Image: seekingalpha.com

In the realm of financial markets, where fortunes are made and lost with each passing moment, there exists a tantalizing and complex world of options trading. Options contracts, like enigmatic enigmas, can unveil a pathway to substantial gains or the perilous precipice of devastating losses. Embark on this exhaustive discourse, and delve into the intricate mechanics of options trading, unraveling its intricacies while equipping yourself to navigate its treacherous waters.

Options, the versatile financial instruments, bestow upon traders the privilege to speculate on the future price movements of underlying assets without the obligation to buy or sell them outright. This dynamic facet of options empowers investors to explore a myriad of strategies, ranging from hedging portfolio risks to seeking exponential returns. Yet, the allure of options trading is inextricably intertwined with its inherent risks, demanding a thorough understanding of the dynamics that govern these contracts.

Understanding Options: Types, Peculiarities, and Mechanics

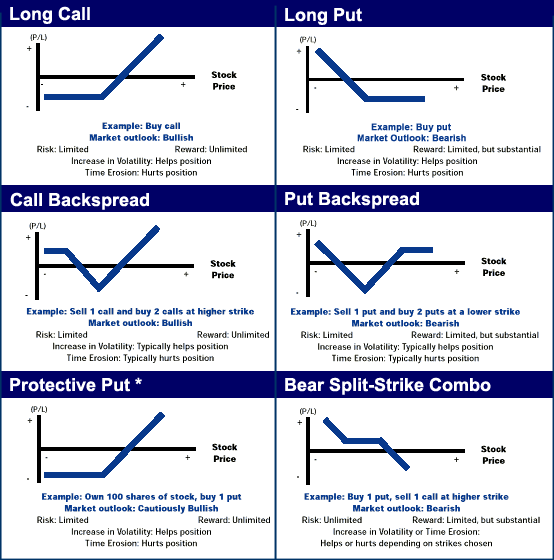

Options contracts come in two distinct flavors: calls and puts. Calls convey the right, but not the obligation, to purchase an underlying asset at a predetermined price known as the strike price. Puts, on the other hand, grant the right to sell the underlying asset at the strike price.

Each options contract possesses a definitive lifespan, expiring on a specific date. European options can only be exercised on the expiration date, while American options afford the flexibility of exercise at any time prior to expiration.

The premium paid for an options contract represents the price of acquiring this right. Premiums fluctuate dynamically, influenced by a constellation of factors, including the underlying asset’s price, volatility, time to expiration, and interest rates.

Risk and Reward: Embracing Volatility and the Art of Hedging

Options trading, like a perilous dance with fortune, is a delicate balancing act between risk and reward. Volatility, the capricious nature of asset price movements, amplifies the potential gains and magnifies the possibility of losses.

Hedging, a prudent strategy in the options trader’s arsenal, provides a sanctuary from the tempestuous winds of market fluctuations. By employing offsetting positions, hedging aims to mitigate portfolio losses in adverse market conditions.

Strategies for Success: Unlocking the Potential of Options Contracts

The tapestry of options trading strategies is as diverse as the human imagination. Covered calls, a harmonious fusion of stock ownership and options selling, harness the power of premium income to augment returns. Put selling, an exercise in tranquility, generates income by capitalizing on the market’s aversion to volatility premiums.

Bull and bear spreads, ingenious creations of the options trading world, offer tailored risk and reward profiles. Bull spreads, with their inherent optimism, wager on rising prices, while bear spreads, instruments of pessimism, profit from declining markets.

The Evolving Landscape of Options Trading: Technology and Innovation

The advent of electronic trading platforms has revolutionized the mechanics of options trading. These platforms, epitomes of convenience and efficiency, streamline order execution, enhance liquidity, and empower traders with sophisticated analytical tools.

Amidst the relentless march of technological progress, artificial intelligence and machine learning algorithms are poised to reshape the options trading landscape. These algorithms, with their uncanny ability to crunch vast amounts of data, promise to enhance risk management and identify trading opportunities with unmatched precision.

Conclusion: Empowerment Through Knowledge and Discipline

Options trading, a crucible of risk and reward, demands both a profound understanding of its intricacies and an unwavering discipline in its execution. By embracing the knowledge imparted within this comprehensive guide, traders can embark on their options trading journey with newfound confidence, equipped to navigate the turbulent waters of financial markets with a refined strategy.

In the ceaseless quest for financial success, options trading stands as a testament to the enduring allure of risk and the potential for exponential returns. Yet, only those who possess the mettle to master its complexities and embrace its risks will ultimately reap the rewards that await them in this exhilarating arena.

Image: www.visualcapitalist.com

Options Trading Process

Image: in.pinterest.com