A Gateway to Informed Decisions

The world of finance can be a labyrinth of complex concepts, but don’t let that deter you from exploring the captivating realm of option trading. As a trader myself, I’ve witnessed firsthand how this dynamic instrument can empower individuals to navigate financial markets with greater precision and potential.

Image: ss501loverss.blogspot.com

Unlocking the Secrets: An Overview

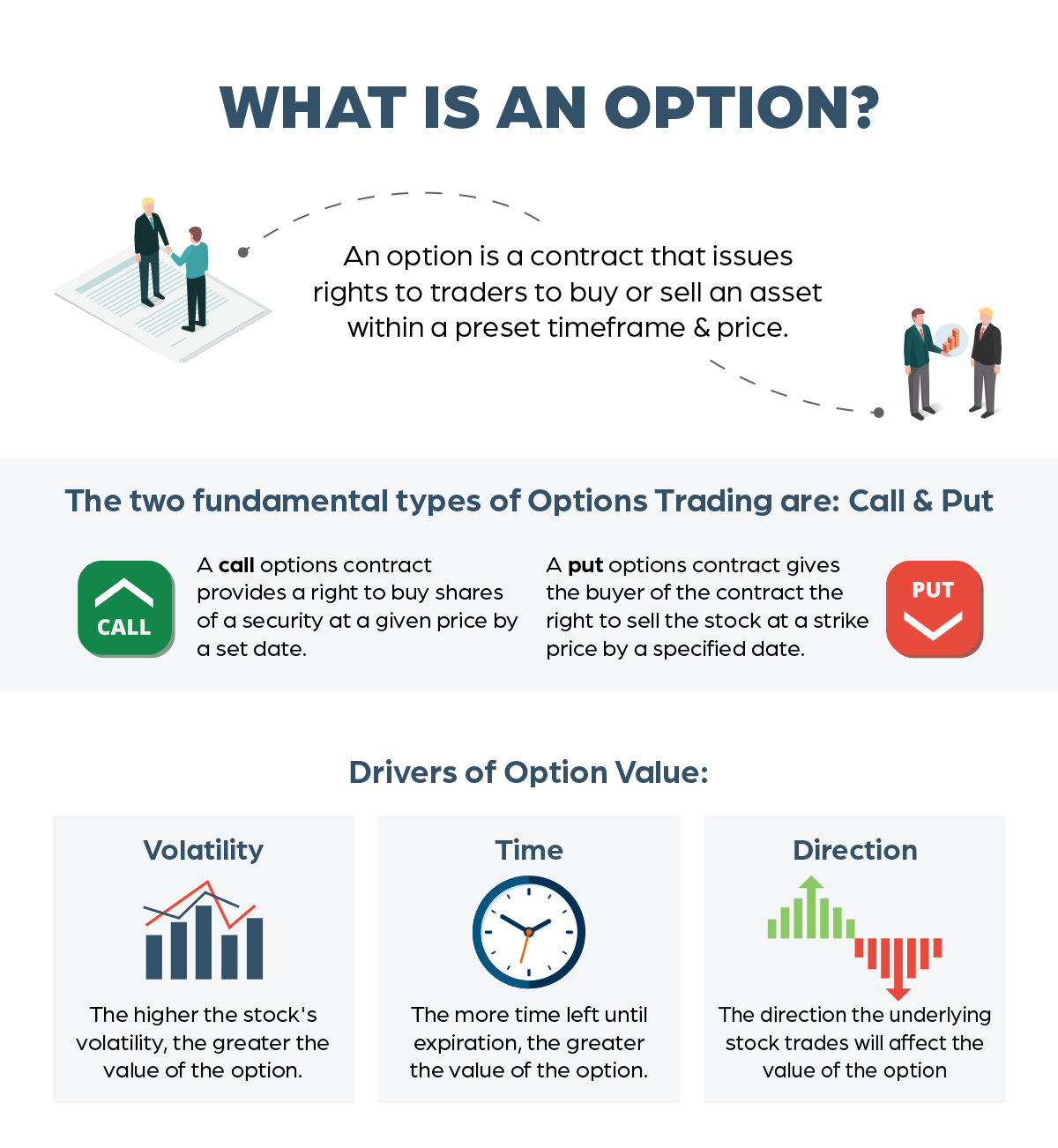

At its core, an option is a financial contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price (strike price) on or before a specific date (expiration date). Like a key, it provides the holder with the flexibility to seize opportunities or hedge against risks.

Option trading, therefore, is the art of buying and selling these contracts to profit from price fluctuations, time value decay, and supply and demand dynamics. It empowers traders to express their market views, speculate on potential outcomes, and create tailored investment strategies.

The Evolution of Option Trading: A History of Adaptation

Tracing its roots back to ancient Greece, option trading has evolved through various iterations. In the 17th century, the Amsterdam Stock Exchange introduced options on tulip bulbs, a testament to their versatility. They found new significance in the United States during the 20th century, thanks to the Chicago Board Options Exchange (CBOE), which standardized options contracts.

Today, option trading has become a ubiquitous tool in global financial markets. From individual investors and hedge funds to corporations and financial institutions, it caters to a diverse array of participants with varying investment goals and risk tolerances.

Empowering Traders: The Benefits of Option Trading

The allure of option trading lies in its numerous benefits:

- Leverage: Options offer traders the ability to control a larger position than their capital allows, potentially magnifying gains.

- Flexibility: Traders can tailor options strategies to suit their specific market outlook and risk appetite.

- Income Generation: Premium received from selling options can provide a steady stream of income.

- Hedging: Options can help mitigate risk by protecting existing investments against market fluctuations.

Image: www.pinterest.com

Navigating the Nuances: Understanding Option Dynamics

To understand option trading thoroughly, it’s crucial to grasp the following key dynamics:

- Volatility: Higher volatility means greater fluctuations in the underlying asset’s price, influencing option prices.

- Time Decay: As an option approaches its expiration date, its value diminishes, known as time decay.

- Greeks: Numerical values (Greeks) measure an option’s sensitivity to various factors, such as the underlying asset’s price and time to expiration.

- Strategy Building: Traders combine differentオプションtypes and strategies to create customized positions tailored to specific market conditions.

Tips and Expert Advice for Option Traders

To navigate the complexities of option trading successfully, consider these valuable tips and expert advice:

- Educate Yourself: Thoroughly research and understand different option strategies and their risk implications.

- Start Small: Begin with small investments, gradually increasing your position size as your knowledge and confidence grow.

- Manage Risk: Implement risk management strategies like diversification, position sizing, and stop-loss orders.

- Stay Informed: Monitor market news, economic data, and industry trends to make informed trading decisions.

Frequently Asked Questions (FAQs)

- Q: What is the difference between a call and a put option?

A: A call option gives the right to buy, while a put option grants the right to sell the underlying asset at a specified price. - Q: When is the best time to sell an option?

A: The optimal time to sell an option depends on the specific strategy employed. Consider factors like volatility, time value decay, and market conditions. - Q: Are options suitable for beginners?

A: While options can be complex, beginners can start by educating themselves and practicing with a virtual trading platform.

Information On Option Trading

Image: www.rockwelltrading.com

Conclusion: Empowering Investors with Knowledge and Opportunity

Embarking on the journey of option trading requires a blend of knowledge, strategy, and risk management. By embracing the principles outlined in this article, you can unlock the potential of this versatile instrument to enhance your investment decisions and create tailored financial strategies. Remember, whether you’re a seasoned trader or just starting, the world of options awaits your exploration and discovery.