As an options trader, I’ve encountered countless market scenarios that demand adaptability and strategic decision-making. In the face of fluctuating market conditions, non-directional options trading has emerged as a valuable hedging mechanism, enabling traders to generate consistent returns irrespective of market direction.

Image: www.pinterest.com

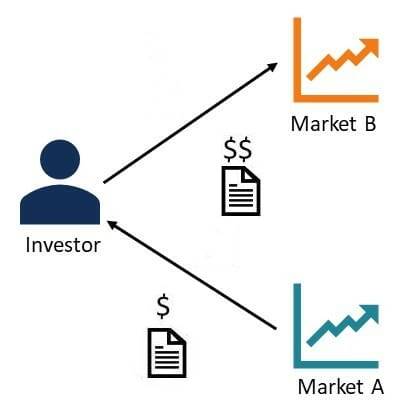

Non-directional options trading involves strategies that profit from price fluctuations within a specific range, rather than relying solely on directional predictions. This approach mitigates risk and increases the odds of successful trades.

The Essence of Non-Directional Options Trading

At its core, non-directional options trading capitalizes on market volatility by selling or buying options with a preset range of strike prices. Traders seek to benefit from the time decay of options premiums, reaping profits from the gradual decrease in value as expiration approaches.

This risk-averse approach allows traders to sidestep the potentially catastrophic losses associated with directional bets. By limiting the potential loss to the premium paid for the options, non-directional options trading enhances the overall portfolio resilience.

Latest Trends and Techniques

The non-directional options trading landscape is continuously evolving, with innovative strategies and techniques emerging to meet the challenges of increasingly complex market conditions. To stay abreast of the latest trends, it’s crucial to stay attuned to industry updates, news sources, and engage in active discussions with the trading community.

For instance, a recent advancement in this arena is the deployment of machine learning algorithms to identify optimal entry and exit points for non-directional trades. By leveraging historical data and advanced statistical models, traders can enhance their decision-making process and capitalize on market inefficiencies.

Expert Tips for Maximizing Returns

Based on my experience and insights from seasoned options traders, I’ve compiled a set of expert tips to assist you in navigating the intricacies of non-directional options trading:

- Thorough understanding: Delve deeply into the concepts and intricacies of non-directional options trading, mastering the nuances and complexities involved.

- Select suitable strategies: Explore a range of non-directional trading strategies and opt for those that align with your risk tolerance, capital allocation, and market outlook.

- Tightly manage risk: Implement rigorous risk management techniques to limit potential losses, including position sizing, stop-loss orders, and scenario analysis.

In addition, consider the following advice:

- Embrace patience: Non-directional options trading often necessitates patience and discipline. Allow for ample time for positions to play out and resist the urge to make impulsive decisions.

- Focus on long-term returns: While non-directional options trading offers consistent returns, it may not yield substantial overnight profits. Focus on accumulating gradual gains over time.

Image: www.quantsapp.com

Frequently Asked Questions (FAQs)

Q: Is non-directional options trading suitable for beginners?

A: While non-directional options trading carries reduced risk compared to directional trading, it still requires a sound understanding of options fundamentals, market dynamics, and risk management principles. It’s advisable for beginners to gain experience through simulated trading before venturing into real-world markets.

Q: How do I determine the optimal range of strike prices for non-directional trades?

A: Optimal strike price selection depends on several factors, including historical volatility, time to expiration, and the trader’s expected market range. Technical analysis tools such as Bollinger Bands and Ichimoku Clouds can assist in identifying potential price boundaries.

Non Directional Trading Options

Image: www.pinterest.com

Conclusion

Non-directional options trading offers a prudent and effective approach to navigating market volatility. By adopting the principles outlined in this article, you can enhance your understanding of this valuable trading technique and maximize your chances of generating consistent returns. Whether you’re a seasoned trader or just starting your journey, non-directional options trading is a powerful tool to consider for your financial arsenal.

Are you eager to explore the world of non-directional options trading further? Join our community of experienced traders and immerse yourself in the latest strategies, market analysis, and trading tips.