When investing, there’s no shortage of excitement and trepidation. Amidst the diverse array of trading strategies, one that skillfully navigates this duality is vertical spread options trading. It’s a technique that empowers investors to tap into the potential of options while mitigating risk with precision. Join us as we delve into the complexities of vertical spread options, unraveling its secrets and unlocking its potential.

Image: luckboxmagazine.com

The Essence of Vertical Spreads

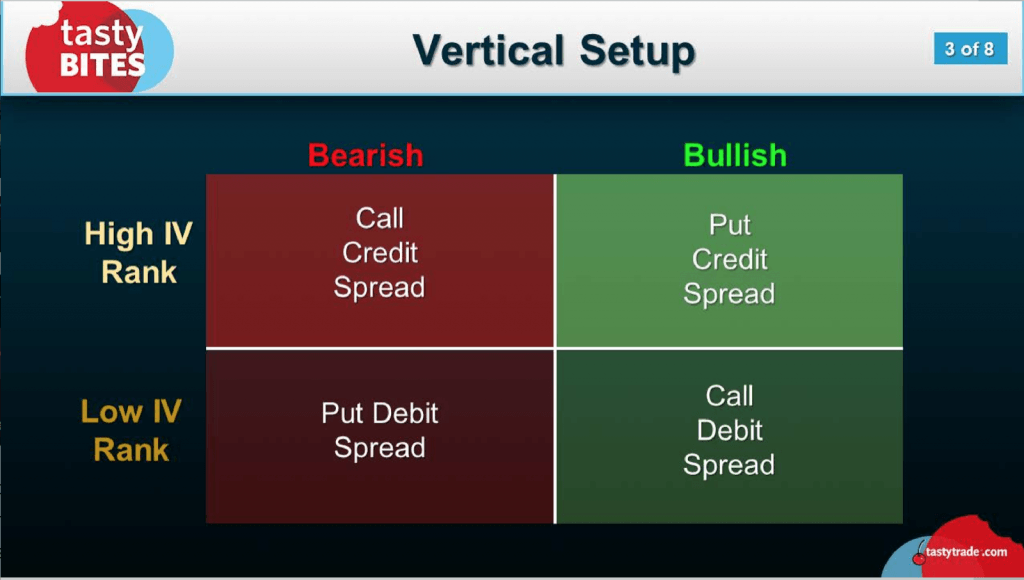

At its core, vertical spread options trading involves purchasing and selling options of the same underlying asset, with different strike prices and expiration dates. By creating a vertical spread, traders establish a defined spread between the two options. This empowers them to capture specific market movements within that defined range, effectively creating a tailored risk profile.

The Power of Combinations

The beauty of vertical spread options lies in the flexibility it offers. By combining calls and puts with varying strike prices, numerous spread configurations emerge, each tailored to different market scenarios. Bullish strategies like bull call spreads and bear call spreads allow investors to profit from a rising underlying asset. Conversely, bearish spreads like bear put spreads and bull put spreads cater to those anticipating a market decline.

Unveiling the Strategies

Bull Call Spread: Purchase an at-the-money call and simultaneously sell an out-of-the-money call with a higher strike price. This strategy benefits from a modest rise in the underlying asset, with limited downside risk.

Bear Call Spread: Sell an at-the-money call while buying an out-of-the-money call with a lower strike price. It favors a moderate decline in the underlying asset, offering limited profit potential.

Bear Put Spread: Purchase an at-the-money put and sell an out-of-the-money put with a higher strike price. This strategy profits from a modest decline in the underlying asset, with capped upside potential.

Bull Put Spread: Sell an at-the-money put while buying an out-of-the-money put with a lower strike price. It thrives in scenarios of a moderate rise in the underlying asset, with limited profit but reduced risk.

Image: optionalpha.com

Expert Insights: Unlocking Success

Harnessing the power of vertical spread options requires a deep understanding of its nuances. Here’s where experts weigh in:

-

“Vertical spreads provide an optimal balance between defined risk and potential profit,” says Mark Sebastian, a seasoned options trader. “They enable investors to customize risk exposure, tailoring it to their specific goals.”

-

“Mastering the art of vertical spreads involves understanding both the fundamentals and the intricacies of options pricing,” emphasizes Dr. Giulia Cerrato, an academic expert in options trading. “A keen grasp of Greeks and the interplay between strike prices is paramount.”

Actionable Tips: Empowered Trading

-

Define Your Objectives: Clearly articulate your trading goals before venturing into vertical spreads. Determine your risk tolerance and potential profit targets.

-

Conduct Due Diligence: Thoroughly research the underlying asset, its historical price fluctuations, and market outlook. This forms the foundation of informed trading decisions.

-

Manage Your Risk: Monitor market conditions and adjust your spread positions as needed. Implement risk management strategies, such as stop-loss orders, to protect your capital.

-

Stay Informed: Continuously stay abreast of market developments and news that may impact your positions. Knowledge is power, especially in the fast-paced world of options trading.

Vertical Spread Options Trading

Conclusion: Embrace the Calculated Advantage

Vertical spread options trading presents a powerful tool for investors seeking to manage risk while pursuing profit. By understanding its intricacies, leveraging expert insights, and adhering to actionable tips, traders can harness this strategy to their advantage.

Remember, investing involves inherent risk. Approach vertical spread options trading with a well-defined strategy, proper risk management, and a commitment to ongoing learning. Unlock the potential of this dynamic technique and elevate your trading journey towards informed, calculated success.