Introduction

Image: www.bsic.it

In the realm of financial markets, where uncertainty and volatility reign supreme, dispersion options trading emerges as a sophisticated strategy that grants investors the ability to manage risk and potentially enhance returns. Defined as options that speculate on the relative performance of multiple underlying assets, dispersion options offer a unique tool for customizing risk exposure and tailoring investments to specific objectives. Understanding the intricate dynamics of dispersion options trading can empower investors with a competitive edge in navigating the ever-evolving financial landscape.

Unveiling the Concept: Dispersion Options 101

Dispersion options, also known as dispersion Greeks, are a specialized type of option contract that derives its value from the dispersion of underlying assets. In contrast to traditional options that focus solely on the price movement of a single asset, dispersion options capitalize on the divergence or convergence of multiple assets’ performance. This approach introduces a new dimension to risk management, allowing investors to diversify their portfolios and manage risk across different sectors or industries.

The Intricacies of Dispersion Options Trading

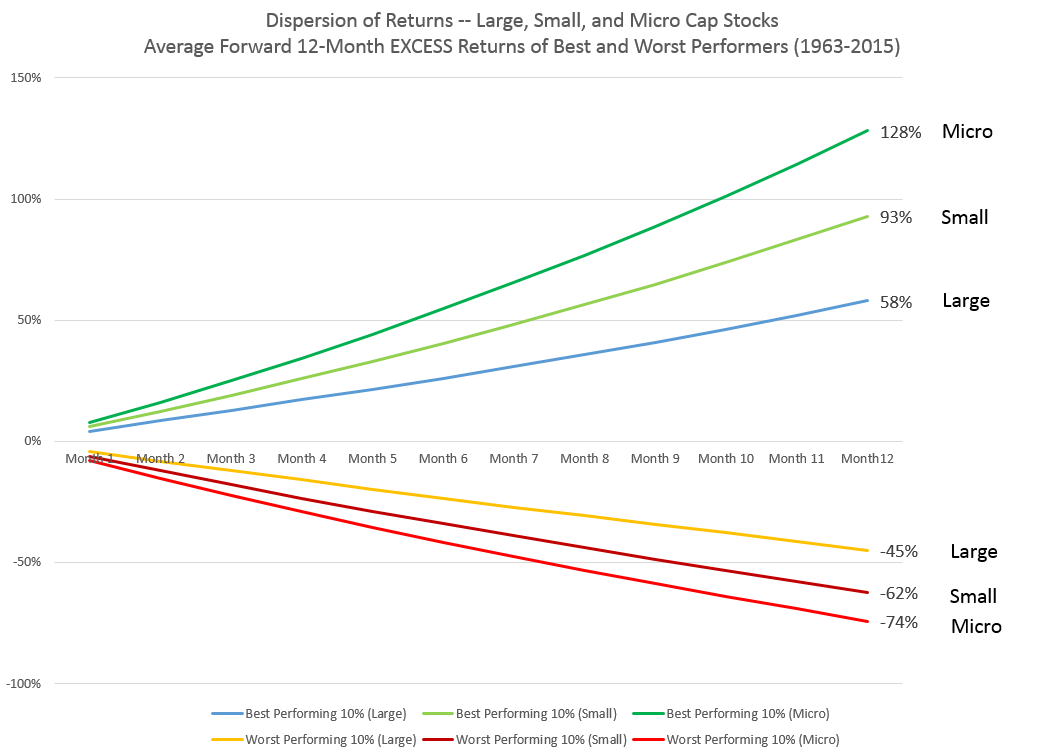

The intricacies of dispersion options trading lie in their ability to capture the interplay of underlying asset price movements. Traders can express directional or non-directional views on the relative performance of assets using different types of dispersion options, such as butterfly spreads, iron condors, and ratio spreads. The intricate dance of these options involves speculating on the spread or difference between the prices of the underlying assets, rather than their individual price movements.

By meticulously selecting the underlying assets and tailoring the option strategy, investors can customize their risk and return profiles to align with their investment goals. Dispersion options trading becomes an art form, where skill and experience converge to optimize risk management and enhance portfolio performance.

Real-World Applications: Unlocking the Potential

In the practical realm of finance, dispersion options unlock a myriad of applications. Hedge funds, investment banks, and sophisticated investors utilize dispersion options to manage risk, enhance portfolio returns, and express directional or non-directional views on market dynamics.

For instance, an investor anticipating a divergence in the performance of technology stocks could employ a dispersion option strategy to capture the spread between the winners and losers within the sector. Alternatively, a trader expecting convergence in the price trajectories of commodities could utilize dispersion options to mitigate risk and potentially generate returns from the narrowing price differential. The versatility of dispersion options makes them an indispensable tool for navigating the intricacies of the financial markets.

Exploring the Latest Trends and Developments

The world of dispersion options trading is constantly evolving, fueled by technological advancements and innovative trading strategies. The integration of artificial intelligence and machine learning enhances the analysis and execution of dispersion options, enabling traders to identify and capitalize on market inefficiencies. Additionally, the rise of structured dispersion products, such as exchange-traded funds, provides accessible options for investors seeking exposure to dispersion strategies.

Conclusion: Empowering Investors in a Dynamic Market

Dispersion options trading has emerged as a powerful technique for managing risk and tailoring investments to specific goals. By understanding the nuances of dispersion options, investors gain the ability to navigate market uncertainty and capitalize on the divergence or convergence of underlying asset prices. As the financial landscape continues to evolve, dispersion options will undoubtedly remain a crucial tool for savvy investors seeking to enhance their portfolio performance and mitigate risk in a dynamic and intricate market environment.

Image: seekingalpha.com

Dispersion Options Trading

Image: www.researchgate.net