Introduction

In the realm of investing, the quest for generating income and enhancing returns often leads us down a labyrinth of options. Among these options lies a strategy that combines the allure of stock ownership with the flexibility of options trading: covered calls. As we delve into the intricacies of covered calls, let’s uncover how these financial instruments can empower you to navigate volatile markets, mitigate risks, and harness the potential for steady income streams.

Image: www.youtube.com

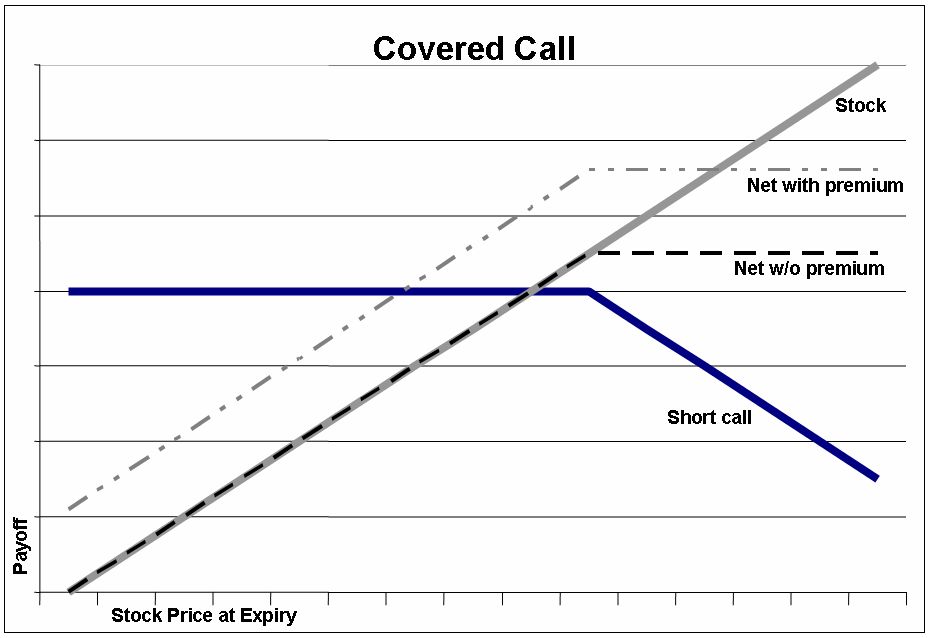

Covered calls, simply put, involve selling or “writing” call options against a stock you already own. These call options grant the buyer the right, but not the obligation, to purchase your stock at a predetermined strike price before a certain expiration date. By selling these options, you receive a premium upfront, representing income generated solely from the option transaction.

The Mechanics of Covered Calls

Understanding the mechanics of covered calls is essential to appreciate their potential. When you sell a covered call, you’re granting the buyer the option to buy your stock at the specified strike price on or before the expiration date. For this privilege, the buyer pays you an upfront premium, which becomes your immediate profit on the transaction. However, it’s crucial to note that if the stock price rises above the strike price before expiration, the buyer may exercise their option, obligating you to sell the underlying stock at that price, potentially limiting your potential profit on the stock itself.

Let’s illustrate this concept with an example. Suppose you own 100 shares of Apple (AAPL) stock, currently trading at $150, and you sell a covered call option with a strike price of $155 and an expiration date of one month. The market is currently valuing this option at $5, which means you’ll receive a premium of $500 (5 x 100 shares) right away.

Now, there are three possible outcomes:

-

Stock Price Below Strike Price: If AAPL remains below $155 at expiration, the call option will expire worthless, and you retain ownership of your stock while pocketing the $500 premium.

-

Stock Price at Strike Price: If AAPL closes at $155, the buyer may or may not exercise the option. If they do, you’ll sell them your shares at $155, realizing a profit of $1,500 (100 shares x ($155 – $150)) plus the $500 premium, for a total profit of $2,000.

-

Stock Price Above Strike Price: If AAPL rallies to $160, the buyer will likely exercise their option to purchase your stock at $155, forcing you to sell at that price. In this scenario, while you’ll still receive the $500 premium, your potential profit on the stock is capped at $500 (100 shares x ($155 – $150)), as you’re obligated to sell at that lower price.

Benefits of Covered Calls

Covered calls offer several potential advantages to investors:

-

Income Generation: The upfront premium received from selling covered calls provides a steady stream of cash flow, potentially supplementing your income from dividends or other sources.

-

Partial Risk Mitigation: Unlike traditional option selling, covered calls limit the potential downside of stock ownership, as you only risk losing the option premium rather than the entire value of the underlying stock.

-

Enhanced Stock Performance: The premium you earn from covered calls can supplement potential gains from stock price appreciation, effectively enhancing your overall returns.

Considerations Before Selling Covered Calls

While covered calls offer potential benefits, it’s crucial to consider certain factors before implementing this strategy:

-

Stock Volatility: Covered calls are generally more appropriate for stocks with relatively low volatility, as excessive price fluctuations can lead to unexpected results.

-

Opportunity Cost: Selling covered calls may limit your potential gains on the underlying stock if it rallies significantly, as you’ll be obligated to sell at or below the strike price.

-

Complexity: Options trading involves complexities, and covered calls are no exception. It’s essential to fully understand the concept, risks, and potential rewards before engaging in this strategy.

Image: epsilonoptions.com

Covered Calls Options Trading

Image: www.newtraderu.com

Empowering Your Investment Journey

Covered calls can be a valuable tool in the hands of informed investors seeking to generate income, mitigate risks, and enhance returns. By understanding the mechanics and nuances of covered calls, you can harness their potential to augment your investment strategy.

Remember, investing always involves inherent risks, and covered calls are no exception. It’s crucial to conduct thorough research, consult with financial professionals if needed, and consider your individual investment goals and risk tolerance before implementing this or any other investment strategy.