Introduction

In the labyrinthine realm of global finance, there lies a clandestine market where sophisticated investors engage in high-stakes currency trading: the over-the-counter (OTC) currency options market. This enigmatic arena has long been shrouded in mystery, but its impact on the wider financial ecosystem is undeniable. Join us as we venture into the heart of OTC currency options trading, unraveling its complexities and exploring the sheer volume that drives this enigmatic financial landscape.

Image: www.youtube.com

Navigating the Over-the-Counter Currency Options Market

OTC currency options, unlike their standardized counterparts traded on exchanges, are bespoke derivatives that allow parties to engage in customized contracts tailor-made to their specific risk-return profiles. This flexibility and opacity have made OTC currency options a preferred choice for institutional investors, including hedge funds, asset managers, and large corporations.

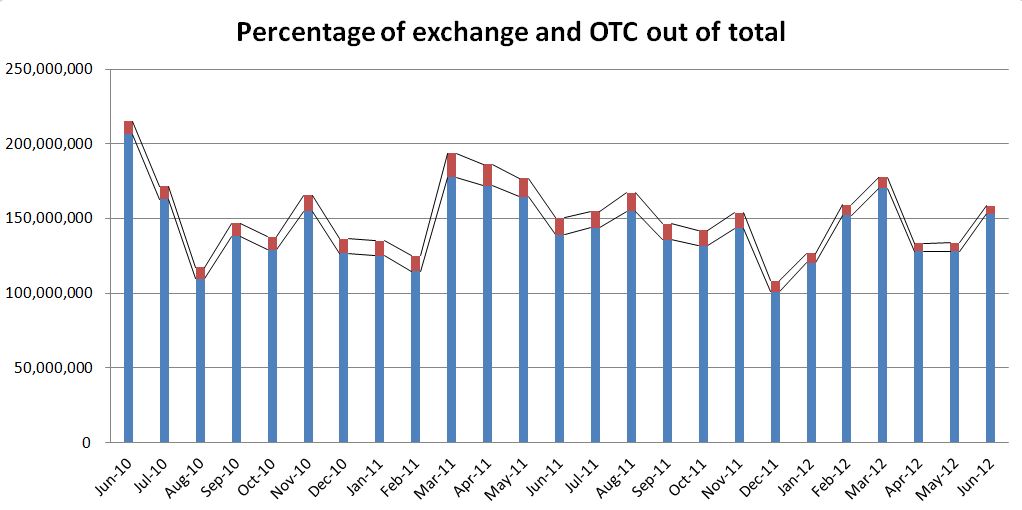

The sheer volume of OTC currency options trading is a testament to its significance. In 2023, the notional amount of outstanding OTC currency options contracts reached a staggering $72 trillion, dwarfing the volume of exchange-traded currency options contracts. This colossal amount reflects the growing demand for hedging risk, speculative trading, and strategic positioning among global market participants.

Decoding the Mechanics of OTC Currency Options

Delving into the intricate workings of OTC currency options, we encounter a derivative contract that grants the buyer the right, but not the obligation, to exchange one currency for another at a predetermined exchange rate and date. This flexibility empowers the buyer to respond dynamically to fluctuating currency markets, benefiting from favorable exchange rate movements.

The seller of the option, on the other hand, bears the obligation to fulfill the contract if the buyer chooses to exercise their option. In return for this commitment, the seller receives a premium, which represents the value of the option and compensates them for the potential risk they undertake.

Drivers of the OTC Currency Options Trading Volume

The mammoth volume of OTC currency options trading can be attributed to a multitude of factors. Foremost among these is the ever-increasing volatility in global currency markets. The advent of geopolitical uncertainty, macroeconomic shifts, and unpredictable market events has heightened the demand for hedging mechanisms like OTC currency options.

Moreover, the burgeoning global trade and investment activities have concomitantly increased the need for managing exchange rate risk. Businesses and investors seek to safeguard their financial interests by using OTC currency options to mitigate potential losses arising from unfavorable currency fluctuations.

Image: www.researchgate.net

Insights from Industry Experts

To gain a deeper understanding of the OTC currency options market, we reached out to industry stalwarts for their invaluable insights.

“The rise of digitalization has significantly transformed the OTC currency options market,” observes Martha Reyes, a senior analyst at JP Morgan. “Electronic trading platforms have streamlined order execution, improved transparency, and reduced counterparty risk, making OTC currency options more accessible and appealing to a wider range of participants.”

Echoing this sentiment, Elliot Grant, a portfolio manager at Goldman Sachs, adds, “OTC currency options provide unparalleled flexibility and customization, allowing investors to precisely tailor their risk-reward profiles. This has driven their widespread adoption by institutional investors seeking sophisticated hedging and investment strategies.”

Harnessing the Potential of OTC Currency Options

While OTC currency options offer powerful tools for risk management and speculation, harnessing their full potential requires a thorough understanding of their intricacies. Investors should carefully consider their risk tolerance, investment objectives, and market outlook before venturing into this complex arena.

To navigate the OTC currency options market effectively, it is prudent to seek guidance from experienced financial advisors, brokers, or educational resources. These experts can provide personalized advice, tailored to your specific needs and aspirations, ensuring you make informed decisions and maximize your chances of success.

The Volume Of Otc Currency Options Trading Is

Image: qoxoxoxiqel.web.fc2.com

Conclusion

The OTC currency options market is a vast and multifaceted landscape, offering a potent combination of risk management and speculative trading opportunities. Its sheer volume reflects the growing importance of customized risk management in today’s volatile global economy. Whether you are a seasoned investor or a novice seeking to expand your financial horizons, understanding the nuances of OTC currency options can empower you to make informed decisions and navigate the complexities of the global financial markets.