself. Negative sentiment can drive down option prices, creating buying opportunities. Conversely, positive sentiment can inflate prices, reducing the potential for a discount.

Benefits and Risks

Investing in stock options trading at a discount to NAV offers several potential benefits:

Benefits:

- Value Acquisition: Acquire options at a favorable price, increasing the potential for profit.

- Hedging Risks: Reduce risk exposure by purchasing put options at a discount, allowing for protection against market downturns.

- Enhanced Returns: Leverage the potential for options to amplify returns compared to direct stock ownership.

Risks:

- Time Decay: Options have a limited lifespan, and their value diminishes over time.

- Volatility Risks: Option prices are highly sensitive to changes in volatility, which can lead to sudden losses.

- Limited Upside: Stock options have a predetermined strike price, limiting potential gains if the underlying asset rises significantly above the strike price.

Strategies for Trading Discounted Options

Once discounted stock options are identified, implementing effective trading strategies is crucial for maximizing potential returns. Consider the following approaches:

1. Discount Arbitrage:

Acquire the discounted stock options and short the underlying asset in the appropriate proportions to capitalize on the price discrepancy. This strategy mitigates risks by reducing exposure to market volatility.

2. Time Arbitrage:

Purchase long-term discounted options and sell short-term options on the same underlying asset. The strategy exploits the time decay of short-term options, potentially generando profits even if the underlying asset price does not rise significantly.

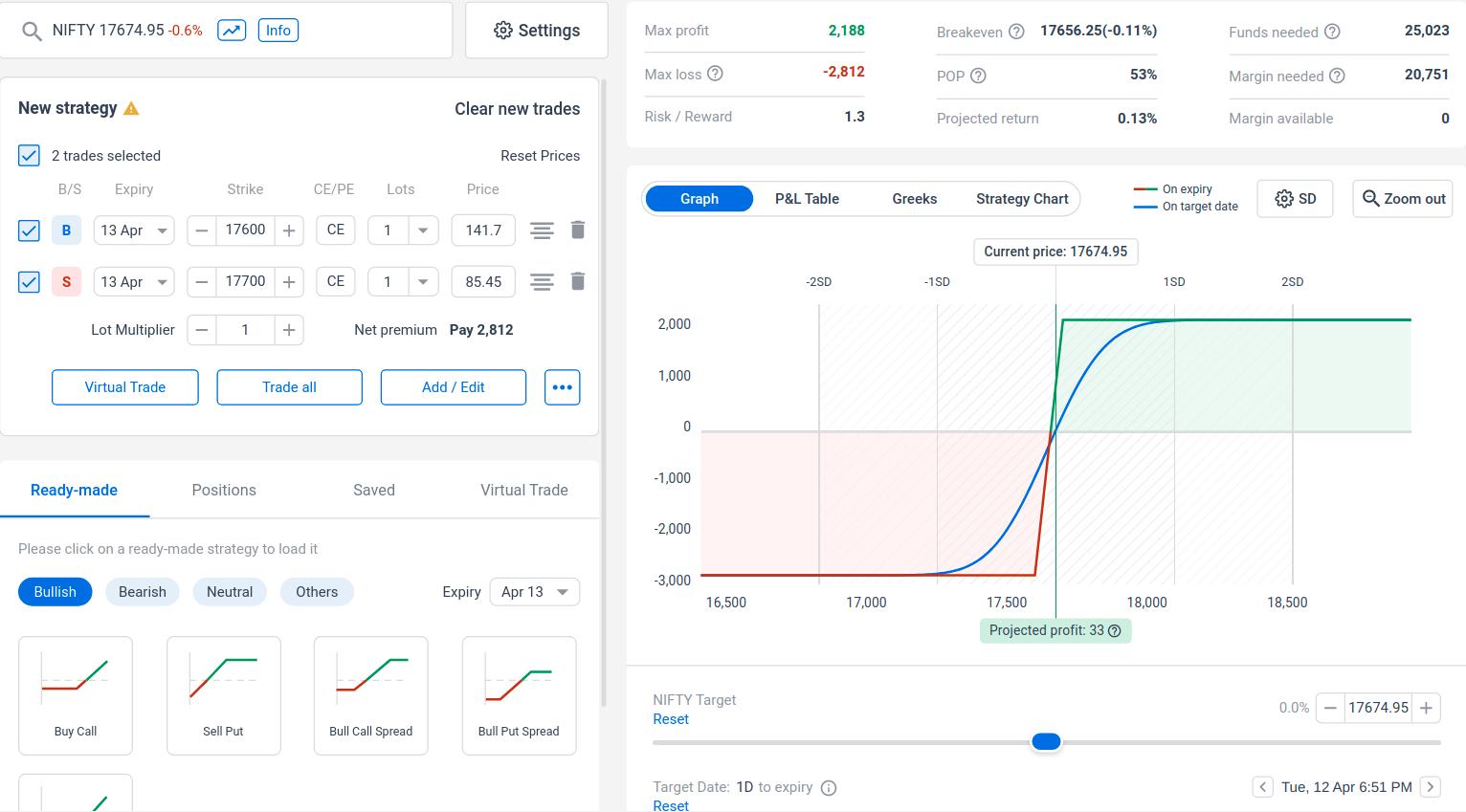

3. Delta Neutral Trading:

Create a neutral position by purchasing a discounted call option and selling a put option with the same strike price and expiration date. This minimizes market direction風險and benefits from narrowing price movements.

Find Stock Options Trading At A Discount To Nav

Image: www.rockwelltrading.com

Conclusion

Finding stock options trading at a discount to NAV requires a combination of research, analysis, and strategic thinking. By understanding the fundamentals of option undervaluation and employing effective trading techniques, investors can unlock the potential of these undervalued assets. Whether leveraging discounts for value acquisition, hedging against risks, or enhancing returns, the strategies outlined in this guide provide a comprehensive approach to profiting from this unique market opportunity.