Introduction

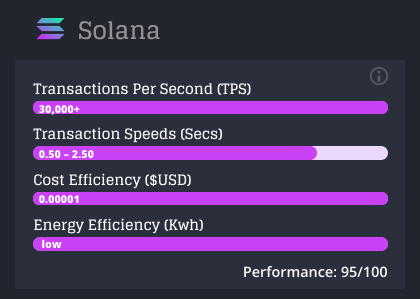

Embrace the transformative power of Solana options trading, a frontier of decentralized finance (DeFi) that has ignited unprecedented opportunities in the world of cryptocurrency investments. Solana, a lightning-fast blockchain renowned for its scalability and low transaction fees, has introduced options contracts to the DeFi landscape, empowering traders with cutting-edge financial instruments.

Image: cryptogoodnews.com

Options contracts, intricate financial agreements that grant the right (not the obligation) to buy or sell an asset at a predetermined price on a set expiry date, have traditionally been the domain of centralized exchanges. However, Solana’s advent has decentralized this arena, opening doors to democratized access to these sophisticated financial tools.

Understanding Solana Options Contracts

Solana options contracts function as a pair consisting of a call option and a put option. The call option confers the right to buy the underlying asset, while the put option grants the right to sell the asset. Each contract specifies an underlying asset (such as the SOL token), a strike price (the price at which the asset can be bought or sold), and an expiration date (the date beyond which the option ceases to exist).

Traders can choose to exercise their options (buy or sell the asset) anytime before the expiration date, or they can simply let the options expire worthless. If the price of the underlying asset moves in the favorable direction, the holder of the option stands to make a profit; however, if the price moves against them, they could potentially lose their entire investment.

Why Solana Options Trading Matters

Solana options trading empowers investors with a diverse spectrum of financial strategies. These versatile instruments enable traders to:

- Protect against price volatility: Options provide a safety net against adverse price swings, allowing traders to hedge their investments and reduce potential losses.

- Amplify profit potential: Options offer opportunities for leveraged returns, enabling traders to amplify their gains if the underlying asset’s price moves in their predicted direction.

- Generate income from market fluctuations: Options can be used to generate income even in sideways markets, by selling options premiums to other traders.

- Increase capital efficiency: Options contracts require significantly less capital compared to spot trading, making them an attractive option for traders with limited funds.

Navigating the Solana Options Trading Landscape

Venturing into the realm of Solana options trading requires a deep understanding of the concepts, a strategic approach, and access to reliable platforms.

1. Choosing a Solana Options Exchange:

Multiple platforms facilitate Solana options trading, including decentralized exchanges (DEXs) and centralized exchanges (CEXs). DEXs like Serum and Mango Markets offer non-custodial trading with reduced fees, while CEXs like FTX and Binance provide a more structured and user-friendly interface.

2. Understanding Key Metrics:

Traders should familiarize themselves with crucial metrics such as the bid-ask spread (the difference between the buying and selling price of an option contract), implied volatility (a measure of expected price fluctuations), and the Greeks (a set of metrics that measure an option’s sensitivity to different factors).

3. Crafting a Trading Strategy:

Successful options trading hinges on a well-defined strategy that aligns with your risk tolerance and financial goals. Consider factors like market conditions, underlying asset price movements, and time to expiration when formulating your trading plan.

4. Managing Risk:

Options trading, while rewarding, also entails risks. Implementing prudent risk management strategies, such as setting stop-loss orders and diversifying your portfolio, is paramount to mitigating potential losses.

Image: www.pinterest.com

Latest Trends and Developments in Solana Options Trading

Solana options trading is a rapidly evolving landscape, constantly witnessing new developments and innovations. Here are some key trends shaping the future of this vibrant ecosystem:

-

Increased Adoption of Automated Trading Bots: Algorithmic trading bots are becoming increasingly popular, enabling traders to automate their trading strategies and execute trades based on predefined parameters.

-

Growth of Solana-Based Options Protocols: Innovative protocols like PsyOptions are emerging, providing traders with advanced options strategies and enhanced liquidity.

-

Integration with Cross-Chain Bridges: Options trading is expanding beyond Solana’s native ecosystem, with platforms like Allbridge facilitating the transfer of options contracts between Solana and other blockchains.

Solana Options Trading

Image: dashboard.incryptohub.com

Conclusion

Solana options trading has emerged as a transformative force in the DeFi space, empowering traders with sophisticated financial instruments and unparalleled opportunities. By