In the realm of financial markets, where risk and opportunity dance endlessly, option trading emerges as an intricate art form. Among the numerous strategies that dot the trading landscape, directional option trading stands out as a powerful tool for amplifying potential returns. This article delves into the world of directional option trading, with a particular focus on the Nasdaq-100 Index ETF (QQQ), a bellwether for the technology sector. Understanding this strategy and its nuances can empower investors with a precise scalpel to carve out profitability in the ever-shifting market landscape.

Image: qqq-options-trading.com

A Brief Interlude: The Concept of Directional Option Trading

Directional option trading hinges on the trader’s ability to forecast the direction of an underlying asset’s price. As implied by its name, this strategy revolves around betting on whether the price will rise (bullish trade) or fall (bearish trade). By purchasing or selling options, traders speculate on the future movements of the underlying asset, aiming to capitalize on correctly predicting its path.

Unveiling the QQQ: A Technological Powerhouse

The Nasdaq-100 Index ETF (QQQ) is an index fund that tracks the performance of the 100 largest non-financial companies listed on the Nasdaq stock exchange. It serves as a proxy for the technology sector, offering exposure to giants such as Apple, Microsoft, Amazon, and Google. The QQQ’s concentration in the tech industry makes it an attractive target for investors seeking exposure to the sector’s growth potential.

Bullish Bets: Capturing the QQQ’s Surge

When bullish sentiments prevail, traders can employ directional option trading strategies to capture the QQQ’s upward trajectory. Buying call options grants the right to purchase the underlying asset at a predetermined price (strike price) by a specific expiration date. Should the QQQ’s price rise above the strike price, the call option’s value increases, potentially yielding substantial profits to the trader.

Bearish Maneuvers: Navigating the QQQ’s Dips

In anticipation of a bearish market, traders can initiate directional option trades to profit from the QQQ’s decline. Selling put options involves the obligation to sell the underlying asset at a specified strike price upon the option’s expiration. As the QQQ’s price falls below the strike price, the value of the put option escalates, providing the trader with a source of income.

Market Influences and Technical Indicators

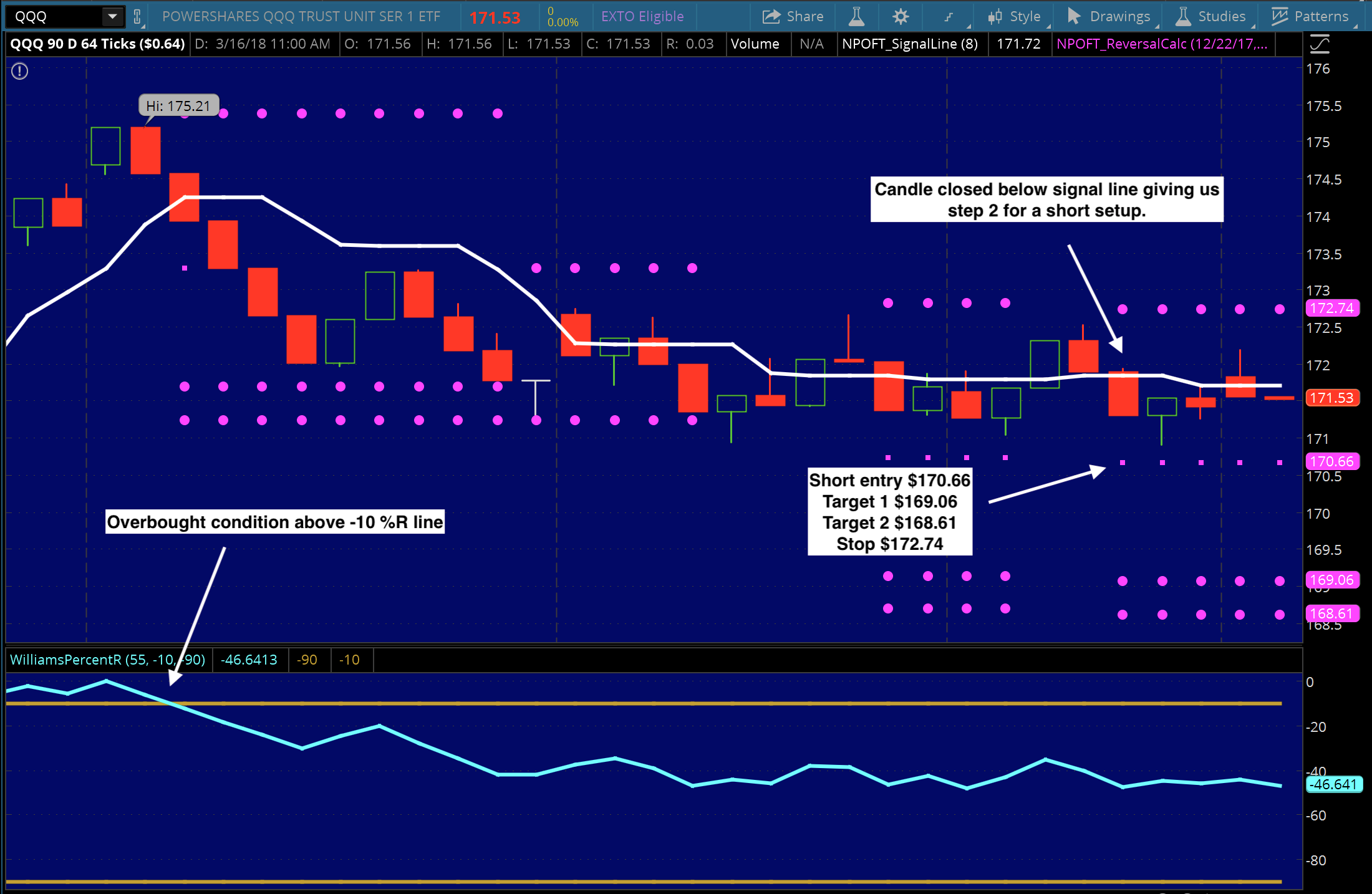

Navigating the dynamic waters of directional option trading requires a keen understanding of market influences and technical indicators. Economic data, earnings reports, and geopolitical events can significantly impact the QQQ’s price. Traders must stay abreast of these developments to make informed trading decisions.

Technical indicators, such as moving averages, support and resistance levels, and momentum oscillators, offer valuable insights into the QQQ’s price movements. By studying these indicators, traders can identify potential trading opportunities and refine their directional option trading strategies.

Risk Management: Walking the Tightrope of Reward and Risk

As with any financial endeavor, directional option trading carries inherent risks. Unforeseen market movements can lead to substantial losses, which is why effective risk management is paramount. Position sizing, stop-loss orders, and hedging techniques serve as essential tools for traders to mitigate their exposure and protect their capital.

Conclusion: Harnessing the Power of Directional Option Trading

Directional option trading presents an astute method for capitalizing on the price fluctuations of the Nasdaq-100 Index ETF (QQQ). By understanding the concept of directional trading, traders can tailor strategies to capture the QQQ’s upward momentum or benefit from its downturns. However, it is essential to exercise due diligence, manage risk prudently, and continuously monitor market dynamics and technical indicators to maximize returns and navigate potential pitfalls. With a discerning eye and unwavering discipline, directional option trading can empower investors to ride the QQQ’s technological wave and unlock the potential of the market

Image: tradingforexguide.com

Diectional Option Trading The Qqq

Image: www.netpicks.com