Introduction

In January 2021, the world witnessed an extraordinary event that shook the foundations of traditional finance: the meteoric rise and subsequent plummet of GameStop stock. At the heart of this financial rollercoaster was a surge in options trading, driving the stock price to dizzying heights before sending it crashing down. This article delves into the captivating story of the GameStop options trading phenomenon, exploring its origins, strategies, and the profound impact it has had on the financial landscape.

Image: play.google.com

The Power of Retail Investors

The rise of GameStop was fueled by an unprecedented influx of retail investors, many of whom were armed with online trading platforms that made it easier than ever before to participate in options trading. These everyday investors, driven by a shared belief in the stock’s potential, banded together to drive up its price by purchasing call options. Call options give the buyer the right to purchase a stock at a specified price on or before a certain date. As retail investors bought more call options, the demand for GameStop shares increased, leading to a dramatic rise in its stock price.

Short Squeeze: A Dangerous Game

The surge in GameStop options trading triggered a chain reaction known as a short squeeze. Hedge funds and other institutional investors had been betting heavily against the stock, a practice known as short selling. When GameStop’s stock price began to rise, these short sellers were forced to cover their positions by buying back the shares they had sold. This created even more demand for the stock and further amplified the price rise. The short squeeze sent shockwaves through Wall Street, as major financial institutions lost billions of dollars.

The Thrill of the Ride

The GameStop options trading saga captivated audiences around the world. Social media platforms became a battlefield, with both retail investors and traditional analysts engaging in heated debates. The rapid price fluctuations and the David-versus-Goliath narrative created a thrilling spectacle that kept everyone on the edge of their seats. The rise of GameStop showed the potential for retail investors to disrupt established financial institutions and spark financial revolutions.

Image: www.freexenon.com

Regulation and Aftermath

The GameStop frenzy did not come without its challenges. Regulators and financial authorities were caught off guard by the extent of the retail trading activity. In the aftermath of the event, lawmakers and financial regulators proposed new measures to enhance market stability and protect investors. The Securities and Exchange Commission (SEC) implemented rules to curb excessive volatility and ensure fair trading practices in the options market.

Impact on Traditional Finance

The GameStop options trading episode has left an enduring mark on the financial industry. It highlighted the growing influence of retail investors and the potential of social media in shaping market sentiment. Fund managers and institutional investors have since become more cognizant of the power of retail sentiment and the risks associated with short selling. The event also accelerated the adoption of new technologies and trading platforms that cater to the needs of individual investors.

Lessons Learned

The GameStop options trading phenomenon offers valuable lessons for investors. It underscores the importance of due diligence, understanding the risks involved in options trading, and avoiding blind speculation based solely on social media hype. Moreover, it highlights the need for continuous monitoring and adaptability in the face of rapidly changing market conditions. Investors must always remember that even in the most captivating financial tales, there are risks that should not be ignored.

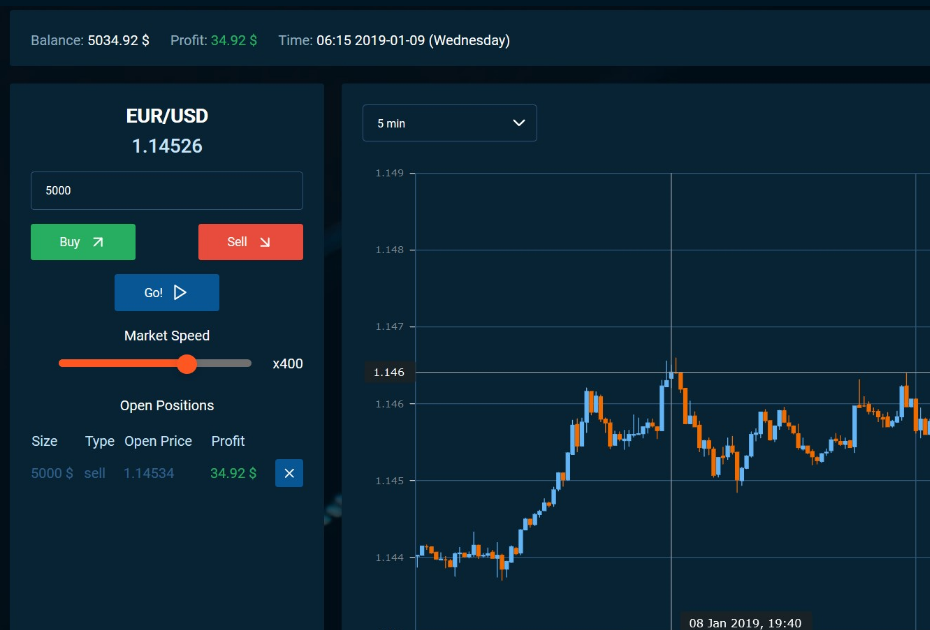

Options Trading Game Stop

Image: forexgame.io

Conclusion

The rise and fall of GameStop options trading will forever be etched in the annals of financial history. It demonstrated the profound impact that retail investors can have on the financial markets and exposed vulnerabilities in traditional investing practices. As the financial landscape continues to evolve, the lessons learned from the GameStop saga will serve as valuable reminders of the ever-changing nature of the investing world. By embracing a balanced approach that considers both opportunities and risks, investors can navigate the complexities of the financial markets with greater success.