Introduction

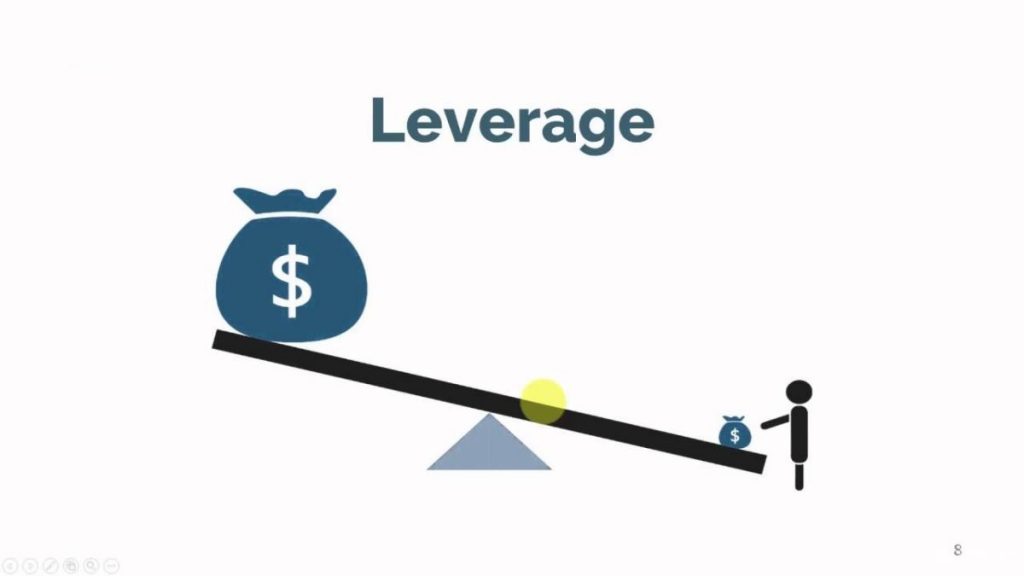

In the realm of financial markets, options trading offers investors the potential for substantial gains and losses. At the heart of this dynamic market lies the concept of leverage, a tool that can both magnify rewards and amplify risks. Understanding the nuances of leverage is paramount for traders seeking to navigate the complexities of options trading.

Image: unbrick.id

Leverage in options trading refers to the ability to control a large underlying asset with a relatively small initial investment. Options contracts grant investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specific date (expiration date). The combination of these features allows traders to leverage the price movement of the underlying asset to potentially generate outsized returns.

Leverage: A Double-Edged Sword

While leverage can significantly enhance profit potential, it also amplifies the risks associated with options trading. The limited initial investment required to purchase an options contract means that potential losses are not capped to the premium paid, as is the case with traditional stock investments.

For instance, if a trader purchases a call option on a stock that subsequently declines in value, the trader could lose a significant portion of their investment, even exceeding the initial premium paid. Conversely, if the stock price surges, the trader’s gains could far exceed their initial investment.

Calculating Leverage

The degree of leverage available in options trading is determined by a number of factors, including:

- Option Premium: The price paid for the option contract.

- Underlying Asset Price: The current price of the underlying asset.

- Strike Price: The specified price at which the option can be exercised.

The leverage ratio can be calculated by dividing the notional value of the underlying asset by the option premium. For example, if an investor purchases a call option with a notional value of $100 and an option premium of $5, the leverage ratio is 20:1. This means that a 1% increase in the underlying asset’s price would result in a 20% return on the investment.

Managing Risk with Leverage

Harnessing the benefits of leverage while mitigating its risks requires a disciplined approach to options trading. Traders should consider the following strategies:

- Establish Clear Trading Goals: Define specific objectives and risk tolerance before entering any trade.

- Thoroughly Research Underlying Assets: Understand the dynamics of the underlying assets and their potential price drivers.

- Control Position Sizing: Limit the leverage used to avoid excessive risk exposure.

- Implement Risk Management Tools: Employ stop-loss orders and other protective measures to limit potential losses.

- Seek Professional Guidance: Consult with experienced advisors or fund managers for personalized guidance and mentorship.

Image: www.youtube.com

Expert Insights on Leverage

“Leverage in options trading is a powerful tool, but it must be used wisely,” advises renowned options trader Carlos Mendoza. “Traders should focus on managing their risk effectively and not let emotions dictate their decisions.”

“Understanding leverage and its implications is crucial for successful options trading,” adds market analyst Jessica Jones. “Traders who lack a clear understanding of leverage often find themselves facing significant losses.”

Actionable Tips for Utilizing Leverage

- Start Small: Begin with small trade sizes to manage risk and gain experience.

- Monitor Market Conditions: Pay close attention to economic indicators, news, and analyst reports that may impact option prices.

- Time Trades Carefully: Options contracts have expiration dates, so plan accordingly to optimize profit potential.

- Diversify Portfolios: Spread investments across multiple options contracts and underlying assets to reduce portfolio risk.

Leverage In Options Trading

Conclusion

Leverage in options trading offers a unique opportunity to magnify potential returns while accepting an elevated risk profile. By carefully considering leverage ratios, managing risk effectively, and seeking professional guidance when needed, traders can harness the power of this tool to enhance their financial outcomes while preserving their capital.