Embark on your options trading journey with confidence! An options trading journal is your secret weapon, a roadmap to track your progress, identify patterns, and refine your strategies. It’s a pivotal tool that empowers you to become a savvy trader, minimizing risks and maximizing returns.

Image: lisannakainat.blogspot.com

Think of your options trading journal as the captain’s log of your financial adventures. Every trade, every decision, and every lesson learned meticulously inscribed, guiding you towards trading mastery. But starting with an empty template can seem overwhelming. That’s where we step in, providing you with a comprehensive template that will kickstart your trading journal and propel your trading performance to new heights.

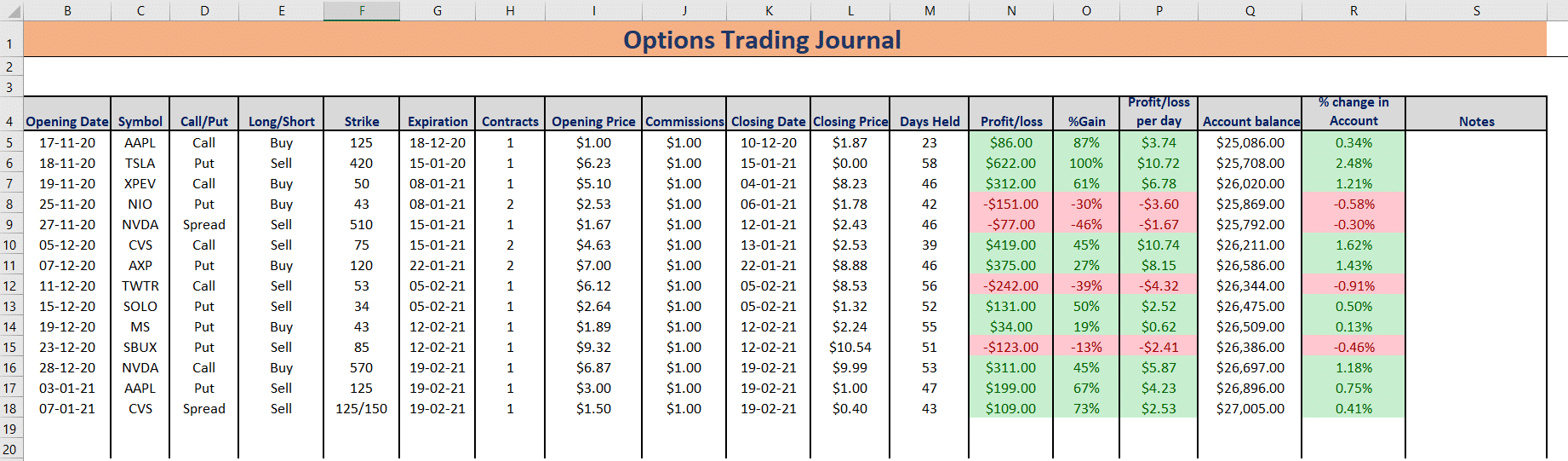

Section 1: Trade Overview

Begin each journal entry with a clear snapshot of the trade. Record the date, ticker, option type (call or put), strike price, and expiration date. Also, don’t forget to capture the premium paid or received and the number of contracts traded.

Example:

- Date: June 20, 2023

- Ticker: AAPL

- Option Type: Call

- Strike Price: $150

- Expiration Date: July 21, 2023

- Premium: $5.00

- Quantity: 5 contracts

Section 2: Trade Rationale

Document your reasoning behind each trade. Explain why you chose the underlying asset, the expiration date, and the specific option type and strike price. Consider what market conditions and technical indicators influenced your decision.

Example:

“Purchased 5 AAPL July $150 calls based on the bullish MACD crossover and the breakout above the $145 resistance level. Expected the stock to continue its upward trend.”

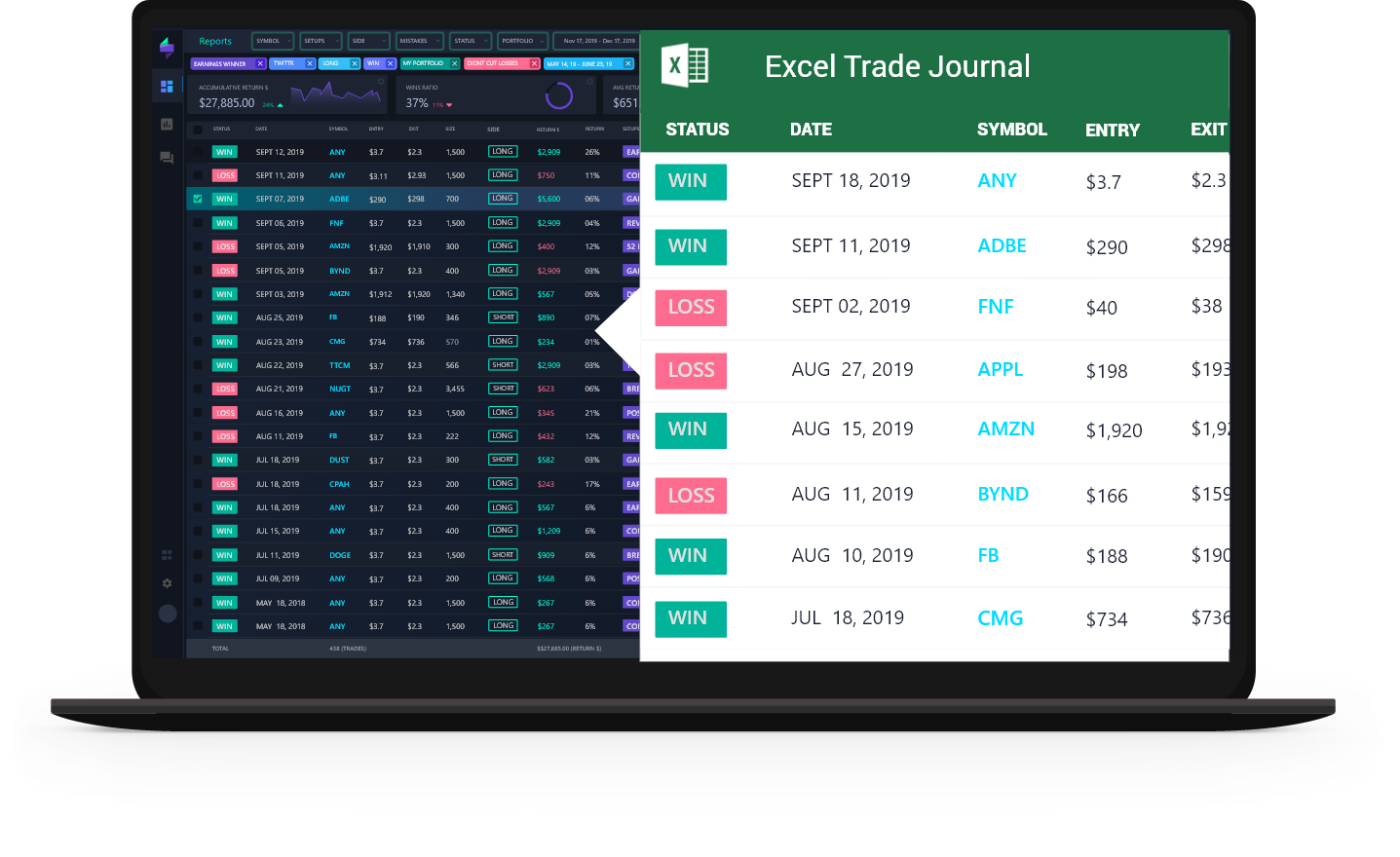

Section 3: Trade Management

Throughout the life of the trade, track how you manage it. Record any adjustments made, such as adjustments to your profit target or stop-loss level. Also, note the date and price of any partial or full exits.

Example:

- June 27, 2023: Adjusted profit target to $7.00

- July 5, 2023: Sold 3 contracts at $6.50

- July 10, 2023: Closed the remaining 2 contracts at $5.75

Image: tradersync.com

Section 4: Trade Results

Finally, once the trade is complete, determine its outcome-profit, loss, or breakeven. Calculate the total profit or loss, including any commissions or fees incurred. Also, note the return on investment (ROI) and any lessons learned.

Example:

“Total profit: $1,000. ROI: 20%. Lesson learned: Should have exited the trade earlier to lock in more profits.”

Additional Considerations

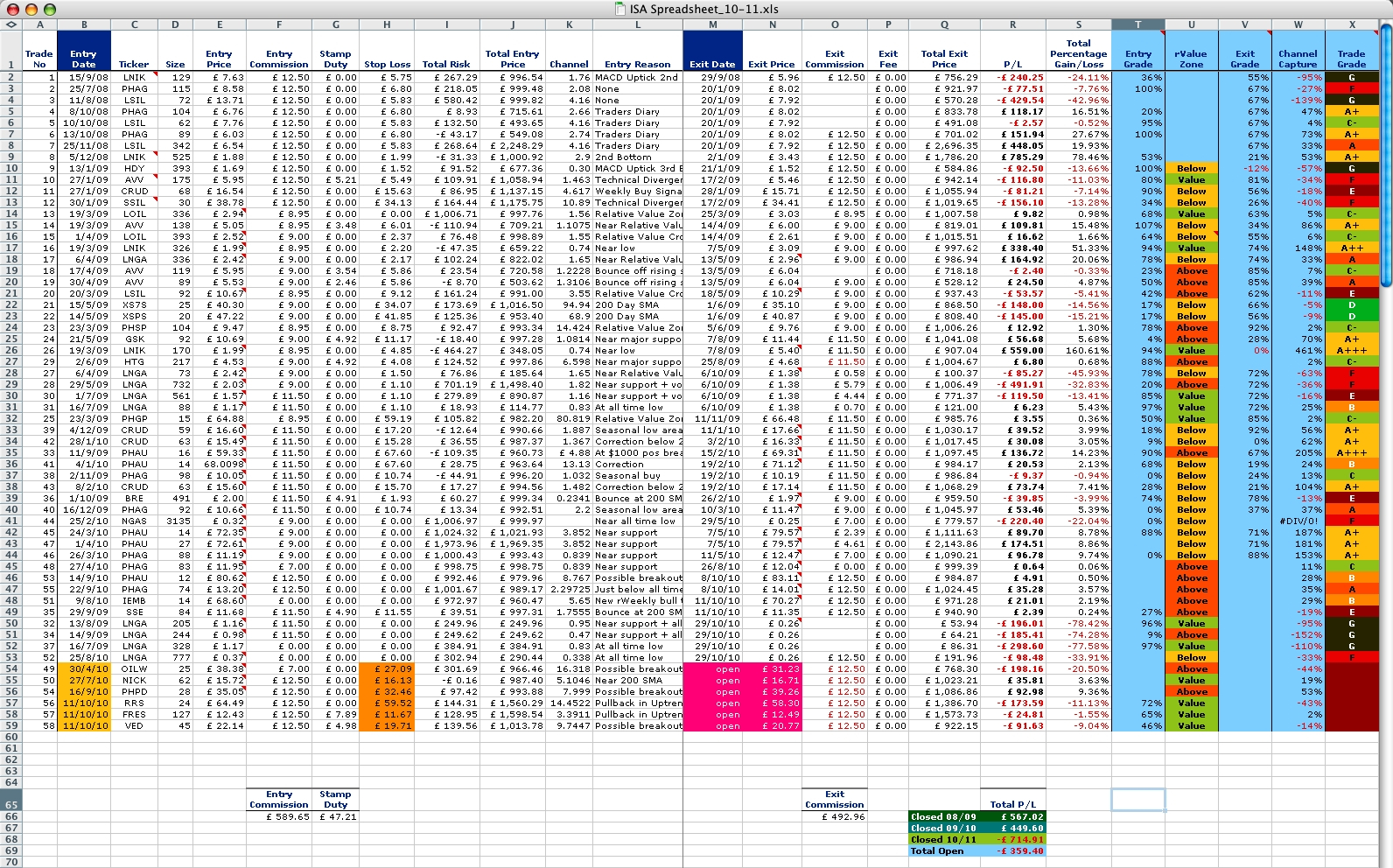

In addition to these core sections, consider adding these optional sections to your journal:

- Market Conditions: Note the overall market conditions, such as volatility and economic news, that may have influenced your trade.

- Chart Analysis: Include any technical analysis or chart patterns that supported your decision.

- Options Greeks: Monitor the key option Greeks, such as delta, theta, and gamma, to understand the risk and potential reward.

- Trade Journal Notes: Jot down any thoughts or observations about the trade that may be helpful for future reference.

Options Trading Journal Template

Image: db-excel.com

Conclusion

By diligently maintaining an options trading journal, you transform your trading into a systematic and profitable endeavor. Your journal becomes a treasure trove of knowledge, empowering you to continuously improve your strategies and make informed decisions. Embrace the power of tracking your trades, and let your options trading journal guide you towards financial success.

Remember, consistency is key. Make it a habit to record every single trade, regardless of its outcome. It’s in the detailed examination of both your wins and losses that true trading mastery lies. So, get started today, forge your options trading journal, and embark on a journey to unlock your trading potential.