For many investors and traders, the stock market represents a blend of thrilling opportunities and daunting uncertainties. Notably, options trading introduces an extra layer of complexity and allure. With the potential to magnify profits but also amplify losses, understanding options trading becomes indispensable for achieving success.

Image: www.victoriana.com

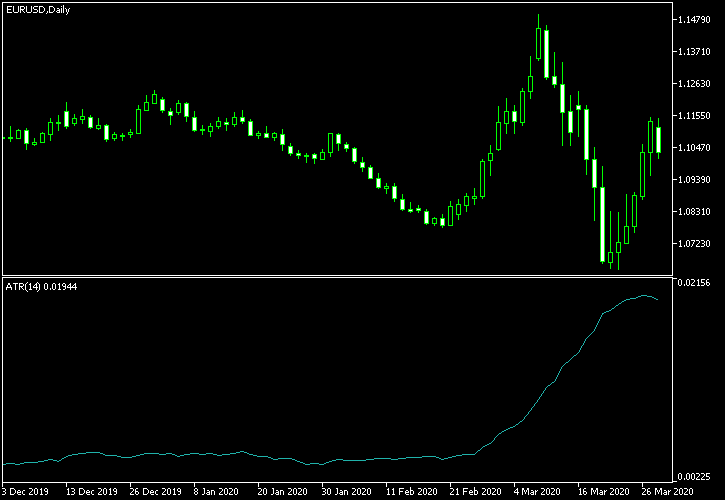

Navigating the intricacies of options trading requires a firm grasp of multiple factors, including volume and volatility. Volatility measures the degree to which a security’s price changes, while volume represents the number of shares traded within a specific period. Both factors play a pivotal role in determining options premiums and can significantly influence trading strategies.

Understanding Options Trading Volume and Volatility

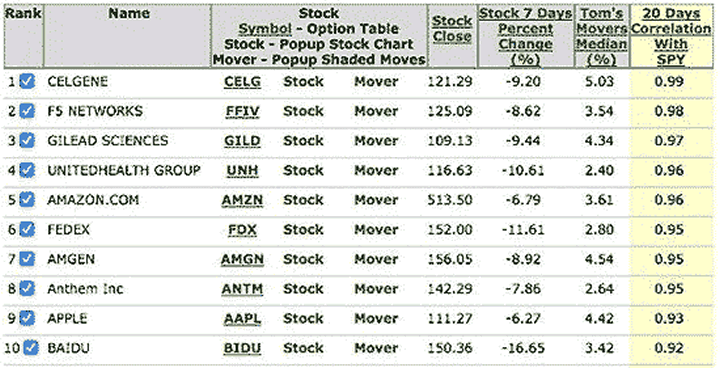

Volume often serves as an indicator of market sentiment. High trading volume typically suggests a surge of interest in the underlying asset and could indicate potential price fluctuations. Conversely, low volume may imply a lack of enthusiasm or a period of consolidation.

Volatility, on the other hand, reflects the magnitude of a stock’s price movements. Implied volatility (IV), which traders derive from option prices, gauges the market’s expectation of future volatility. High IV indicates anticipation of substantial price swings, while low IV suggests expectations of relative stability.

Volume and Volatility in Options Trading

High volume coupled with high volatility can create optimal conditions for options trading. In such scenarios, the rapid price movements can generate substantial premiums for options contracts. However, traders must exercise caution as these conditions can also lead to equally significant losses.

Conversely, low volume and low volatility may limit profit potential. When there’s less trading activity, premiums tend to be lower, and price movements might be less pronounced. Nevertheless, this environment can also present opportunities for traders seeking less risk.

Influence of News and Events

Volume and volatility can be significantly influenced by external events such as news announcements, earnings reports, and economic data releases. Market-moving events can trigger sharp price movements, creating ample opportunities for options traders. Monitoring such events and incorporating them into trading strategies is an essential skill for success.

Image: www.marketoracle.co.uk

Tips for Utilizing Volume and Volatility

Consider the following tips to leverage volume and volatility in options trading:

Monitor Market Sentiment: Gauge investor sentiment by observing volume levels. High volume suggests increased interest and may indicate potential price action.

Analyze Implied Volatility: IV provides insights into market expectations for future volatility. High IV suggests anticipation of significant price swings, allowing traders to adjust their strategies accordingly.

Frequently Asked Questions (FAQ)

Q: How can traders benefit from high volume and volatility?

A: High volume and volatility can present opportunities for substantial premiums, but traders should exercise caution due to increased risk.

Q: What are the potential drawbacks of low volume and volatility?

A: Low volume and volatility can limit profit potential, but they may also provide opportunities for traders seeking less risk.

Best Stocks Options Trading Volume Volatility

Image: www.adviceperiod.com

Conclusion

Trading options with consideration for volume and volatility can significantly enhance trading strategies. By understanding the relationship between these factors and how they influence option prices, traders can make informed decisions and navigate the challenges of the stock market more effectively. Questions to consider: Are you interested in learning more about volume and volatility in options trading? Share any questions or comments below.