In the ever-evolving realm of option trading, it’s easy to get caught up in the allure of popular strategies. While those techniques have their merits, there lies a treasure trove of lesser-known strategies that can propel your trading journey to extraordinary heights. In this comprehensive guide, we’ll embark on an enlightening exploration of these hidden gems, empowering you to navigate the financial markets with newfound confidence and sophistication.

Image: ritholtz.com

Unveiling the Secrets of Lesser-Known Option Trading Strategies

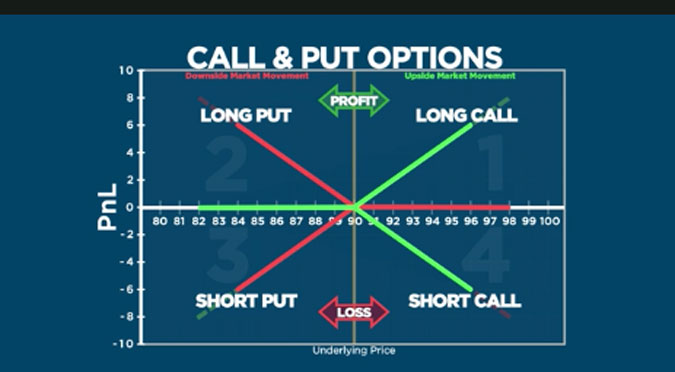

Option trading, a powerful tool in the hands of savvy investors, involves speculating on the future price movement of an underlying asset. While traditional strategies like buying calls or puts are well-known, there’s a wealth of untapped potential in the lesser-known strategies we’re about to uncover. These strategies offer traders the ability to adapt to diverse market conditions, manage risk, and potentially generate substantial returns.

1. Collar Strategy: A Protective Hedge for Upswing Potential

The collar strategy is a clever combination of buying a protective put option while simultaneously selling a call option. This structure creates a “collar” around the underlying asset, providing downside protection within a specified price range. While limiting the profit potential compared to simply buying a call option, the collar strategy is a defensive maneuver that can safeguard your portfolio in volatile markets.

2. Butterfly Spread: Profiting from Momentum Shifts

The butterfly spread involves buying one option at the strike price (the price at which the option can be exercised) and selling two options at higher and lower strike prices. This strategy capitalizes on sustained directional movement in the underlying asset. If the price continues to move in the anticipated direction, the trader can reap substantial profits while limiting risk.

3. Condor Spread: Capturing Range-Bound Price Action

A condor spread is an advanced strategy that involves buying one option at the lowest strike price, selling two options at higher strike prices, and buying one option at the highest strike price. This strategy is designed to benefit from a constrained price range, earning the trader a profit if the underlying asset stays within that range.

4. Straddle and Strangle Strategies: Betting on Volatility

Straddles and strangles are two strategies that wager on increased volatility in the underlying asset. Straddles involve buying both a call and a put option with the same strike price. Strangles, on the other hand, involve buying a call and a put option with different strike prices. Both strategies profit when the volatility of the asset rises, potentially leading to significant gains.

5. Iron Condor Strategy: Defined Risk, Unlimited Reward

The iron condor strategy is a neutral strategy that combines a bull call spread with a bear put spread. This structure creates a limited risk, defined return profile. As long as the underlying asset remains within a specific range, the trader earns a profit. The iron condor strategy is ideal for those seeking a balance between risk and reward.

Unlocking the Potential through Expert Insights

Harnessing the power of these lesser-known option trading strategies requires not only comprehension but also execution finesse. To ensure success, we sought the insights of seasoned experts in the field who have mastered these techniques.

“The collar strategy is my go-to defensive strategy,” shared renowned trader Mark Douglas. “It allows me to take advantage of upside potential while protecting my portfolio from unexpected downturns.”

According to trading guru Tom Sosnoff, “The butterfly spread is a potent momentum-based strategy. By identifying assets with strong directional movement, I’ve been able to generate substantial returns with this technique.”

Embracing the Path Forward

Lesser-known option trading strategies are not merely obscure techniques; they are hidden gems waiting to be mined. By incorporating these strategies into your trading arsenal, you not only expand your arsenal of tactics but also unlock the potential to enhance your financial success. While trading involves inherent risk, knowledge, strategic implementation, and ongoing refinement are the keys to mastering the markets.

Image: www.adigitalblogger.com

Lesser Known Option Trading Strategies

Image: fintrakk.com