When I first stepped into the world of options trading, I felt like a lost soul. The complexities of the market baffled me until I stumbled upon the treasure trove of knowledge hidden within nse option trading books. These literary gems transformed my journey, empowering me to navigate the turbulent waters of the market with newfound confidence and understanding.

Image: www.samco.in

Nse option trading books are not mere textbooks; they are gateways to a world of financial possibilities. They delve deep into the intricacies of options trading, offering comprehensive insights and practical advice. Whether you’re a seasoned trader or just starting your journey, these books can be your guiding light, illuminating the path to success.

The Anatomy of Nse Option Trading Books

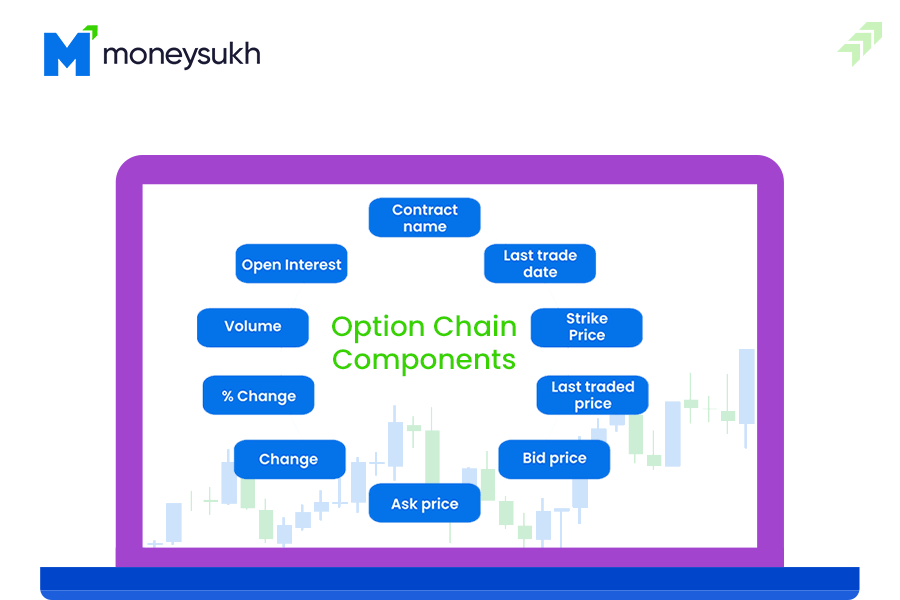

Nse option trading books cover a wide spectrum of topics that shape your understanding of this dynamic market:

- Core Concepts and Definitions: These books lay the foundation by introducing fundamental concepts like options contracts, premium pricing, and volatility.

- Trading Strategies: They explore proven trading strategies, including long straddle, short strangle, and covered call, providing step-by-step guidance for execution and risk management.

- Market Analysis Techniques: From technical analysis to fundamental analysis, these books equip you with the tools to understand market trends, price movements, and the factors that drive option pricing.

- Risk Management: Options trading carries inherent risks. These books emphasize the importance of risk management, covering strategies for mitigating losses and protecting your investments.

- Case Studies and Real-Life Examples: Many books feature case studies and real-life examples, bringing the concepts to life and demonstrating how professional traders apply them in practice.

Unveiling the Nuances through Expert Advice

Nse option trading books aren’t just a source of information; they embody the collective wisdom of experts. Seasoned traders and financial analysts share their insights, providing valuable guidance that can sharpen your skills:

- Technical Analysis Wisdom: These books offer insights into technical analysis techniques, empowering you to identify trends, assess momentum, and predict potential price movements.

- Risk Management Strategies: Experts reveal their risk management strategies, teaching you to calculate risk-reward ratios, set stop-loss orders, and manage your portfolio effectively.

- Trading Psychology Mastery: These books delve into the psychological aspects of trading, helping you overcome emotional biases and develop a disciplined trading mindset.

FAQ: Unveiling the Mysteries of Nse Option Trading

To further clarify your understanding of nse option trading, here’s a brief FAQ section addressing common queries:

- What are nse options contracts?: They are derivatives that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date.

- How do I calculate option premium?: Option premium is influenced by factors like underlying asset price, time to expiration, strike price, and volatility.

- What are the different types of nse options?: They include calls, puts, straddles, strangles, and butterflies.

- How do I manage risk in nse option trading?: Techniques like stop-loss orders, position sizing, and hedging help mitigate risk.

Image: www.indiatoday.in

Nse Option Trading Books

Image: learn.moneysukh.com

Conclusion

Nse option trading books are a treasure trove of knowledge and expertise, unlocking the secrets of this complex market. By embracing the insights they offer, you can transform your trading journey, navigate market challenges with confidence, and unlock the full potential of nse option trading. Embark on this literary quest today and elevate your trading acumen to new heights.

Are you ready to dive into the world of nse option trading? Let these expert books guide your journey towards financial success.