In the dynamic realm of financial markets, options trading presents a captivating avenue for investors to capitalize on market fluctuations. Among the most versatile financial instruments are call and put options, empowering traders with the potential to amplify profits and manage risk.

Image: www.amazon.de

Options trading, however, requires a thorough understanding of the underlying concepts and strategic application. This comprehensive guide delves into the nuances of call and put options, providing invaluable insights and expert advice to empower you in navigating the complexities of options trading.

Defining Call and Put Options

Call Options: represent the right to buy an underlying asset (stock, bond, or commodity) at a predetermined price (strike price) on or before a specified date (expiration date).

Put Options: grant the right to sell an underlying asset at the strike price on or before the expiration date.

Understanding the Mechanics of Options

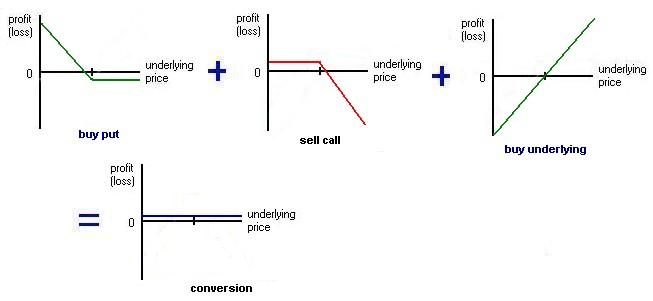

Options contracts involve two parties: the buyer (who pays a premium to acquire the option) and the seller (who receives the premium and assumes the obligation to fulfill the contract if exercised).

The value of an option stems from two primary factors: intrinsic value and time value. Intrinsic value represents the difference between the strike price and the current market price of the underlying asset. Time value embodies the potential for the underlying asset’s price to fluctuate before the expiration date.

Leveraging Call Options for Market Gains

Traders employ call options when they anticipate an increase in the price of the underlying asset. By purchasing a call option, the buyer secures the right to buy the asset at the strike price, regardless of its market price at expiration. If the asset’s price rises above the strike price, the call option gains value, offering the buyer a sizable profit.

Image: icamaveyi.web.fc2.com

Utilizing Put Options to Mitigate Losses

Put options serve as a valuable tool for investors seeking to safeguard against potential losses in the value of an underlying asset. By acquiring a put option, the buyer obtains the right to sell the asset at the strike price, even if its market price falls. This mechanism enables the buyer to limit their potential losses.

Latest Trends and Market Insights

The landscape of options trading is constantly evolving, marked by emerging trends and innovative strategies. Keep abreast of the latest developments by monitoring updates from reputable financial news sources and engaging in thought-provoking discussions on forums and social media platforms dedicated to options trading.

Expert Advice for Successful Options Trading

Seasoned options traders emphasize the importance of meticulous planning and strategic execution. Here are three fundamental tips to enhance your trading acumen:

- Thorough Research: Conduct extensive due diligence on the underlying asset, market conditions, and historical price trends before making any trading decisions.

- Risk Management: Define clear risk parameters and allocate capital wisely. Options trading involves inherent risk, so it’s crucial to manage it effectively.

- Continuous Learning: Stay up-to-date with the latest options trading techniques and market insights. The financial markets are dynamic, and lifelong learning is key.

Frequently Asked Questions (FAQs)

Q: What is the difference between buying and selling options?

A: When you buy an option, you acquire the right (but not the obligation) to buy or sell an underlying asset. When you sell an option, you assume the obligation to fulfill the contract if the buyer exercises it.

Q: Can I lose more than I invest in options trading?

A: Yes, options trading carries the potential for significant losses, especially if you trade with excessive leverage or without proper risk management.

Call And Put Option Trading Tips

Image: www.tradewinsdaily.com

Conclusion

Navigating the world of call and put options requires a comprehensive understanding of market dynamics, strategic planning, and expert guidance. By embracing the insights and advice outlined in this guide, you can unlock the potential of options trading and seize market opportunities while mitigating risks.

Are you ready to delve into the compelling world of options trading? Let us empower you on your journey towards financial success.