Introduction

In the pulsating heart of the financial markets, a captivating saga unfolds where fortunes are made and lost in an electrifying dance of risk and reward. Option trading in Gamestop has emerged as a captivating spectacle, captivating the imaginations of investors seeking both euphoria and the sting of defeat. This comprehensive guide will delve into the intricate tapestry of option trading, exploring its profound implications for investors of all stripes.

Image: laductrading.com

A Primer on Option Trading

Options, intricate financial instruments, afford traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. These enigmatic contracts confer immense flexibility, allowing traders to speculate on future price movements without the upfront capital outlay associated with outright ownership of the underlying asset. The allure of leverage and the potential for exponential returns have propelled option trading to the forefront of investing strategies.

The Gamestop Saga and its Confluence with Option Trading

The Gamestop saga, an extraordinary chapter in the annals of financial history, cast the spotlight on option trading. In a remarkable twist of events, a confluence of retail investors, audacious short-sellers, and social media fervor ignited an unprecedented surge in Gamestop’s stock price. Option trading played a pivotal role in amplifying this explosive volatility, creating both triumphant fortunes and devastating losses.

Benefits of Option Trading in Gamestop

For those who navigate its complexities, option trading in Gamestop offers several enticing benefits:

- Leverage: Options provide significant leverage, enabling traders to control substantial positions with a fraction of the capital required for outright ownership.

- Flexibility: Options bestow traders with unmatched flexibility, allowing them to tailor their strategies to diverse market conditions and risk appetites.

- Profit Potential: The potential for outsized returns is an irresistible lure for many traders, who seek to capitalize on rapid price movements.

Image: libertex.com

Risks Associated with Option Trading in Gamestop

However, it is imperative to recognize the inherent risks associated with option trading in Gamestop:

- Volatility: Gamestop’s stock price is notoriously volatile, magnifying the risks and potential rewards of option trading.

- Timing Risk: Options have finite lifespans, posing the risk of time decay diminishing their value.

- Complexity: Option trading requires a thorough understanding of complex financial concepts and strategies, making it unsuitable for novice investors.

Expert Insights and Actionable Tips

Navigating the option trading landscape in Gamestop demands the wisdom of seasoned experts. Renowned financial analyst Greg Harmon cautions, “Option trading is not a get-rich-quick scheme. It requires discipline and a deep understanding of risk management.”

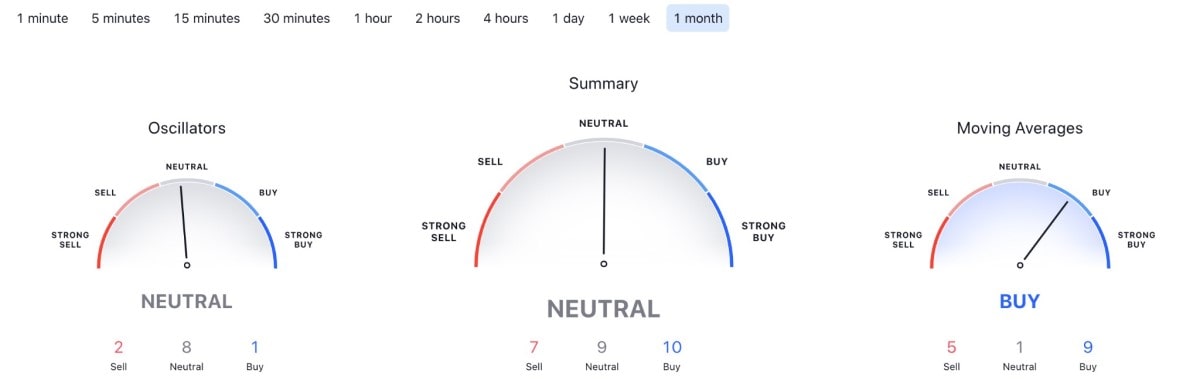

- Embrace Market Research: Scrupulously study market trends, company fundamentals, and technical indicators to gain a comprehensive understanding of market dynamics.

- Trade with Capital You Can Afford to Lose: The volatility associated with Gamestop stock warrants caution. Never risk capital that cannot be comfortably absorbed in the event of losses.

- Seek Guidance from Seasoned Mentors: Knowledge and experience are indispensable in option trading. Seek guidance from reputable mentors who can impart invaluable insights and strategies.

Option Trading Gamestop

Image: www.reddit.com

Conclusion

Option trading in Gamestop offers a tantalizing yet perilous landscape where fortunes can be made and lost in the blink of an eye. By embracing a deep understanding of the complexities involved, implementing sound risk management practices, and seeking expert guidance, investors can potentially harness the power of option trading to enhance their financial outcomes. However, it is crucial to approach this dynamic arena with both exhilaration and prudence, mindful of the inherent risks it harbors. Like a daring game of chess, option trading in Gamestop demands strategic finesse, calculated risk-taking, and a keen eye on the ever-shifting market.