Have you ever wondered how investors can profit from market sentiment without having to take a directional view on the underlying asset? The answer lies in a sophisticated options strategy known as skew trading. This technique involves exploiting the difference between the implied volatility of out-of-the-money (OTM) calls and puts, allowing traders to capitalize on market expectations and potential market biases.

Image: luckboxmagazine.com

Skew trading options offer a unique opportunity to generate income in relatively flat or range-bound markets, where significant price movements in either direction are unlikely. This makes it an attractive strategy for both experienced options traders and those new to the world of options investing. Let’s dive into the intricacies of skew trading options and how you can integrate this strategy into your trading repertoire.

Understanding Skewness and Implied Volatility

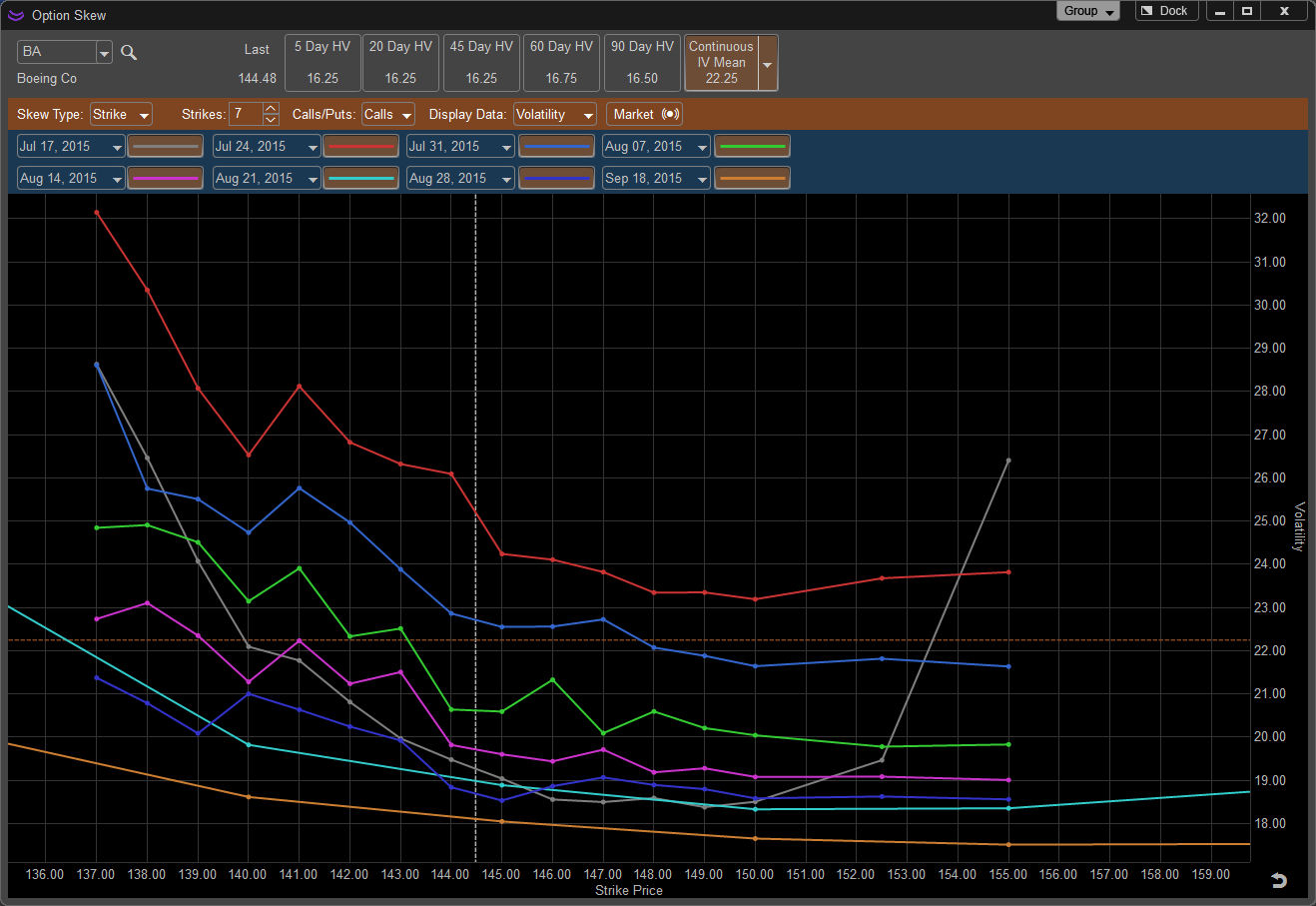

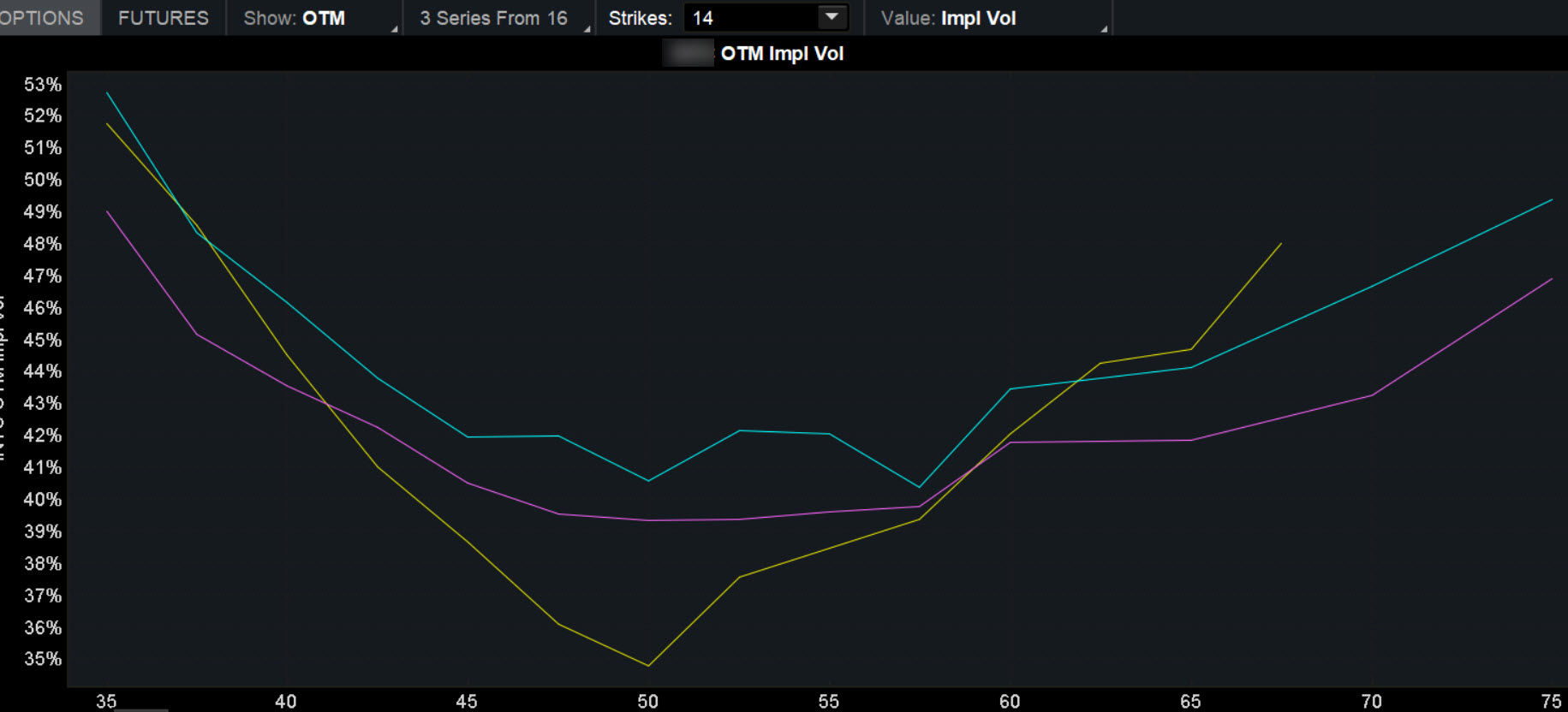

Skewness, in the context of options trading, refers to the asymmetry in the implied volatility (IV) of OTM call and put options. Typically, implied volatility is higher for OTM call options than for OTM put options. This is because the market tends to assign a higher probability of significant upward price movements than significant downward price movements.

Implied volatility is a key metric that traders use to gauge market sentiment and expectations regarding the future volatility of an underlying asset. In skew trading, traders seek to profit from discrepancies between the implied volatility of calls and puts.

Types of Skew Trades

There are two main types of skew trades:

-

Bullish Skew Trades: Traders expect market sentiment to remain bullish, with a higher probability of upward price movements. They buy OTM call options and sell OTM put options at the same strike price and expiration date.

-

Bearish Skew Trades: Traders expect market sentiment to turn bearish, with a higher probability of downward price movements. They buy OTM put options and sell OTM call options at the same strike price and expiration date.

Factors Influencing Skewness

The skewness of options can be influenced by several factors, including:

- Macroeconomic conditions

- Market sentiment

- Event risk

- Historical volatility

- Time to expiration

Traders should carefully consider these factors when analyzing skew and developing their trading strategies.

Image: www.dynamictrend.com

Benefits of Skew Trading Options

Skew trading options offers several advantages, including:

- Income generation: Skew trades can generate income in both flat and trending markets.

- Low directional risk: Traders do not need to take a directional view on the underlying asset, reducing directional risk.

- Diversification: Skew trading can diversify a trading portfolio by providing exposure to different market scenarios.

- Scalability: Skew trades can be scaled up or down to meet the risk appetite and capital base of traders.

Risks Associated with Skew Trading Options

As with any trading strategy, skew trading options involves certain risks:

- Volatility risk: If the implied volatility of the underlying asset decreases, the value of skew trades may decline.

- Time decay: Skew trades are time-sensitive, and the value of the options will decay as the expiration date approaches.

- Liquidity risk: Skew trades may become illiquid in certain market conditions, making it difficult to exit positions.

- Margin requirements: Skew trades often require margin, which can amplify potential losses if market conditions turn unfavorable.

Skew Trading Options

Image: tickertape.tdameritrade.com

Conclusion

Skew trading options is a powerful strategy that savvy traders can use to profit from market sentiment and potential market biases. By understanding the concept of skewness, analyzing the factors influencing skewness, and carefully managing risk, traders can develop profitable skew trading strategies. However, it is important to remember that, as with any investment strategy, there are inherent risks involved, and traders should only allocate capital that they are comfortable losing. By carefully considering these factors and conducting thorough research, traders can effectively integrate skew trading into their options trading arsenals and enhance their chances of success.