Unveiling Hidden Opportunities in the Options Market

Welcome to the exciting world of options trading! As you navigate this dynamic market, it’s crucial to identify opportunities that offer potential upside. In that spirit, this article delves into current options trading below intrinsic value, shedding light on a strategy that can help you uncover hidden gems.

Image: www.optiontradingtips.com

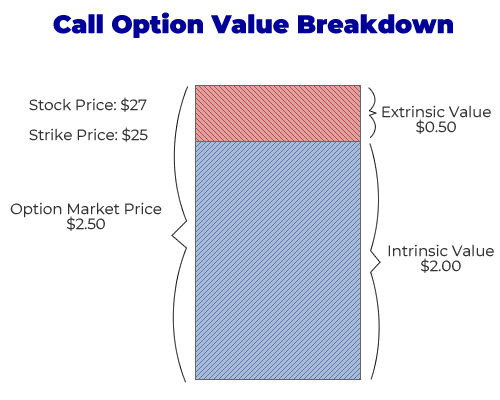

Intrinsic Value: A Defining Concept

Before exploring undervalued options, let’s establish a clear understanding of intrinsic value. Intrinsic value, in the context of options trading, refers to the actual worth of an underlying asset, calculated based on its price at the moment of valuation. This value acts as a benchmark against which an option’s market price is compared. Understanding intrinsic value is vital, as it provides a foundation for evaluating the potential profitability of an option.

Options Trading Below Intrinsic Value: Unlocking Potential

Now, let’s shift our focus to the topic of options trading below intrinsic value. This situation arises when an option’s market price falls beneath its calculated intrinsic value. Such occurrences can be attributed to market inefficiencies or fleeting fluctuations in supply and demand. In essence, trading below intrinsic value implies that you are purchasing an option at a discount, creating a potential for favorable returns.

Strategies for Identifying Undervalued Options

To successfully capitalize on options trading below intrinsic value, it’s essential to adopt a strategic approach. Identifying undervalued options requires meticulous research and an understanding of the relevant factors. One effective method is utilizing fundamental analysis to assess the underlying asset’s prospects and identify potential underpricing in the options market. Additionally, technical analysis can provide valuable insights into historical price patterns and market sentiment, assisting in the recognition of undervaluation.

Image: www.thestreet.com

Trading Tips for Maximizing Profitability

Navigating the world of options trading requires both skill and strategy. Here are a few tips to help you maximize your profitability:

- Conduct thorough research: Diligently assess the fundamentals and technical indicators of the underlying asset.

- Choose options with sufficient time to expiration: This provides ample opportunity for the asset’s price to move in your favor.

- Price monitoring: Continuously monitor the market price and the option’s intrinsic value to track any potential changes.

- Consider hedging strategies: Implement risk management techniques to mitigate potential losses.

- Exercise discipline: Maintain a disciplined trading approach, avoiding emotional decisions.

Frequently Asked Questions (FAQs): Clarifying Common Inquiries

Q: How do I determine an option’s intrinsic value?

A: For call options, subtract the strike price from the current market price of the underlying asset. For put options, deduct the current market price from the strike price.

Q: Is it possible to lose money trading options below intrinsic value?

A: While the chances of profit are generally higher, trading options always carries risk. Market volatility and unpredictable fluctuations can lead to losses.

Q: What are some common pitfalls to avoid when trading options below intrinsic value?

A: Lack of research, poor risk management, and emotional trading decisions are detrimental to successful options trading.

Current Options Trading Below Intrinsic Value

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Image: danilacalise.blogspot.com

Conclusion: A Call to Action

Embracing the world of options trading below intrinsic value offers a unique opportunity to harness potential profitability. By delving into the concepts, strategies, and tips outlined in this article, you can develop a more informed trading approach. Remember, consistent research and diligence are key to success.

We invite you to explore the fascinating landscape of options trading. Are you ready to uncover the hidden gems waiting to be unlocked in the financial markets?