Introduction

Moving averages are a fundamental technical indicator used by traders to smooth out price data, eliminate noise, and identify trends. In options trading, this technical tool offers unique benefits and insights. Understanding and incorporating moving averages into your options trading strategy can significantly enhance your probability of success. This article delves into the world of moving average options trading, explaining its key concepts, strategies, and applications to help you master this powerful technique.

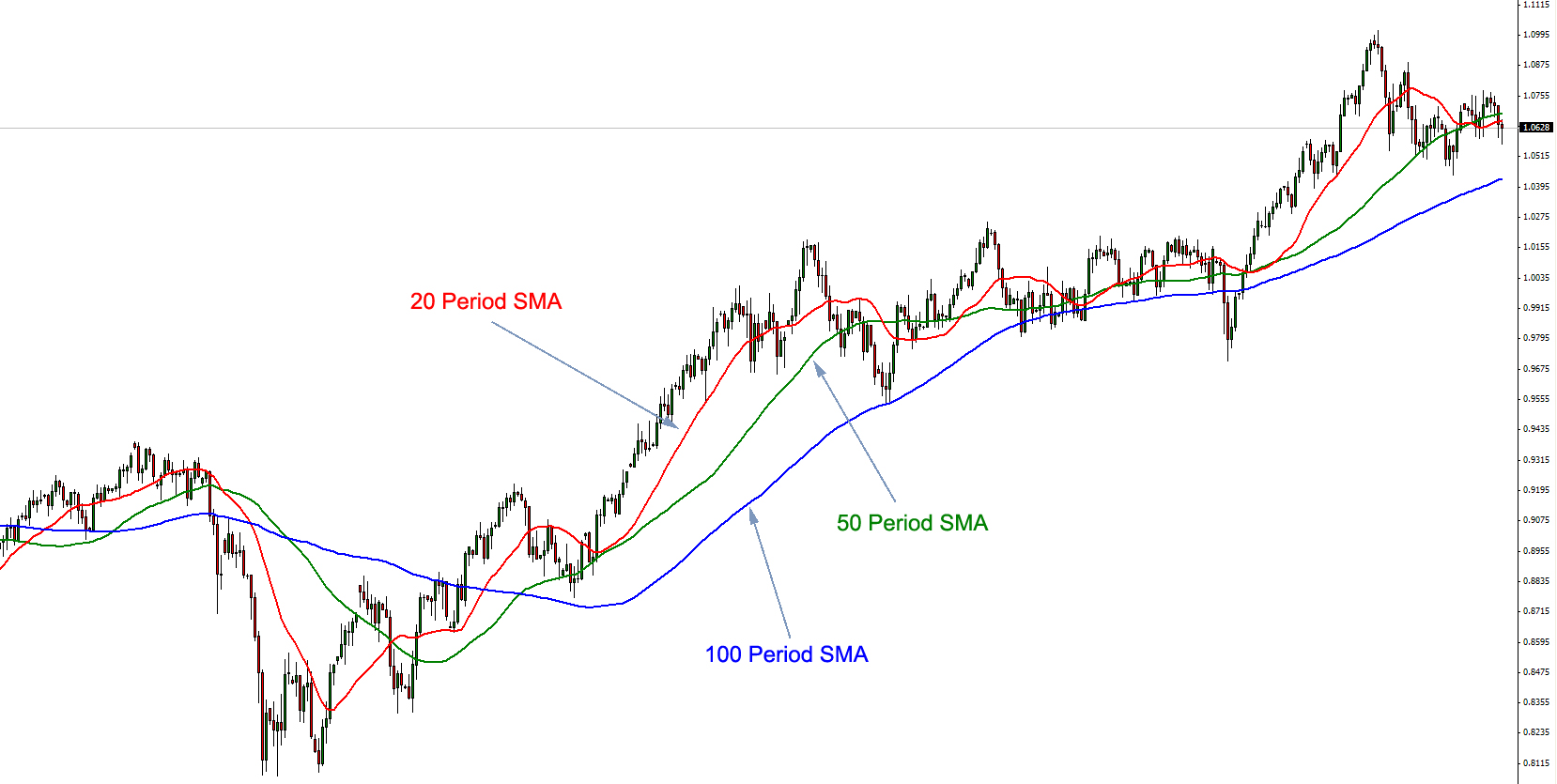

Image: centerpointsecurities.com

Moving Averages: Unlocking Historical Trends

A moving average is a statistical calculation that takes the average price of a security over a predefined period. By plotting the moving average on a price chart, traders gain a clearer picture of the underlying trend, filtering out minor price fluctuations and highlighting the general direction of the market. The two most common types of moving averages are Simple Moving Average (SMA) and Exponential Moving Average (EMA), each with its unique characteristics and sensitivities to price changes.

Options Trading with Moving Averages

Options provide traders with the flexibility to speculate on future price direction without directly owning the underlying asset. By incorporating moving averages into options trading, traders can make informed decisions based on the underlying trend and market momentum. One common strategy is to trade options in the direction of the moving average trend, buying calls (bets on price increases) when the price is above the moving average or selling puts (bets on price decreases) when the price is below the moving average.

Intersection Points and Crossovers

Intersections between the price chart and the moving average often signal potential trend reversals, making them crucial points for options traders to monitor. When the price crosses above a moving average that was previously above it, it indicates an upward breakout, suggesting the beginning of an uptrend. Conversely, when the price falls below a moving average that was previously below it, it signals a potential downtrend reversal. Traders can use options to capitalize on these breakouts by buying calls or puts based on their anticipated trend direction.

Image: s3.amazonaws.com

Finding Support and Resistance

Moving averages also serve as potential support and resistance levels in an options trading context. Traders often observe price action around moving averages to gauge whether these levels hold. If the price bounces off a moving average, it suggests support or resistance at that level, and options traders can consider trading strategies such as buying calls near support or selling puts near resistance.

Gauging Momentum and Volatility

Moving averages can provide insights into the momentum and volatility of a market. A rapid rise or fall in a moving average often reflects strong momentum in the underlying trend. Options traders can use this momentum to identify potential trading opportunities, such as buying options contracts with longer expiry dates to capture extended moves. Conversely, low volatility, as indicated by a relatively flat moving average, can be a sign of market consolidation or sideways trading, which may lead to options traders considering shorter-term options strategies like scalping or day trading.

Moving Average Options Trading

Image: www.tradingpedia.com

Conclusion

Moving averages are powerful technical indicators that offer valuable insights for options traders. By understanding the concepts, applications, and strategies related to moving average options trading, traders can make more informed and profitable decisions. Remember, while moving averages provide valuable information, they are not a perfect predictor. Always consider multiple factors and strategies when making options trading decisions. By leveraging the power of moving averages, you can enhance your options trading skills and navigate market trends with increased confidence.