You’ve heard the whispers, read the headlines, and maybe even seen the memes: option trading. It promises the potential for massive returns, but also carries a significant risk. But how do you actually start trading options on a platform like Robinhood, and what should you know before you dive in?

Image: lucrobroker.com.br

This guide breaks down the fundamentals of option trading on Robinhood, from understanding the basics to navigating the platform and managing risk. We’ll cover everything from choosing the right strategies to analyzing the market and maximizing your potential. Whether you’re a curious beginner looking to test the waters or a seasoned investor seeking new opportunities, this comprehensive guide has you covered.

Understanding the Basics: What Are Options?

Options are contracts that give you the *right*, but not the *obligation*, to buy or sell an underlying asset (like a stock) at a specific price (the strike price) on or before a certain date (the expiration date). There are two main types of options:

- Calls: Give you the right to *buy* the underlying asset.

- Puts: Give you the right to *sell* the underlying asset.

Think of options like a bet on the future price of an asset. If you believe the price will go up, you buy a call. If you believe the price will go down, you buy a put. The beauty of options lies in their leverage. With a relatively small investment, you can control a large amount of the underlying asset, which can translate to significant profits (or losses!).

Navigating the Robinhood Platform for Options

Robinhood offers a user-friendly interface for trading options. Here’s how to get started:

1. Opening an Account

If you don’t already have a Robinhood account, simply download the app or visit their website and create an account. You’ll need to provide personal information and go through a verification process.

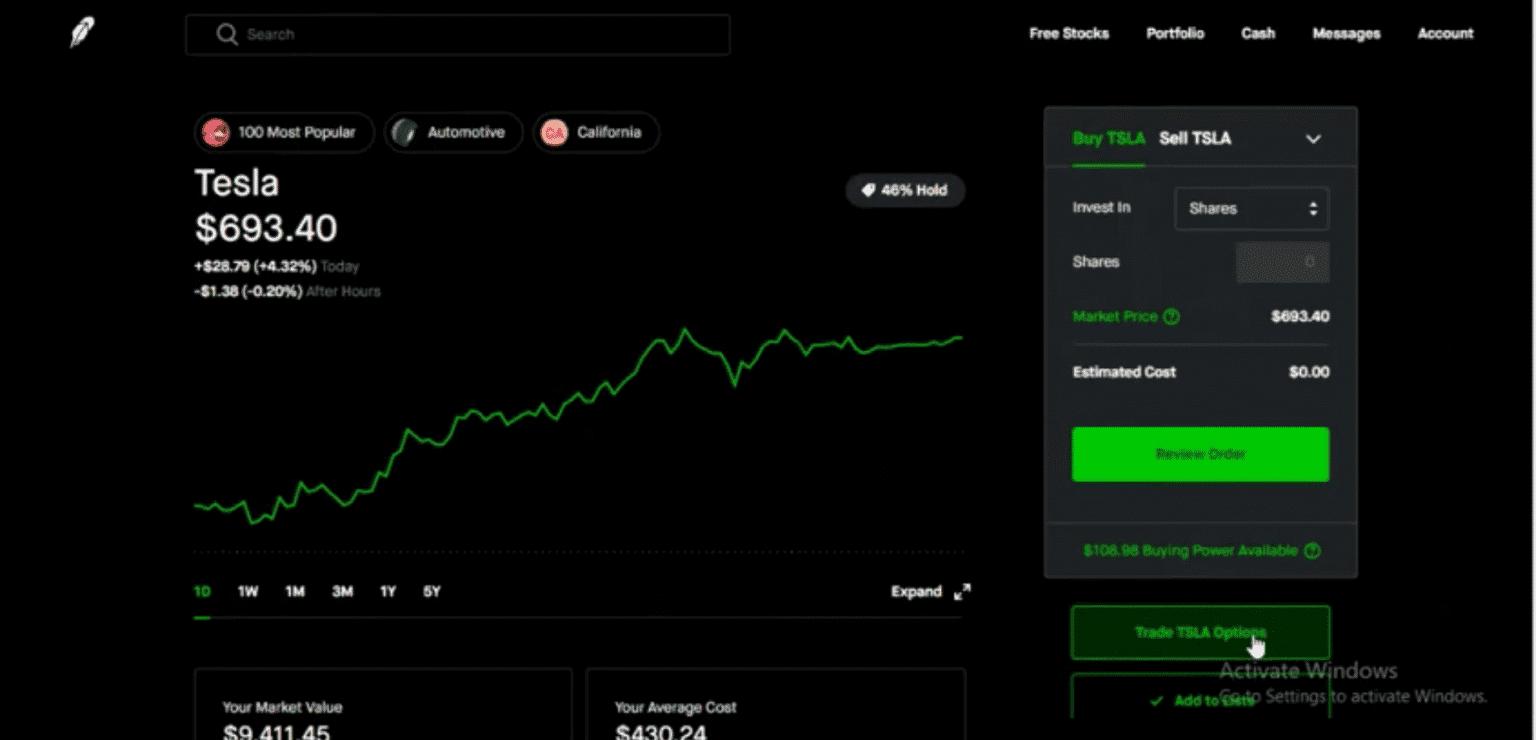

Image: marketxls.com

2. Fund Your Account

Add funds to your account so you have the capital to purchase options contracts. Robinhood offers various deposit options, including bank transfers and debit card payments.

3. Finding Options

Once you’re logged in, you can search for the specific stock or ETF you’re interested in trading options on. You can then click on the **Options** tab to view the available contracts for that asset.

4. Choosing Your Options

The key to selecting the right option is understanding your investment goals and risk tolerance.

- Strike Price: This is the price at which you can buy or sell the underlying asset.

- Expiration Date: This is the date when the option contract expires.

- Premium: This is the price you pay for the option contract. It’s important to consider the premium versus the potential return.

Remember, options involve leverage, so even a small wrong decision can lead to significant losses. Always conduct thorough research, analyze charts, and carefully consider your risk tolerance.

Strategies for Trading Options on Robinhood

There are various options trading strategies you can use, ranging from straightforward to complex. This guide will explore a few of the most popular options trading strategies on Robinhood:

1. Covered Calls

This strategy involves selling call options while holding the underlying stock. You profit when the stock price stays relatively stable or rises slightly, as you receive a premium for selling the call. However, if the price goes up significantly, you limit your potential profit because you’re obligated to sell the stock at the strike price if the option holder exercises it.

2. Covered Puts

Covered puts involve selling put options while holding the underlying stock. This strategy is beneficial when you believe the stock price will remain stable or increase slightly. You profit from the premium, and your risk is limited if the price falls below the strike price because you can purchase the stock at the strike price if the option holder exercises it.

3. Naked Calls

This strategy involves selling call options without holding the underlying stock. It’s a high-risk, high-reward strategy that can lead to massive losses if the stock price skyrockets. You profit from the premium you receive when selling the option, but you risk having to buy the stock at the strike price if the option holder exercises it.

4. Naked Puts

Naked puts are another high-risk, high-reward strategy where you sell put options without owning the underlying stock. You profit from the premium, but if the stock price drops below the strike price, you are obligated to purchase the stock at the strike price if the option holder exercises it.

5. Bullish Call Spread

This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price. With a bullish call spread, you profit when the underlying stock price rises beyond the higher strike price, and your losses are limited since you’re buying a call for a lower price.

6. Bearish Put Spread

A bearish put spread involves buying a put option with a lower strike price and selling a put option with a higher strike price. This strategy is suitable when you anticipate the underlying stock price to decline. You profit when the underlying stock price falls below the strike price of the put you bought, and your losses are capped because you bought a put for a lower price.

Managing Risk in Option Trading

Options trading carries inherent risks, so effective risk management is crucial. Here are some key risk management strategies to consider:

1. Limit Losses with Stop-Loss Orders

Stop-loss orders are crucial tools for limiting your potential losses. They automatically sell your options contracts when they reach a specific price, preventing huge losses if the market turns against you. Robinhood allows you to set stop-loss orders for your options positions.

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your options portfolio by investing in multiple assets, sectors, and trading strategies. This reduces the impact of a single bad bet and helps spread out risk.

3. Understand Expiration Dates

Time decay (theta) is a significant factor in options trading. Options lose value as they approach their expiration date. As the time to expiration decreases, the rate of theta decay increases. Therefore, it’s crucial to understand the time value of your options and manage your positions accordingly to minimize losses.

4. Stay Informed – Market Research and Analysis

Knowledge is power. Stay informed about market movements, news events, and economic data that can impact options prices. Utilize resources like financial news websites, charts, and trading platforms like Robinhood to conduct thorough research and analysis.

Option Trading On Robinhood

Conclusion: Embrace the Potential, Manage the Risk

Option trading can be an exciting and potentially lucrative adventure, but it’s not for the faint of heart. Mastering the basics, understanding strategies, and managing risk are critical steps to success. Robinhood provides a user-friendly platform for beginners to explore the world of options trading. However, always remember that options trading is inherently risky and should be approached with caution. Start with a solid understanding of the fundamentals, continue learning, and manage your risk wisely, and you can potentially unlock the world of opportunities offered by options trading.