Imagine a stage where the actors are stocks and the audience plays the role of investors. Among these spectators, there’s a select group known as options traders, holding a unique backstage pass that grants them the power to shape the direction of the play. One such instrument they wield is the mighty “m play” options strategy. What is it, and how can you harness its potential? Let’s pull back the curtain and delve into the captivating world of m play options trading.

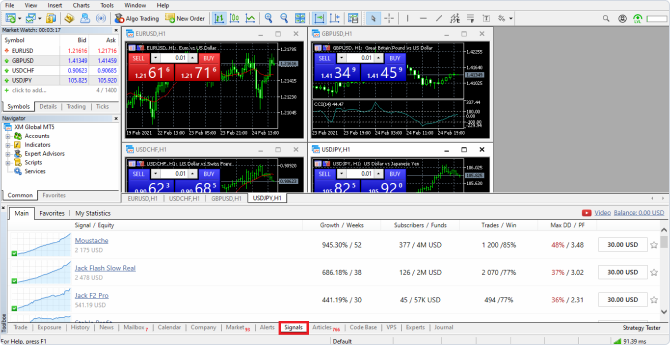

Image: tradersunion.com

Unveiling M Play Options Trading: A Game of Leverage and Calculated Risk

Options, as financial instruments, bestow upon traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). These contracts carry a premium, which represents the cost of acquiring this right. M play options trading takes this concept a step further, involving the simultaneous purchase of a call option and a put option with the same strike price but different expiration dates.

Navigating the Strategy: A Symphony of Expiration Dates

The beauty of m play options trading lies in its flexible nature. By strategically selecting expiration dates for the call and put options, traders can adapt the strategy to various market scenarios and customize their risk-reward profile. For instance, a near-term expiration date for the call option and a longer-term expiration date for the put option would favor a scenario where the trader anticipates a surge in the underlying asset’s price within the short term, followed by a potential decline in the longer term.

Understanding the Payout: Balancing Gains against Losses

The payout structure of m play options trading is a delicate dance between potential gains and inevitable losses. If the underlying asset’s price moves in favor of the trader’s predictions, the call option may generate substantial profits, offsetting the premium paid for both options. However, if the market takes an unfavorable turn, the put option acts as a safety net, potentially mitigating losses to an extent.

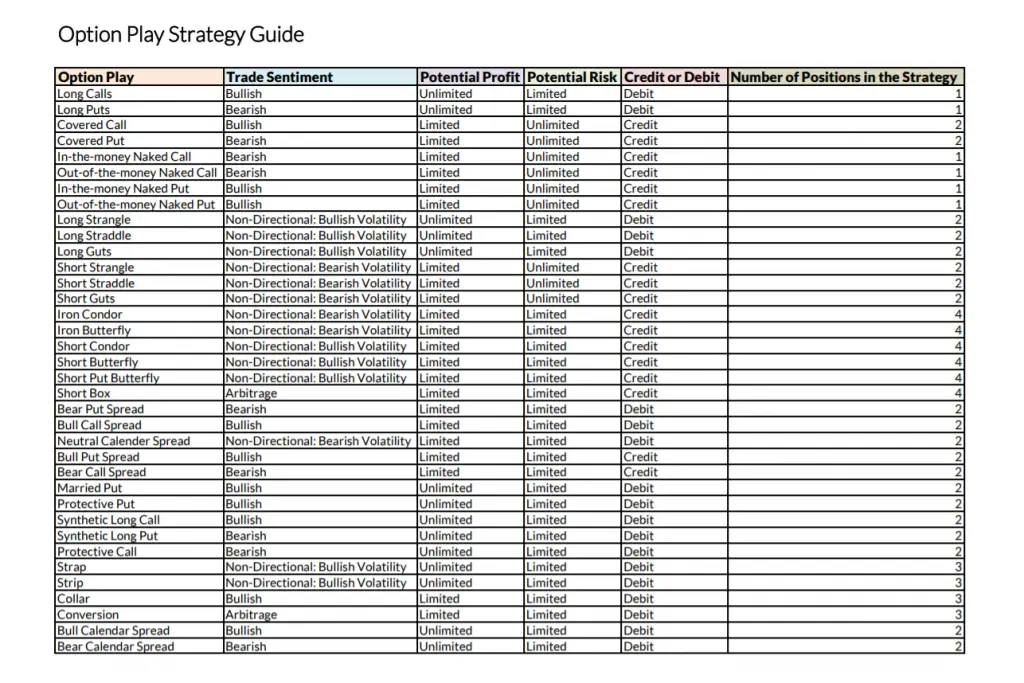

Image: www.newtraderu.com

Mastering M play: Unveiling the Art of Precision

Executing profitable m play options trades requires a keen eye for market trends, meticulous planning, and precise execution. Traders must carefully analyze the underlying asset’s price movements, study historical volatility patterns, and forecast future price trajectories to maximize their chances of success. Additionally, managing risk through position sizing and hedging strategies is paramount to navigate the often-turbulent waters of the financial markets.

M Play Options Trading

Image: www.mql5.com

Conclusion: Empowering Traders with Versatility and Opportunity

M play options trading presents a versatile and dynamic strategy that empowers traders to express their market views and potentially enhance their returns. By mastering its nuances, investors can navigate the complexities of the financial markets with greater confidence and precision. Whether you’re a market novice or a seasoned trader, incorporating m play strategies into your investment arsenal can bring new dimensions to your trading journey.