Introduction

In today’s fast-paced financial landscape, navigating the world of options trading can be a daunting endeavor for novice investors. Fortunately, a comprehensive understanding of the basics, coupled with thoughtful strategic planning, can equip you with valuable insights to navigate this market effectively. This guide delves into the intricacies of options, simplified through lucid explanations, concrete examples, and a strategic toolkit to empower your trading decisions.

Image: pezewehemave.web.fc2.com

Defining Options Contracts

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a future date. They are often categorized into two primary types:

- Call Options: Enable the holder to purchase an underlying asset at a specified price (known as the strike price) on or before the expiration date.

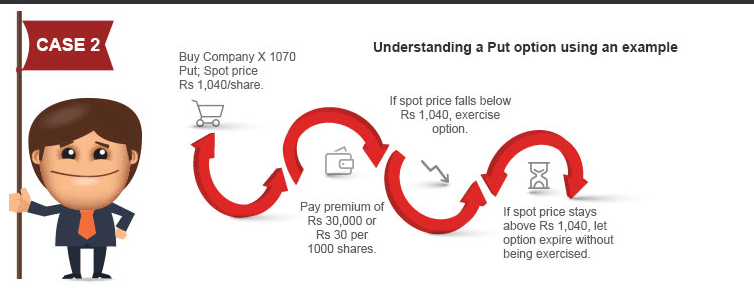

- Put Options: Provide the holder with the right to sell an underlying asset at a specific strike price on or before the expiration date.

Benefits and Risks of Options Trading

Options trading presents a range of potential benefits, including:

- Profitability: Capitalizing on market movements through leverage, which allows for substantial profit generation even with small capital investments.

- Flexibility: Adapting strategies based on risk tolerance and market conditions by choosing from a diverse spectrum of option types and expiration dates.

However, options trading also involves inherent risks, such as:

- Time Decay: As the expiration date nears, the value of an option contract gradually diminishes, irrespective of underlying asset price fluctuations.

- Loss of Capital: Unlike traditional stock ownership, options trading involves the potential for complete capital loss.

Basic Options Trading Strategies

To navigate the options market effectively, it’s crucial to grasp fundamental trading strategies:

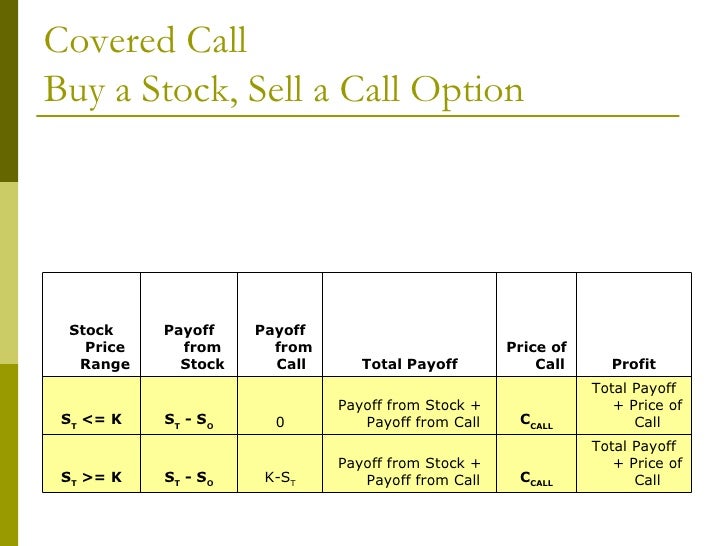

- Covered Call: Selling a call option while possessing the underlying asset in a long position to generate income.

- Protective Put: Purchasing a put option to mitigate potential losses on an underlying asset owned in a long position.

- Cash-Secured Put: Selling a put option with sufficient cash reserves to purchase the underlying asset in case it falls below the strike price.

Image: investgrail.com

Fidelity: A Platform for Options Trading

Fidelity Investments, renowned for its vast experience in the financial industry, offers a robust platform for options trading, featuring:

- Intuitive Interface: User-friendly platform, simplifying option selection and order placement.

- Comprehensive Resources: Access to educational materials, trading tools, and market analysis.

- Dedicated Support: Support provided by a team of knowledgeable professionals to assist with inquiries and execution.

Understanding Options And Basic Trading Strategies Fidelity

Image: investgrail.com

Conclusion

Understanding options and adopting strategic trading techniques can empower investors to navigate the financial arena with greater confidence and effectiveness. Fidelity’s platform and support system create an ideal environment for both novice and experienced traders to explore the world of options trading. By assimilating the insights presented herein, investors can unlock the potential for financial success and navigate the market’s intricacies with poise.