As an active options trader, I’ve witnessed firsthand the significance of meticulous record keeping. The relentless pace and complexities of options trading demand accurate and organized records to navigate the market’s intricacies. In this article, we unravel the essential aspects of option trading record keeping, providing you with the tools to harness the power of data for strategic insights.

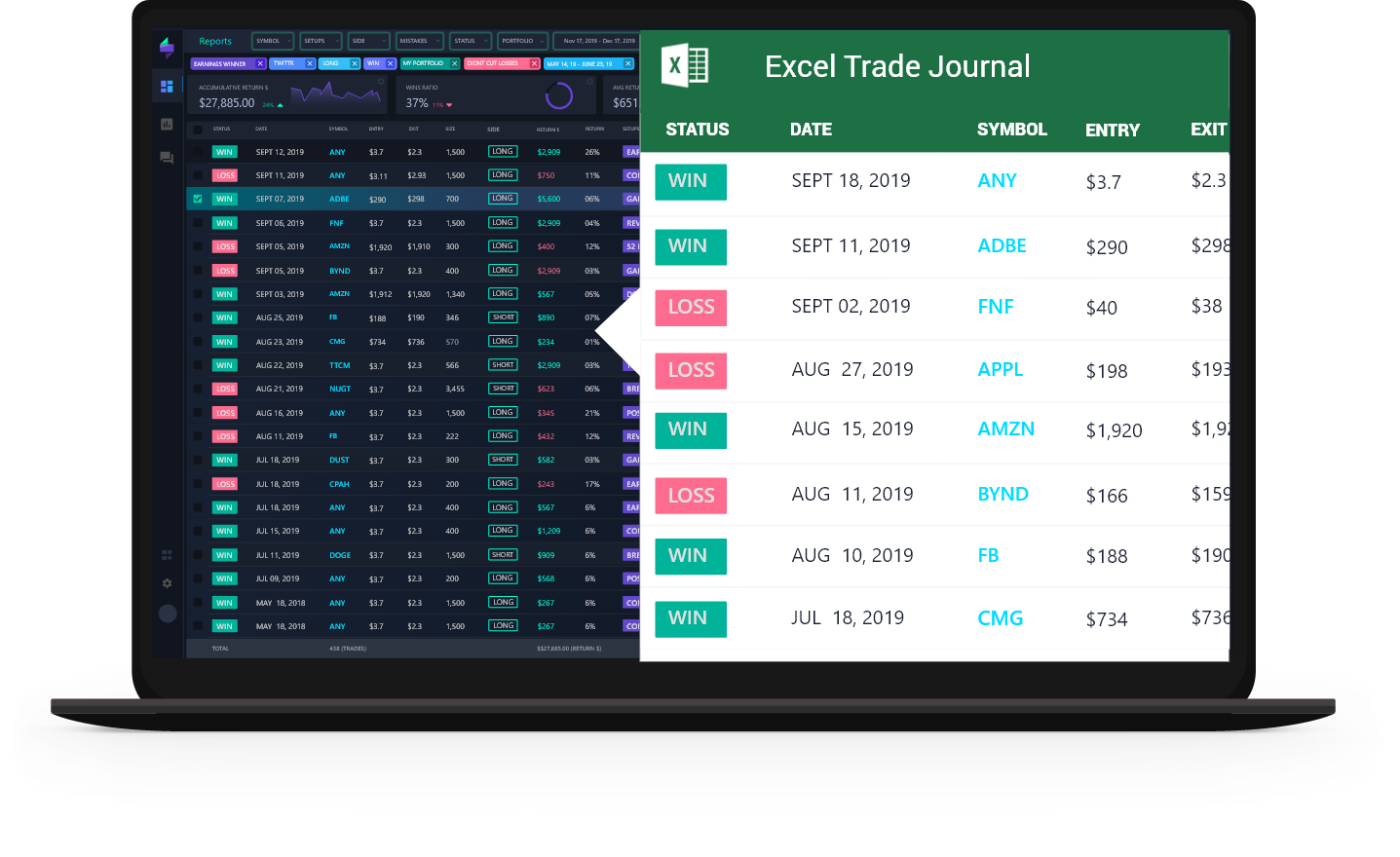

Image: tradersync.com

The Merits of Diligent Record Keeping

Effective record keeping in options trading is not merely an administrative task; it’s a fundamental pillar supporting informed decision-making. Through comprehensive record-keeping, you gain a panoramic view of your trading activities, enabling you to:

- Track performance and identify areas for improvement: By meticulous evaluation of your trades, you discern patterns in your approach, allowing for targeted refinement to enhance your strategies.

- Monitor risk exposure and manage potential losses: Detailed records elucidate your overall market exposure, empowering you to align your risk appetite with strategic choices, minimizing potential setbacks.

- Maintain compliance with regulatory requirements: Comprehensive records serve as a valuable resource for auditors, ensuring compliance with industry regulations, safeguarding your reputation, and avoiding costly consequences.

Navigating the Maze of Option Types

The diverse universe of options contracts presents a myriad of possibilities. Each type serves a distinct purpose, and recognizing their nuances is pivotal to effective trading. Here’s a concise overview of the main categories:

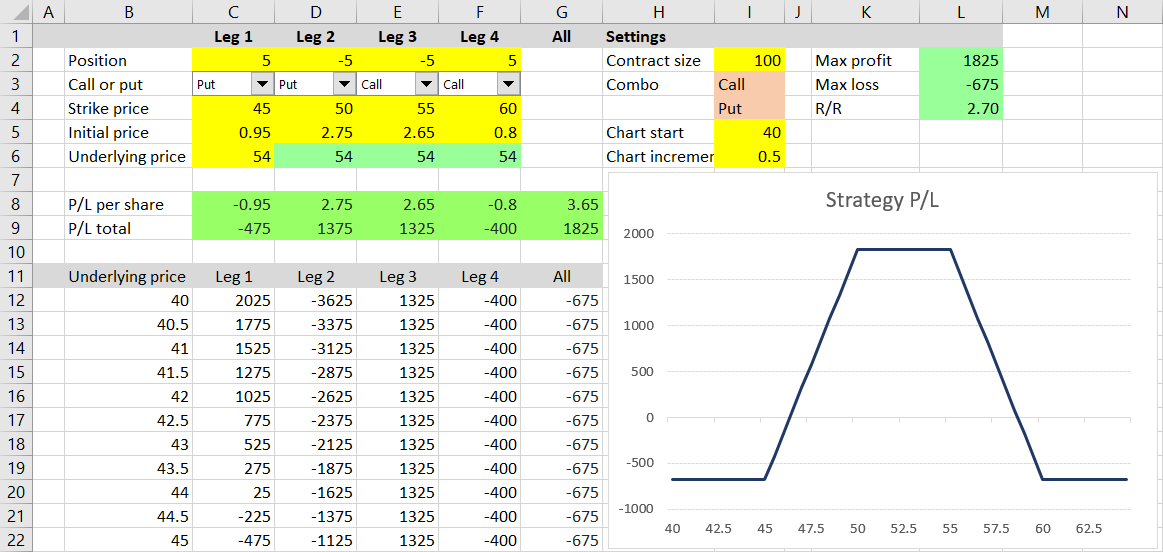

- Calls: These confer upon the holder the right to purchase the underlying asset at a stipulated price, known as the strike price. The value of calls typically increases as the underlying asset’s price rises.

- Puts: In contrast to calls, puts grant the holder the right to sell the underlying asset at the specified strike price. Their value generally climbs as the underlying asset’s price declines.

- Combination strategies: Skilled option traders often craft sophisticated strategies that combine multiple option types to augment returns or mitigate risks.

The Nitty-Gritty of Record Keeping

To navigate the intricacies of options trading, a structured record-keeping system is indispensable. Here are key elements to incorporate into your own:

- Trade log: This chronological ledger meticulously documents every trade executed, capturing essential details such as date, time, underlying asset, option type, strike price, premium paid/received, order type, and execution price.

- Option tracking tool: Specialized software or online platforms streamline option tracking. They furnish real-time data, facilitate strategy analysis, and generate comprehensive reports, enhancing your efficiency.

- Performance analysis: Periodically, delve deep into your trading data, scrutinizing key metrics like win rate, risk-to-reward ratio, and average profit/loss. Objective evaluation empowers you to identify and capitalize upon trading strengths while addressing areas for optimization.

Image: db-excel.com

Expert Insights: Trading Wisdom from the Pros

To maximize the efficacy of your option trading record-keeping, heed the following advice from seasoned experts:

- Embrace technology: Leverage option tracking tools to simplify data management, analysis, and decision-making. The power of technology accelerates your progress towards becoming a discerning trader.

- Seek personalized feedback: Consult with brokers, mentors, or online forums to gain practical insights specific to your trading style and portfolio. External perspectives can refine your approach, leading to enhanced returns.

- Embrace continuous learning: The financial landscape is in a perpetual state of flux. Stay abreast of market trends, regulatory changes, and novel trading strategies to maintain your competitive edge.

Frequently Asked Questions Regarding Option Trading Record Keeping

- Q: How frequently should I review my trading records?

A: Consistency is key. Establish a regular cadence for reviewing your records, whether it be weekly, bi-weekly, or monthly. This structured approach ensures timely identification of areas for improvement. - Q: What if I incur losses? Should I track them as well?

A: Absolutely. Losses are integral to the learning process. By meticulously documenting both wins and losses, you cultivate valuable insights into market dynamics and your trading approach. - Q: How can record keeping assist in tax preparation?

A: Comprehensive records serve as an invaluable resource for tax reporting. They furnish accurate and verifiable documentation of your trades, simplifying the preparation process and minimizing the risk of inaccuracies or inaccuracies.

Option Trading Record Keeping

Image: www.macroption.com

Conclusion

Effective option trading record keeping is an indispensable tool for the modern-day trader. By embracing the principles outlined in this guide, you stand to elevate your trading prowess, leveraging the power of data to make informed decisions, maximize returns, and minimize risks. Remember, the arduous journey towards financial success requires meticulous record-keeping as your steadfast ally. So, embrace the art of documentation to unleash your full potential in the dynamic realm of options trading.

Are you ready to embrace the transformative power of option trading record keeping? Share your thoughts and experiences in the comments section below.