Introduction:

In the exhilarating world of finance, options trading presents tantalizing opportunities for savvy investors seeking to amplify their returns. However, navigating the brokerage landscape can be daunting, particularly when budget constraints demand a discerning approach. In this comprehensive guide, we embark on a quest to identify the most cost-effective option trading brokerages, empowering you with the knowledge to unlock maximum value without compromising on quality service.

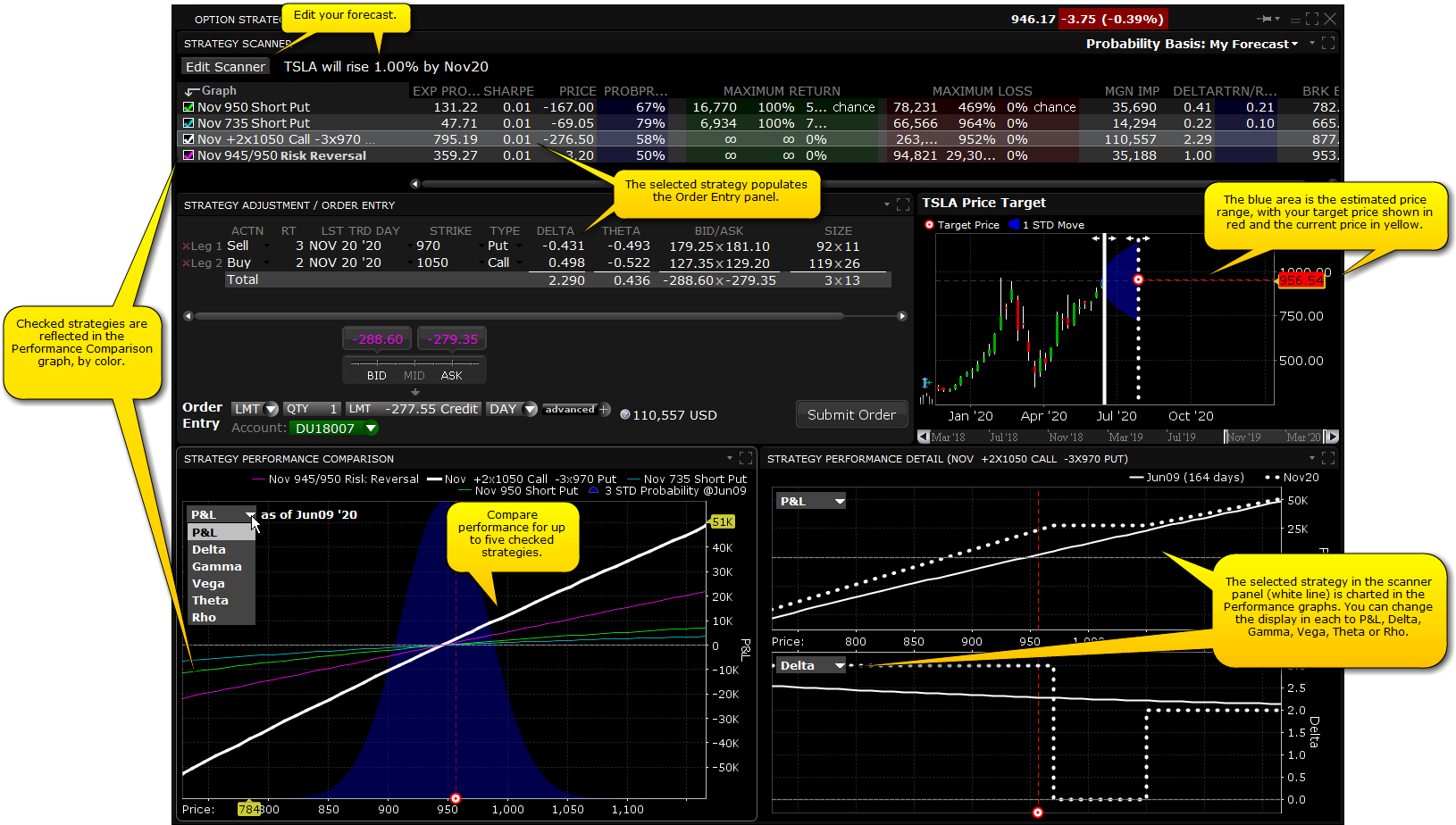

Image: www.ibkrguides.com

Section 1: Understanding Option Trading Brokerage Fees

Option trading brokerages levy a multitude of fees that directly impact your profitability. Understanding these charges is crucial to making informed decisions when selecting a brokerage. Common fees include commissions, spreads, exercise fees, and margin interest. Transparent fee structures and competitive rates should be at the forefront of your considerations.

Section 2: Evaluating Brokerages for Value

Beyond fees, it’s essential to assess the overall value proposition of a brokerage. Seek platforms that offer robust trading tools, educational resources, and advanced order types, which can significantly enhance your trading experience. Responsive customer support, reliable execution speeds, and access to charting software are additional factors to evaluate.

Section 3: Discount Brokerages: A Budget-Friendly Option

For traders focused primarily on cost, discount brokerages provide attractive options. These brokerages typically offer streamlined services with lower fees but may compromise on some features and educational support. However, if you prioritize cost over frills, discount brokerages can unlock substantial savings.

Section 4: Hybrid Brokerages: A Balance of Cost and Features

Hybrid brokerages offer a compromise between discount brokerages and commission-based brokerages. They typically charge a flat fee per trade, while also providing access to additional features such as advanced charting tools, research, and paper trading accounts. For traders seeking a balance of cost and functionality, hybrid brokerages present a compelling solution.

Section 5: Commission-Based Brokerages: Paying for Premium Service

Commission-based brokerages traditionally charge higher fees per trade. However, they often offer a comprehensive suite of services including dedicated account managers, in-depth research, and personalized trade recommendations. If you value guidance and tailored support, commission-based brokerages may be a suitable option.

Section 6: Comparing and Selecting a Cheap Option Trading Brokerage

To select the most suitable cheap option trading brokerage, carefully assess your trading style, budget constraints, and desired features. Compare brokerage offerings, scrutinize fee structures, and explore free trials or demo accounts to experience the platforms firsthand.

Conclusion:

Navigating the landscape of cheap option trading brokerages requires careful consideration. By understanding fees, evaluating brokerage value, and comparing options strategically, you can find the ideal platform to maximize your returns while minimizing costs. Whether you prioritize simplicity, functionality, or customized support, there’s a brokerage solution tailored to meet your needs. Embrace the opportunity to unlock the financial potential of option trading, all without breaking the bank.

Image: harshbijalwan.com

Cheap Option Trading Brokerage