Introduction

Image: thedeepdive.ca

In the tumultuous realm of the stock market, the saga of GameStop’s option trading frenzy in early 2021 stands as a testament to the unprecedented power of retail investors and the volatility of modern markets. Fueled by social media and online trading platforms, a surge of individual traders targeted heavily shorted stocks, sending shockwaves through the financial industry and captivating the world’s attention.

The Historic Short Squeeze

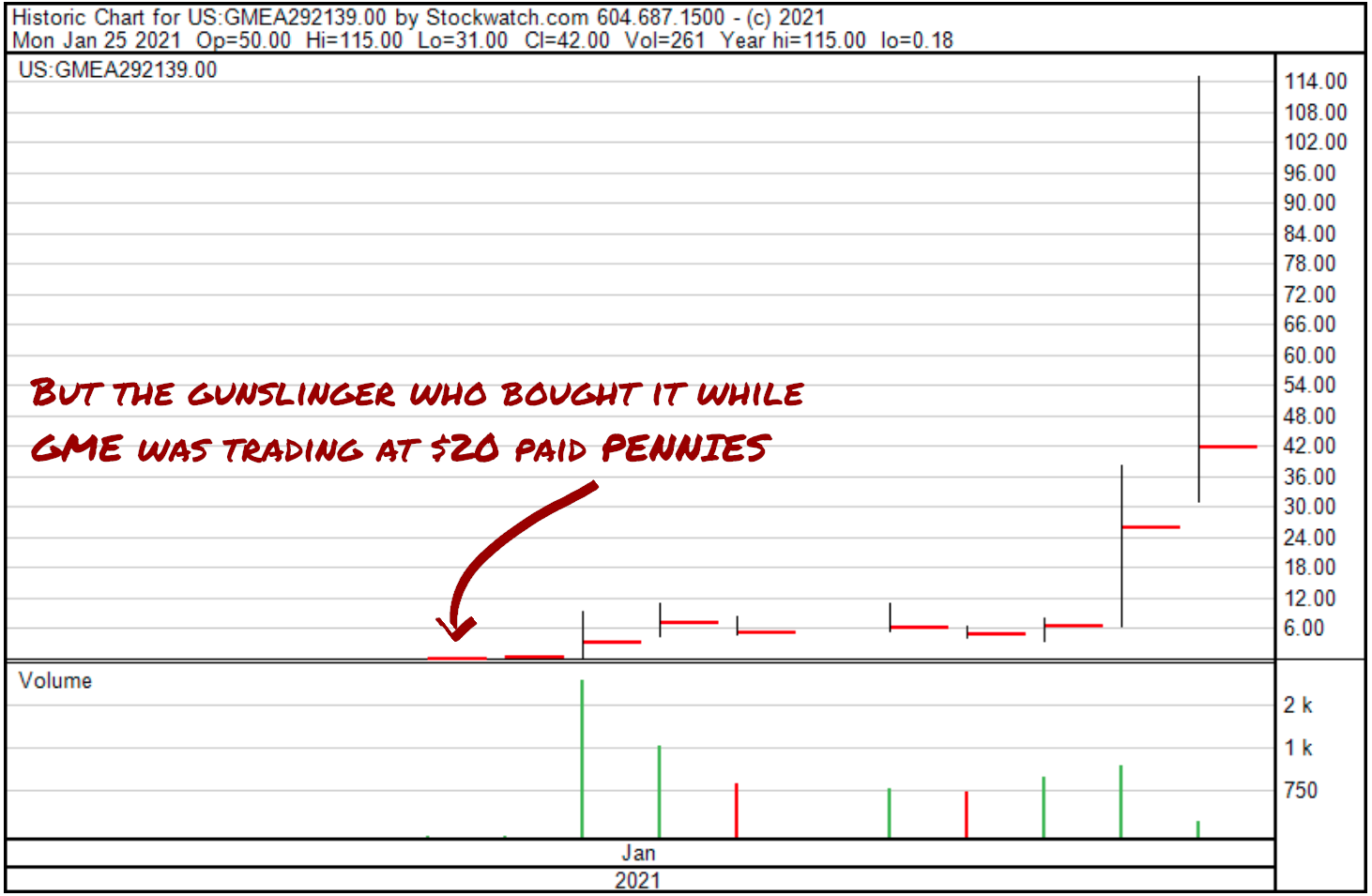

GameStop, a struggling video game retailer, had long been targeted by short sellers, hedge funds betting on its stock price to decline. However, a surge in retail interest ignited by the Reddit forum WallStreetBets led to a massive influx of call option purchases. As the stock price climbed, short sellers were forced to cover their positions, further driving up demand and triggering a historic short squeeze.

The Mechanics of Option Trading

Options are financial instruments that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) on or before a given date (expiration date). By purchasing call options, retail traders essentially leveraged their bets on GameStop, amplifying their potential gains if the stock price rose.

The Impact on the Market

The GameStop saga exposed the vulnerability of heavily shorted stocks and the growing influence of retail traders in shaping market trends. Hedge funds suffered significant losses, and the volatility of option trading raised questions about market stability. The events also spurred regulatory scrutiny as policymakers sought to understand and prevent potential systemic risks.

Lessons Learned and Advice for Traders

The GameStop saga offers valuable lessons for both retail and institutional investors:

- Be aware of the risks: Option trading can amplify both gains and losses, and it’s crucial to understand the risks involved before investing.

- Manage risk: Hedge your positions and use stop-loss orders to limit potential losses.

- Don’t chase trends: Avoid buying options at inflated prices based on short-term momentum.

- Research and due diligence: Thoroughly research underlying assets and understand the potential catalysts for price changes.

- Be patient: Option trading requires patience and the ability to withstand market fluctuations.

Conclusion

The GameStop saga serves as a reminder of the dynamic nature of markets and the potential for both substantial gains and significant risks in option trading. By understanding the mechanics of options, managing risk, and following expert advice, traders of all levels can make informed decisions and navigate the complex world of financial markets.

Are you interested in learning more about GameStop’s option trading saga?

FAQ

- What was the GameStop short squeeze?

A massive rally in GameStop stock triggered by a surge in retail option trading, forcing short sellers to cover their positions.

- How does option trading work?

Options give the buyer the right to buy (call option) or sell (put option) an underlying asset at a specified price.

- What are the risks of option trading?

Option trading can amplify both gains and losses, and it’s important to manage risk and understand the potential downside.

- What lessons can we learn from the GameStop saga?

Traders should be aware of risks, manage positions, research underlying assets, and avoid chasing trends.

Image: moschetto34545.blogspot.com

Gme Option Trading