Are you curious about the enigmatic world of option trading? Among the labyrinth of metrics and jargon, open interest stands out as a beacon of strategic insight. It’s like a crystal ball, offering traders a glimpse into the collective intentions of the market’s participants. In this comprehensive guide, we’ll embark on a journey to unravel the intricacies of open interest, uncovering its value in deciphering option market dynamics.

Image: www.youtube.com

Unveiling Open Interest: A Tale of Time and Obligation

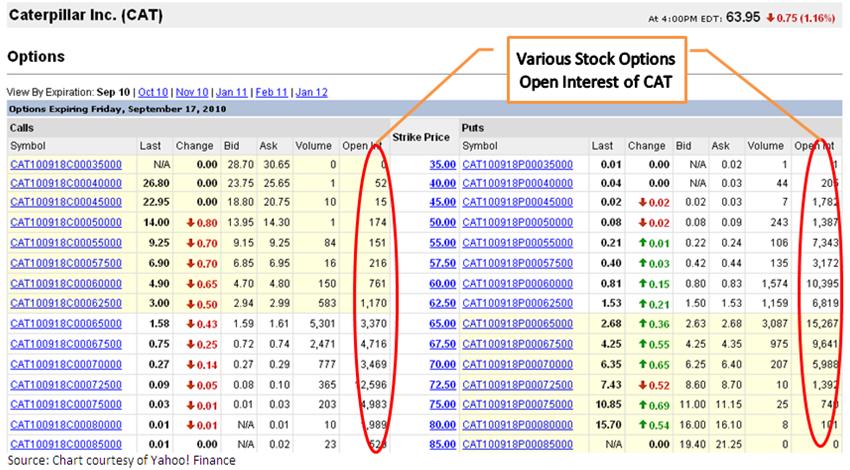

Open interest embodies the total number of outstanding option contracts, either on the call or put side, that have not yet expired. Think of it as the number of contracts that are currently alive and kicking in the market. This metric provides traders with a snapshot of the overall market sentiment, revealing whether traders are betting on the rise or fall of the underlying asset.

But why is it so important? Well, open interest serves as a barometer of market participation. A high level of open interest indicates that a substantial number of traders have skin in the game, signaling a level of conviction and interest in a particular option contract. Conversely, low open interest may suggest a lack of market interest or indecision, potentially making it a less liquid option to trade.

Analyzing Open Interest: A Window into Market Psychology

Now that we’ve established the significance of open interest, let’s explore how it can be wielded to decode market sentiment. When open interest surges, it often reflects a growing consensus among traders. For instance, if open interest in call options is climbing, it could indicate an expectation that the underlying asset will rise in value. On the other hand, rising open interest in put options may signal an anticipation of price decline.

To illustrate this, imagine a scenario where XYZ’s call option open interest skyrockets. This surge suggests that a considerable number of traders are betting on a bullish outcome for XYZ’s stock price. It prompts further investigation, perhaps leading to speculation about positive company news or favorable market conditions driving this optimism.

By continuously monitoring open interest levels, traders can gauge the degree of conviction in the market. If open interest swells alongside a price uptrend, it reinforces the bullish sentiment, potentially indicating further price appreciation. Alternatively, a decline in open interest during a downtrend may imply waning bearishness or a potential reversal.

Interpreting Open Interest: Navigating the Nuances

It’s crucial to remember that open interest is not a crystal ball that guarantees future market outcomes. Instead, it’s an evolving indicator that should be used in conjunction with other technical and fundamental analysis tools. Always consider market context, volatility levels, and prevailing economic conditions when evaluating open interest.

Another essential aspect to consider is contract expiration. As options approach their expiration date, open interest tends to dwindle as contracts are either exercised or expire worthless. Therefore, interpreting open interest in the final days before expiration requires caution.

Image: www.trade-stock-option.com

Unleashing the Power of Open Interest: Practical Applications

Now that we’ve painted a vivid picture of what open interest is and how it can be decoded, let’s delve into its practical applications. Armed with this knowledge, traders can employ open interest to:

Identify market sentiment and assess the strength of prevailing trends.

Gauge the liquidity of an options contract, helping in selecting liquid options for trading.

Anticipate potential market reversals or changes in market direction.

Identify support and resistance levels, providing valuable insights for option pricing and trade execution.

By integrating open interest into their trading toolkit, traders can enhance their decision-making process, navigate market fluctuations, and ultimately strive for greater trading success.

In Option Trading What Is Open Interest

Conclusion: Gearing Up for Option Trading Success

In the dynamic landscape of option trading, open interest stands as an indispensable tool for understanding market sentiment and shaping trading strategies. By embracing the insights it offers, traders can navigate the complexities of the market with greater confidence. Open interest illuminates the collective wisdom of the market, guiding traders towards informed decisions and maximizing their potential for trading success. So, next time you venture into the world of option trading, don’t forget to cast a keen glance at open interest—it might just be the missing puzzle piece you need to conquer this captivating financial arena.