As a fervent observer of the financial markets, I couldn’t help but be drawn to the captivating world of Tesla options trading. With its unyielding pursuit of innovation and limitless growth potential, Tesla has become a beacon for traders seeking both financial gain and the opportunity to participate in a revolutionary technological movement.

Image: seekingalpha.com

Delving into Tesla Options Trading

Options trading, in essence, grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price and time. In the case of Tesla options trading, traders can speculate on the future price movements of the company’s stock, known as the underlying asset. The allure of options trading lies in its amplified profit potential relative to traditional stock purchases.

Navigating Call and Put Options

Understanding the mechanics of call and put options is crucial for successful Tesla options trading. Call options confer the right to buy the underlying stock at a predetermined price, known as the strike price, while put options provide the right to sell at the strike price. These options, when employed adeptly, empower traders to capitalize on anticipated price fluctuations.

If a trader anticipates a rise in Tesla’s stock price, they may purchase a call option. Conversely, if a decline is expected, a put option would be the appropriate choice. The strike price, time to expiration, and implied volatility of the option all impact its value and the potential profit or loss involved.

Navigating the Tesla Options Landscape

Tesla options trading thrives amidst high volatility and substantial trading volume, making it an exhilarating yet challenging terrain for even seasoned traders. Keeping abreast of the latest company news, economic updates, and market sentiment is paramount to making informed decisions.

Traders should also pay heed to the intrinsic value and time value of Tesla options. The intrinsic value represents the difference between the stock price and the option’s strike price, reflecting the potential for profit or loss at the time of purchase. Time value, on the other hand, reflects the period remaining before the option expires, with longer-dated options commanding a higher premium.

Image: seekingalpha.com

Tips for Maximizing Tesla Options Trading Success

Successful Tesla options trading hinges on a deep understanding of the market and a well-defined trading strategy.

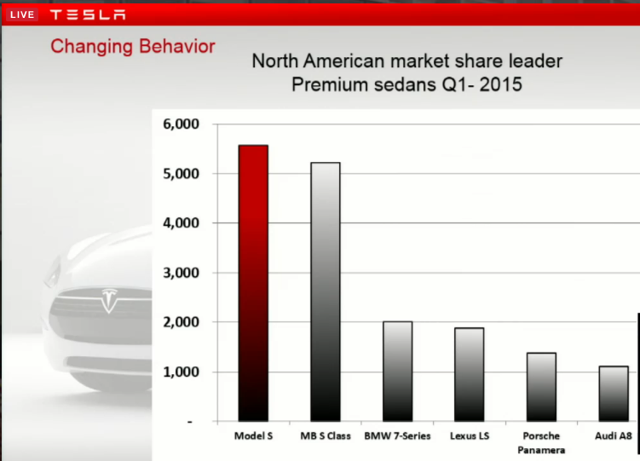

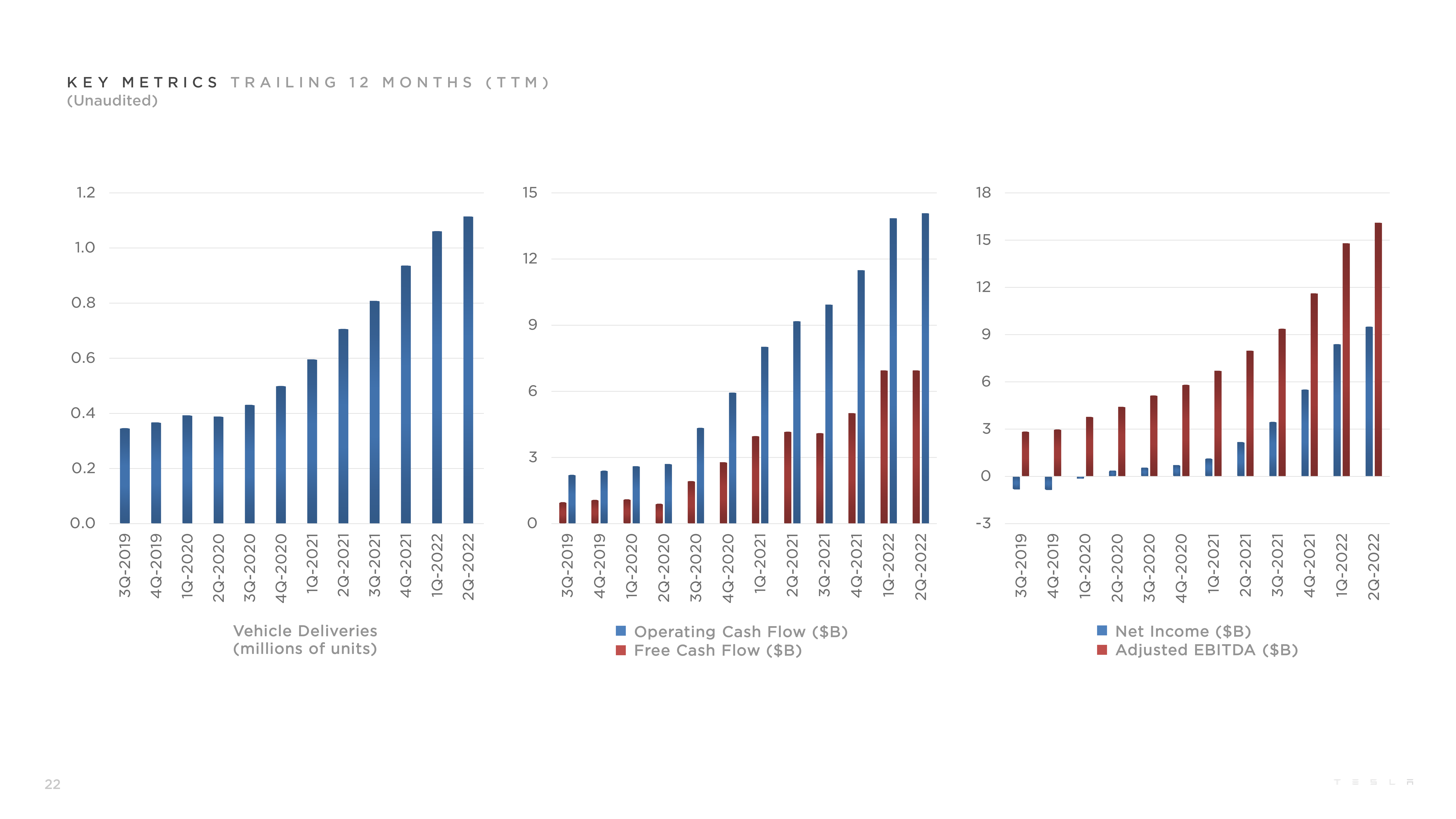

- Scrutinize Tesla’s fundamentals: Evaluating Tesla’s financial performance, growth prospects, and industry position provides valuable insights for informed decisions.

- Comprehend option pricing models: A working knowledge of models such as the Black-Scholes model enables traders to calculate option premiums and make informed pricing assessments.

- Monitor market volatility: Volatility, a measure of price fluctuations, significantly influences option prices. Closely tracking historical volatility and implied volatility aids in formulating trading strategies.

Leverage technical indicators: Technical analysis tools, such as moving averages, support and resistance levels, and momentum indicators, can provide valuable insights into short-term price trends.

Common Queries Regarding Tesla Options Trading

- Q: What are the risks associated with Tesla options trading?

A: Tesla options trading carries inherent risks, including the possibility of losing the entire investment, or even exceeding the initial investment in certain scenarios.

- Q: How do I select the appropriate strike price and expiration date for Tesla options trading?

A: Strike price selection depends on the trader’s market outlook. The expiration date should align with the expected duration of the price movement.

- Q: Is Tesla options trading suitable for novice investors?

A: The complexities and risks involved make Tesla options trading generally inadvisable for inexperienced investors without a thorough understanding of financial markets.

Tesla Options Trading

Conclusion

Tesla options trading presents a potent blend of excitement and financial opportunity, empowering traders to potentially harness the revolutionary momentum of the electric vehicle giant. However, it’s imperative to approach this arena with a deep understanding of the mechanics, risks, and strategies involved.

If you find yourself captivated by the allure of Tesla options trading, I invite you to embark on a quest for knowledge, seek expert counsel, and cultivate a refined trading strategy. The road ahead may be fraught with challenges, but also holds the promise of invigorating experiences and financial rewards.