Introduction

In the realm of cryptocurrency, decentralized exchange (DEX) options trading has emerged as a captivating frontier, offering traders and investors a myriad of opportunities. Unlike their centralized counterparts, DEXs empower users with the autonomy to manage their assets, allowing for greater control over trading decisions. By delving into the intricacies of DEX options trading, traders can harness the power of derivatives to enhance their risk management strategies and amplify their profit potential.

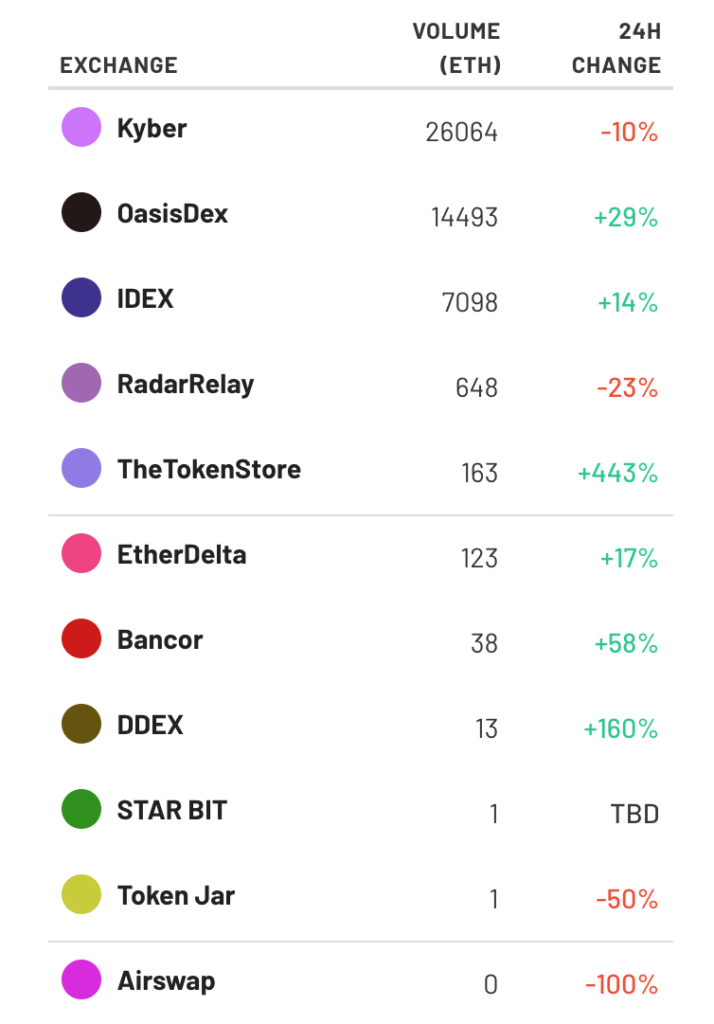

Image: 101blockchains.com

Understanding DEX Options Trading

Options contracts are financial instruments that grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specified date (expiration date). In DEX options trading, these contracts are traded on decentralized exchanges, leveraging blockchain technology to facilitate secure and transparent transactions. By utilizing DEXs, traders gain access to a global marketplace, immune to the whims of centralized entities, and enjoy the benefits of low transaction fees and increased liquidity.

Basic Concepts

The cornerstone of DEX options trading lies in understanding fundamental concepts such as premium, settlement, and exercise. The premium represents the price paid by the buyer of the option to acquire the right to exercise the contract. Settlement refers to the process of fulfilling the terms of the contract, which can involve buying or selling the underlying asset at the strike price. Exercise empowers the buyer of the option to execute the contract and purchase or sell the asset at the predefined conditions.

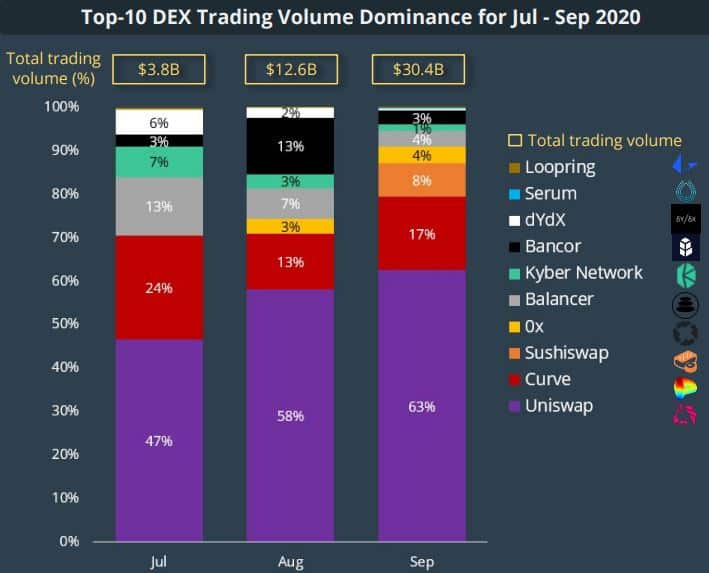

Image: defipicks.com

Dex Options Trading

Image: cryptopotato.com

Real-World Applications

DEX options trading offers a versatile toolkit for traders, enabling them to pursue a range of strategies tailored to their risk appetite and market outlook. Speculative traders can employ options to make directional bets on the price movements of cryptocurrencies, aiming to profit from market fluctuations. Risk-averse traders can leverage options as a hedging instrument, protecting their portfolios against adverse price swings. Sophisticated traders may engage in complex option strategies, such as spreads and straddles, to generate income or enhance their risk-reward profiles.