Unlock the Secrets of Excel for Sophisticated Options Trading

In the realm of financial markets, where opportunities abound and risks lurk around every corner, lies the enigmatic world of equity options trading. As a trader, navigating this complex landscape can be daunting, but with the right tools and knowledge, you can unlock its potential and elevate your trading strategy.

Image: www.scribd.com

Enter Microsoft Excel—a versatile tool that has transformed the way traders analyze data, model scenarios, and execute trades. Its spreadsheet capabilities and powerful functions make it an indispensable ally for any options trader seeking an edge.

Demystifying Options Trading with Excel

Equity options are financial instruments that provide traders with the right, but not the obligation, to buy (Call options) or sell (Put options) an underlying asset, such as a stock, at a specified price on a predetermined date. Understanding the mechanics of options trading is crucial, and Excel serves as an ideal platform for simplifying this process.

By leveraging Excel’s functions, you can effortlessly calculate option prices using the renowned Black-Scholes model. This advanced mathematical formula considers various factors, including the underlying asset’s price, strike price, time to expiration, risk-free rate, and volatility, to determine the fair value of an option contract.

Excel’s Arsenal for Options Traders

Excel’s capabilities extend far beyond basic calculations. Its extensive library of financial functions empowers traders to perform complex analyses, automate calculations, and visualize data with ease.

For instance, Excel’s “Goal Seek” function allows traders to adjust inputs until a desired output is achieved. This feature is particularly valuable for determining strike prices or expiration dates that meet specific profit targets or risk management parameters. Additionally, Excel’s charting tools provide a visual representation of price movements, trends, and technical indicators, enabling traders to make informed decisions.

Trading Strategies and Risk Management in Excel

Excel not only simplifies calculations but also facilitates the development and testing of trading strategies. Traders can create spreadsheet models to simulate various scenarios and analyze potential outcomes based on different market conditions.

Moreover, Excel’s risk management tools aid traders in assessing their positions and managing potential losses. By calculating Greeks—measures of option sensitivity to changes in underlying variables—traders can quantify risk and make informed adjustments to their strategies.

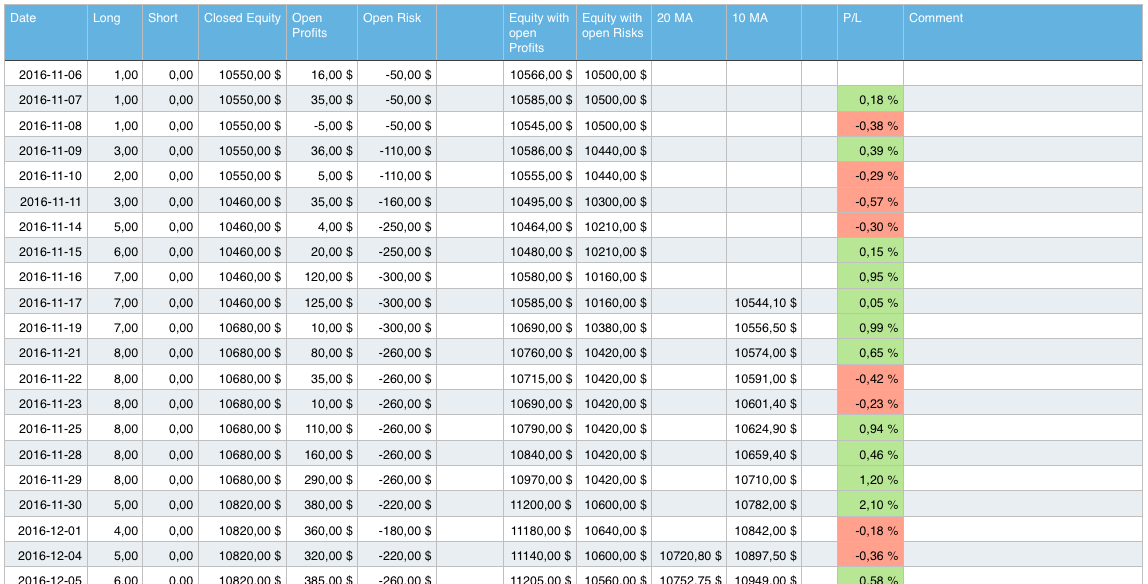

Image: equityrt.com

Expert Advice and Insights

My journey as a blogger has exposed me to a wealth of knowledge and expert insights from seasoned options traders. Here are some invaluable tips to enhance your Excel-based trading experience:

- Master Data Management: Ensure that your spreadsheets are organized and data is accurate. Historical price data can be imported from sources like Yahoo Finance.

- Automate Calculations: Utilize Excel’s formulas and functions to automate repetitive calculations, saving time and reducing errors.

- Visualize Trends: Create charts to monitor price movements and identify trading opportunities. Technical analysis can be enhanced by overlaying indicators like Moving Averages and Relative Strength Index.

- Manage Risk Carefully: Calculate Greeks to assess option sensitivity and adjust positions accordingly. Monitor your trades regularly and implement stop-loss orders to limit potential losses.

Frequently Asked Questions (FAQs)

- Q: Can I trade options effectively using only Excel?

A: While Excel is a powerful tool, it has limitations. Live data streaming, order execution, and position monitoring require additional platforms or broker integrations.

- Q: Is Excel suitable for both beginners and experienced traders?

A: Absolutely! Beginners can use Excel to understand options basics and practice strategies, while experienced traders leverage advanced functions for complex analyses and risk management.

- Q: Are there any limitations to using Excel for options trading?

A: Excel may not be suitable for high-frequency trading due to potential lags in data updates. Additionally, it requires a basic understanding of spreadsheet formulas and functions.

Excel Equity Options Trading

Image: julian-komar.com

Conclusion

Excel plays a pivotal role in empowering traders to navigate the complexities of equity options trading. Its versatile features simplify calculations, facilitate strategy development, aid in risk management, and augment analytical capabilities.

By embracing Excel’s arsenal of tools and applying the expert advice outlined above, you can transform this ubiquitous spreadsheet platform into a potent weapon in your options trading arsenal. Embrace the power of Excel and unlock the boundless opportunities that await you in the world of equity options.

Are you ready to elevate your trading game with Excel by your side?