Venture into the realm of options trading with a modest investment of $3,000 and reap the transformative power of this dynamic financial instrument. Join us as we unveil the intricacies of options trading and guide you towards maximizing your earnings while mitigating risks.

Image: estrategadefinanzas.com

Embarking on an Options Trading Odyssey: Understanding the Basics

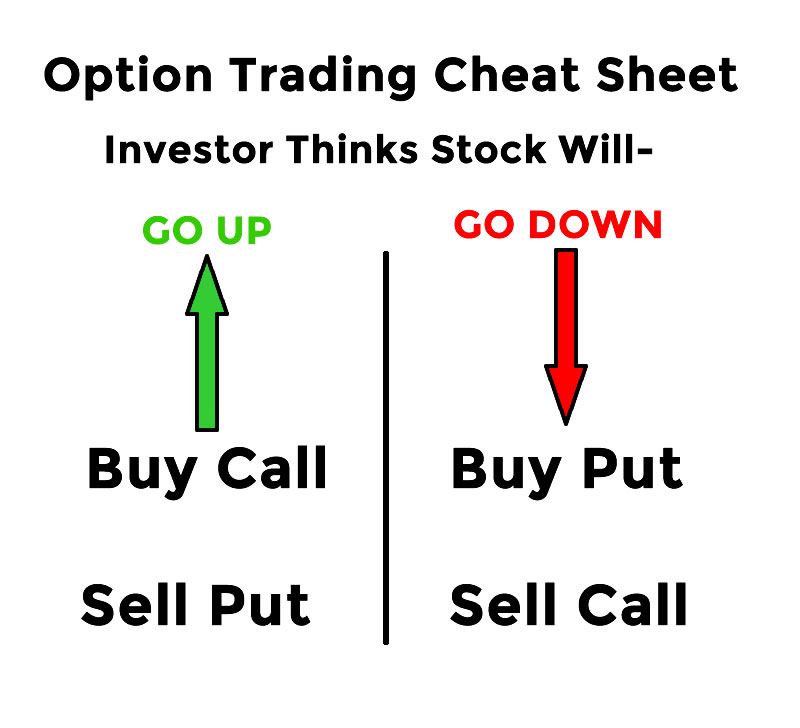

Options contracts, veiled in their simplicity yet imbued with vast potential, empower traders to speculate on the future price movements of underlying assets without ownership burdens. Enter the world of calls and puts, where strategic maneuvers can yield substantial financial gains based on accurate predictions.

Anatomy of an Options Contract: Stripping It Down

Delving into the very essence of options contracts, let us dissect their anatomy. Calls confer the right to purchase an asset at a predetermined price within a specific timeframe. On the other side of the spectrum, puts provide the option to sell an asset at a set price, also within a defined time period. These contracts, however, do not impose an obligation; rather, they bestow upon traders the flexibility to exercise their rights based on market dynamics.

Mastering the Nuances of Time Value Decay

Options contracts, like all good things in life, have a finite lifespan. As time relentlessly marches forward, the value of these contracts gradually erodes, a phenomenon known as time value decay. Understanding this concept is paramount to strategizing successful options trades.

Image: www.tradethetechnicals.com

Options Greeks: Deciphering the Market’s Whispers

In the tapestry of options trading, Greeks emerge as essential metrics, providing valuable insights into the intricacies of options pricing. Delta, gamma, theta, vega, and rho, each with its distinct character, whisper secrets about the behavior of options contracts under varying market conditions.

Exploring the Myriad Strategies for Options Trading

The realm of options trading offers a vast tapestry of strategies, each meticulously crafted to exploit specific market scenarios. From simple long and short positions to more intricate spreads and combinations, traders can tailor their strategies based on their risk tolerance and profit objectives.

Unveiling the Secrets of Options Valuation: A Path to Informed Decisions

Valuing options contracts requires a marriage of theory and practice. The Black-Scholes model, a cornerstone of options pricing, provides a framework for quantifying the fair value of these instruments. By factoring in variables such as underlying asset price, volatility, time to expiration, and interest rates, traders can make informed decisions about the premiums they are willing to pay or receive.

Managing Risk in Options Trading: A Balancing Act of Profits and Protection

Options trading, while presenting the tantalizing prospect of substantial returns, also carries inherent risks that must be skillfully managed. Arm yourself with prudent risk management techniques, such as setting stop-loss orders, understanding position sizing, and employing hedging strategies.

Trading Psychology: The Unshakable Fortress in a Volatile Market

In the tempestuous waters of options trading, where emotions can cloud judgment, it is imperative to cultivate a robust trading psychology. Maintaining composure in the face of market fluctuations, avoiding impulsive decisions, and managing expectations are vital qualities of successful traders.

Investing In Options Trading 3 000

Image: alphabetastock.com

Crafting Your Options Trading Plan: A Blueprint for Success

Navigating the options markets requires a well-defined trading plan, a guiding star that steers you towards your desired destination. Clearly outline your investment objectives, risk tolerance, trading strategies, and risk management protocols within this comprehensive document. Regularly review and refine your trading plan to ensure its alignment with evolving market conditions.