<!DOCTYPE html>

Image: optionstradingiq.com

In the ever-evolving world of financial markets, options have emerged as a powerful tool for investors seeking to navigate uncertainty

and leverage market opportunities. At the heart of these instruments lies vega, a crucial Greek letter that quantifies the

sensitivity of an option’s price to changes in implied volatility. Understanding vega’s role in option trading can help you make more informed decisions and optimize your investment strategies.

The Nature of Vega: Volatility’s Invisible Hand

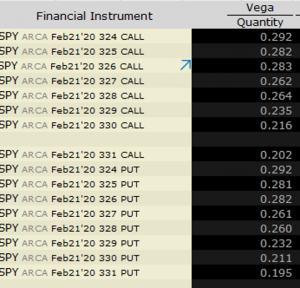

Vega measures the change in the premium of an option for every 1% change in the implied volatility of the underlying asset. Volatility is a key factor that determines the value of an option, as it affects the likelihood of the option reaching its strike price before expiration.

When implied volatility increases, the value of options tends to rise, particularly long-term options. This is because higher volatility increases the probability of the underlying asset’s price moving significantly, making the option more valuable. Conversely, when implied volatility decreases, the value of options generally declines.

Vega’s Significance in Option Pricing

Vega plays a significant role in options pricing because it helps determine the premium investors are willing to pay for the option. Options with higher vega are more sensitive to changes in volatility, meaning that their price will fluctuate more dramatically than options with lower vega.

Traders who believe that volatility will increase in the future may opt for options with high vega, as the potential for profit is greater. However, this strategy also carries more risk if volatility moves in the opposite direction.

Vega and Volatility: A Dynamic Relationship

The relationship between vega and volatility is dynamic and constantly evolving. Volatility can be influenced by various factors, such as economic news, geopolitical events, and market sentiment. Traders must monitor these factors closely to make informed decisions about the vega of the options they trade.

For example, during periods of high market uncertainty or significant economic events, volatility tends to increase, pushing vega values higher. This can lead to substantial price fluctuations in options with high vega. On the other hand, when markets are calm and predictable, volatility and vega tend to be lower, resulting in less significant price changes in options.

Image: calicomputerguys.com

Trading Strategies Involving Vega

Traders can use vega to develop a variety of trading strategies. One common strategy is to buy options with high vega when volatility is low and sell them when volatility rises, capturing the potential profits from vega’s sensitivity. This approach, known as a “vega play,” requires a keen understanding of volatility trends and market dynamics.

Another strategy involves hedging against volatility risk by using options with opposing vega values. For instance, a trader might buy an option with positive vega to benefit from a potential increase in volatility while simultaneously selling an option with negative vega to limit losses in case volatility decreases. This technique seeks to minimize the impact of volatility fluctuations on the overall portfolio.

Tips for Successful Vega Trading

Monitor volatility trends: Volatility is the lifeblood of vega, so keeping a close eye on its fluctuations is vital. Track historical volatility data, news events, and market sentiment to gauge potential volatility scenarios.

Manage risk: Vega trading involves risk, so it’s prudent to set clear limits and risk management strategies before entering trades. Consider the potential impact of vega on your overall portfolio and diversify accordingly.

Frequently Asked Questions (FAQs) on Vega

-

Q: What factors can influence vega?

A: Volatility, time to expiration, and the strike price of the option. -

Q: How does vega differ from other Greek letters?

A: Vega measures sensitivity to volatility, while Greeks like delta, gamma, and theta measure other aspects of option pricing. -

Q: Can I profit from vega changes without directly trading options?

A: Yes, you can use volatility ETFs or futures to gain exposure to vega’s impact on the overall market.

What Is Vega In Option Trading

Image: haikhuu.com

Conclusion: Unveiling the Power of Vega

Vega is not only a Greek letter – it’s a roadmap to navigating the intricate world of implied volatility. By understanding its influence on option pricing, you can optimize your trading strategies, manage risk, and unlock new opportunities for market success.

Is Vega an integral part of your option trading? Share your experiences and insights in the comments section below.