Introduction

Imagine a world where you could generate a consistent stream of income from your brokerage account, regardless of market fluctuations. This dream is not a distant reality, thanks to the power of options trading strategies like covered calls. In this comprehensive guide, we will delve into the intricacies of writing covered calls, empowering you with the knowledge to navigate this lucrative strategy and harness its income-generating potential.

Image: www.pinterest.com

Unveiling the Concept of Covered Calls

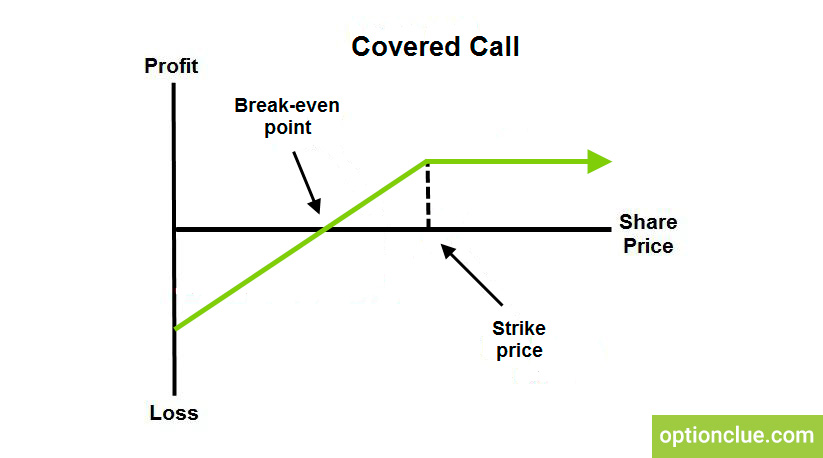

A covered call is a sophisticated options trading strategy that combines buying a stock (or already owning a stock) and selling (writing) a call option on the same underlying asset. Essentially, you are selling someone the right to buy your shares at a specified price within a defined time frame. When successfully executed, covered calls can generate a steady flow of premium income while also providing downside protection for your stock holdings.

How it Works: A Step-by-Step Breakdown

To illustrate the mechanics of covered calls, let’s assume you own 100 shares of Apple stock (AAPL) currently trading at $150 per share. You could sell a June 17th covered call with a strike price of $155 for a premium of $2.50 per share. This means you are granting someone the right (but not the obligation) to buy your AAPL shares at $155 until the option expires on June 17th. Here’s how the potential outcomes unfold:

-

Option Expires Out-of-the-Money (OTM): If AAPL closes below $155 on June 17th, the option you sold will expire worthless, and you will keep the entire premium of $250 ($2.50 x 100 shares).

-

Option Expires At-the-Money (ATM): If AAPL closes exactly at $155 on June 17th, the option could expire worthless or be assigned. If assigned, you will be obligated to sell your AAPL shares at $155, generating a profit of $50 ($155 – $150) per share and the premium of $250.

-

Option Expires In-the-Money (ITM): If AAPL closes above $155 on June 17th, the option will be assigned, and you will be obligated to sell your AAPL shares at $155. While you will miss out on any further upside potential in the stock price, you will still earn a profit from the premium you received.

Harnessing the Income Potential of Covered Calls

The primary allure of covered calls lies in their ability to generate a steady stream of income. By selling call options on your existing stock holdings, you can earn a premium payment upfront, regardless of whether the stock price rises or falls. This income stream can supplement your other investment returns and provide a buffer during market downturns. Additionally, covered calls allow you to participate in potential upside gains of the underlying stock, albeit capped at the strike price of the option you sold.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Image: www.kingdavidsuite.com

Mitigating Risks and Enhancing Strategies

Like any investment strategy, covered calls come with inherent risks. To mitigate these risks, it’s crucial to:

-

Choose Strikes Wisely: Select strike prices that are above your cost basis to protect against potential losses.

-

Manage Time to Expiration: Short-term options (less than 30 days to expiration) carry higher risk and should be used cautiously.

-

Monitor Position Regularly: Regularly review your covered call positions and adjust your strategy as market conditions change.

-

Consider Market Volatility: Understand that options premiums are affected by market volatility. Exercise caution when selling covered calls during highly volatile market periods.

Expert Insights and Actionable Tips

To enhance your covered call strategy, consider these expert tips:

-

“Covered calls are a great way to generate income from your stock portfolio, but it’s essential to manage your risk carefully. Sell calls on stocks you believe will trade sideways or slightly higher.” – Michael Batnick, author of “Big Book of Options”

-

“Don’t get greedy with your strike prices. It’s better to collect a smaller premium and increase the chances of your option expiring out-of-the-money.” – Benzinga, leading financial news and analysis website

Options Trading Writing Covered Calls

Image: optionclue.com

Conclusion

Covered calls are a powerful options trading strategy that can help you generate income, reduce risk, and enhance your overall portfolio performance. By carefully selecting strike prices, managing expiration dates, and monitoring your positions, you can harness the power of covered calls to achieve financial success. Remember to always conduct thorough research, learn from expert insights, and approach trading with a disciplined and risk-averse mindset. Embrace the world of covered calls and unlock the potential for consistent returns in the exciting realm of options trading.