Dive into the Intriguing World of Options Trading with Stash

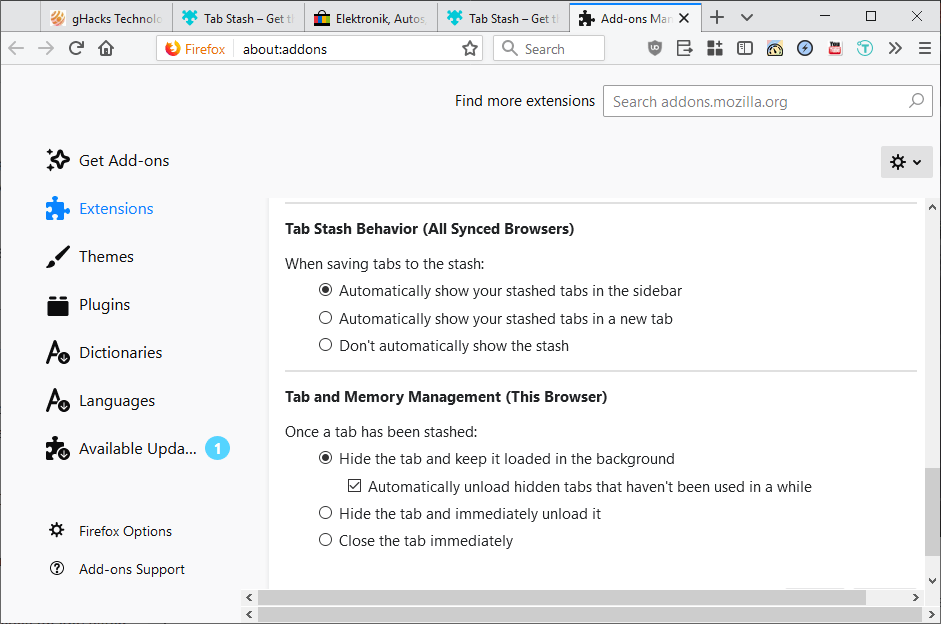

In the ever-evolving financial landscape, options trading has emerged as a potent tool for investors seeking to navigate market volatility and enhance their returns. Stash, a user-friendly investing platform, has made options trading accessible to a wider audience, empowering individuals to unlock the potential of this dynamic investment strategy. This comprehensive guide will delve into the intricacies of stash options trading, covering everything you need to know to get started.

Image: theisozone.com

Unveiling the Essence of Options Trading

Options contracts can be likened to financial instruments that provide the holder with the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specified price within a predetermined timeframe. This flexibility empowers traders to speculate on the future direction of an asset’s price while managing their risk exposure through pre-defined parameters.

Unlike traditional stock investments where ownership of the underlying asset is acquired, options confer upon the holder the ability to capitalize on price fluctuations without the hefty upfront investment required for direct asset ownership. This cost-effective approach to market participation makes options trading an attractive proposition for investors looking to maximize their returns with limited capital.

Decoding the Mechanics of Stash Options Trading

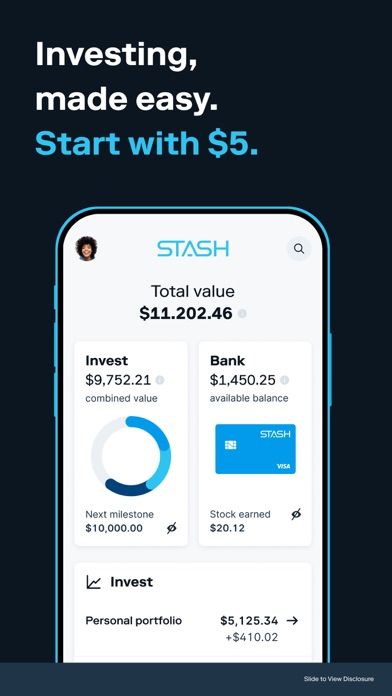

Embarking on your options trading journey with Stash is remarkably straightforward. The platform’s user-friendly interface simplifies the process, enabling you to navigate the intricacies of options trading seamlessly. By selecting the desired stock or ETF, you can conveniently access a range of option contracts with varying expiration dates and strike prices.

Upon selecting your preferred contract, you will be provided with comprehensive details, including the premium (cost of the contract), expiration date, and strike price. The strike price represents the price at which you can potentially buy or sell the underlying asset if you choose to exercise your option.

Unlocking the Power of Call and Put Options

Stash options trading encompasses two primary types of options: call and put options. Call options grant the holder the right to buy the underlying asset at the strike price on or before the expiration date. This strategy is employed when bullish sentiments prevail, anticipating an uptick in asset value. Contrarily, put options confer the right to sell the underlying asset at the strike price. These are typically exercised when bearish market conditions are anticipated, expecting a decline in asset value.

Striking the optimal balance between risk and reward is paramount in options trading. Traders should meticulously assess market conditions, considering factors such as volatility, liquidity, and the underlying asset’s historical performance.

Image: www.ghacks.net

Stash Options Trading: A Beginner’s Perspective

For those venturing into the realm of options trading for the first time, Stash offers tailored options for a measured initiation into this dynamic investment strategy. The platform provides educational resources, including articles, videos, and webinars, to equip you with the necessary knowledge and confidence to make informed trading decisions.

Moreover, Stash’s intuitive interface simplifies order execution, enabling you to place orders with ease. Furthermore, the platform’s advanced charting tools provide a comprehensive visual representation of market trends, empowering traders to make well-informed Entscheidungen based on technical analysis.

Stash Options Trading

Image: alternativeto.net

Charting the Future of Stash Options Trading

The future of stash options trading holds immense promise, with continuous advancements in technology and evolving market trends driving its growth trajectory. Stash’s commitment to innovation and user satisfaction is evident through its relentless pursuit of enhancements and the introduction of new features to cater to the ever-changing needs of its user base.

As the popularity of options trading continues to surge, Stash stands poised to capitalize on this momentum. By harnessing the power of technology and leveraging its expertise in user-centric design, Stash will undoubtedly play a pivotal role in democratizing access to options trading, making it more accessible and less intimidating for a broader spectrum of investors.