Introduction

Bitcoin has emerged as a transformative asset class, and with its increasing adoption, the demand for sophisticated trading strategies continues to surge. Options trading, a powerful tool in traditional financial markets, has found its footing in the Bitcoin ecosystem, offering traders a vast array of opportunities. This comprehensive guide delves into the intricate world of Bitcoin options trading in the United States, covering everything you need to know to navigate this exciting and potentially lucrative market.

What is Bitcoin Options Trading?

Bitcoin options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell a specific amount of Bitcoin at a designated price (strike price) on or before a predetermined date (expiration date). Unlike futures contracts, which obligate the buyer to take delivery of the underlying asset, options provide traders with flexibility and the ability to tailor their trades to their unique risk and reward preferences.

Types of Bitcoin Options

There are two primary types of Bitcoin options: calls and puts. Call options give the buyer the right to purchase Bitcoin at the strike price, while put options give the buyer the right to sell Bitcoin at the strike price. The buyer of the option pays a premium to the seller in exchange for this right.

Key Considerations for Bitcoin Options Trading

Before engaging in Bitcoin options trading, there are several key factors to consider:

1. Expiration Date:

Options contracts have a finite lifespan, and their value decays over time. The further out the expiration date, the more time value the option carries.

2. Strike Price:

The strike price is crucial as it determines whether the option is in or out of the money. Options in the money (ITM) have intrinsic value, while those out of the money (OTM) have only time value.

3. Volatility:

Volatility, a measure of Bitcoin’s price fluctuations, significantly impacts options pricing. Higher volatility leads to higher option premiums.

Benefits of Bitcoin Options Trading

Bitcoin options trading offers traders several advantages:

1. Flexibility:

Options provide greater flexibility compared to outright buying or selling Bitcoin. Traders can tailor their trades to suit their risk tolerance and profit potential.

2. Risk Management:

Options allow traders to hedge against potential losses and manage risk in a more sophisticated manner.

3. Income Generation:

Selling options with favorable terms can generate income through premium payments.

How to Trade Bitcoin Options in the US

To trade Bitcoin options in the US, you will need to:

1. Choose a Regulated Brokerage:

Partner with a trusted and regulated brokerage that offers Bitcoin options trading services.

2. Open an Account:

Once you have selected a brokerage, open an account and undergo the necessary verification procedures.

3. Fund Your Account:

Deposit funds into your account to cover option premiums and potential losses.

4. Analyze the Market:

Conduct thorough research, analyze market conditions, and identify suitable options trading strategies.

5. Place Your Order:

Execute your option trades by specifying the option type, strike price, expiration date, and quantity.

Conclusion

Bitcoin options trading presents US traders with a powerful tool to navigate the complexities of the Bitcoin market. By comprehending the key concepts, available options types, and considerations involved, traders can unlock a vast array of opportunities and enhance their trading strategies. As the Bitcoin ecosystem continues to evolve, options trading will undoubtedly play an increasingly crucial role for traders seeking to maximize returns and manage risk effectively.

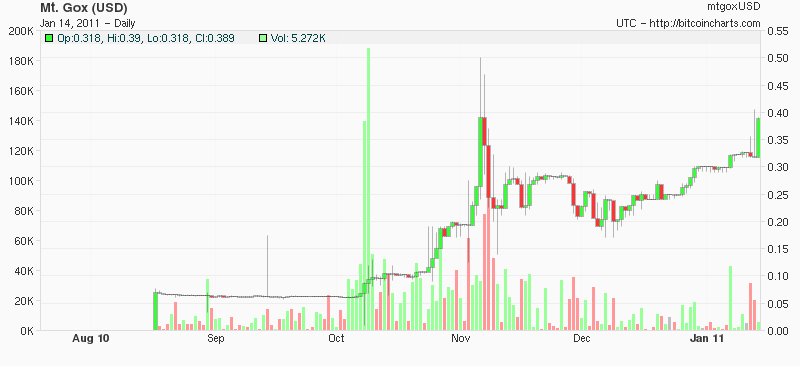

Image: www.tradingview.com

Image: en.bitcoin.it

Bitcoin Options Trading Usa