Introduction

In the enigmatic realm of options trading, options skew trading stands out as a mesmerizing technique that unlocks the hidden sentiments of the market. By harnessing the asymmetry in implied volatility across different strike prices, traders can decipher the collective expectations of market participants and make informed decisions that yield substantial returns. Intrigued? Embark on an enlightening journey into the captivating world of options skew trading, where market sentiment becomes your guiding star.

Image: the7circles.uk

Unraveling the Skew: Foundations of Options Skew Trading

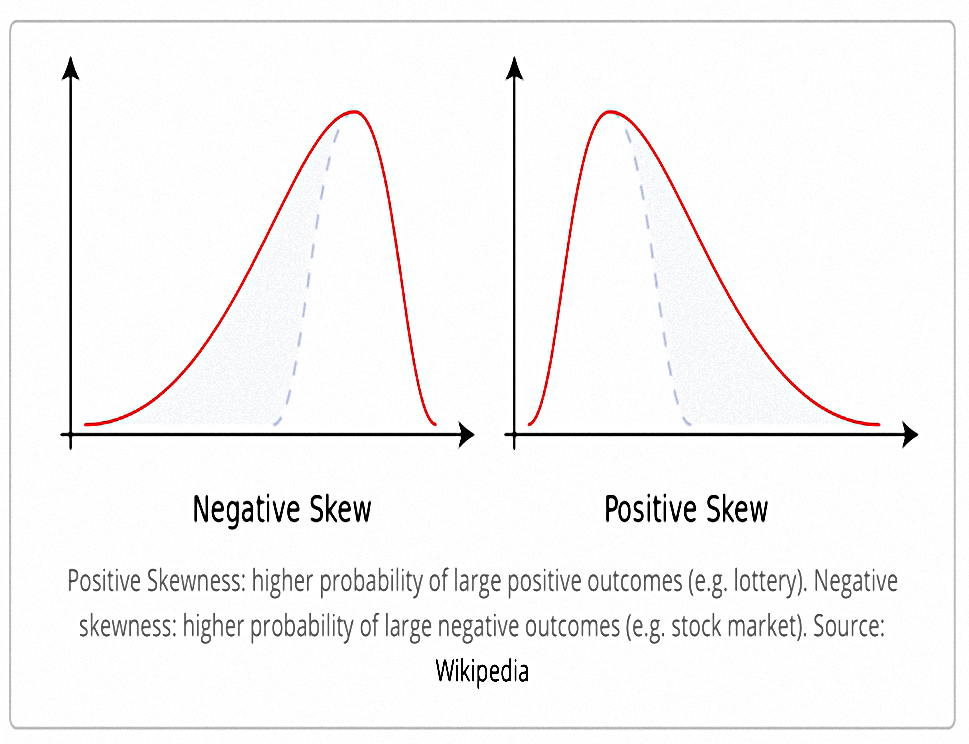

An option’s implied volatility, a key parameter embedded in its price, paints a vivid picture of the market’s perceived risk and uncertainty. Options skew trading leverages the disparities in implied volatility across different strike prices to unveil market sentiment. By meticulously analyzing these variations, traders can deduce whether market participants are predominantly bullish or bearish, gaining an invaluable edge in their trading endeavors.

Strolling through the annals of options skew trading, we encounter the pioneering efforts of the legendary trader Marc Rich, who astutely exploited this technique to amass a vast fortune. Rich’s legacy serves as a testament to the power of options skew trading, inspiring generations of traders to master this intricate art.

Tailwind or Headwind: Bulls versus Bears in the Options Arena

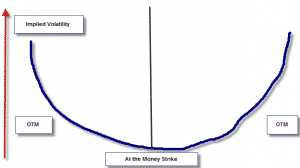

Understanding the dynamics of market sentiment is paramount for successful options skew trading. When the market exudes optimism, the implied volatility of out-of-the-money call options (which benefit from rising prices) tends to be elevated, resulting in a positive skew. Conversely, a negative skew emerges when the market harbors a pessimistic outlook, causing out-of-the-money put options (which profit from falling prices) to exhibit elevated implied volatility.

By astutely interpreting options skew, traders can gauge the underlying biases of market participants. A consistently positive skew, for example, suggests a persistent bullish sentiment, while a persistent negative skew indicates a prevailing bearish outlook. Equipped with this knowledge, traders can align their strategies with the dominant market forces, maximizing their profit potential.

Expert Insights: Navigating the Skewness Landscape

Seasoned options skew traders endorse the following strategies for successful trading:

-

Identify extreme skews: Nonconformist skews, significantly deviating from the market norm, often present lucrative opportunities for traders.

-

Consider the underlying asset’s characteristics: The historical volatility, liquidity, and industry dynamics of the underlying asset can influence options skew.

-

Monitor news and market events: News and events can dramatically alter the market’s perception of risk, causing rapid shifts in options skew.

-

Risk management is paramount: Options skew trading carries inherent risks, and prudent traders implement robust risk management strategies to mitigate potential losses.

Image: optionstradingiq.com

Options Skew Trading

Image: www.menthorq.co

Conclusion: Options Skew Trading—A Gateway to Market Wisdom

Options skew trading empowers traders with a penetrating lens into market sentiment, allowing them to navigate the financial landscape with increased precision. By harnessing the power of this technique, traders can uncover hidden opportunities, proactively respond to market shifts, and unlock the full potential of options trading. As you delve deeper into the captivating world of options skew trading, remember the words of the enigmatic trader George Soros: “The highest return often comes from unconventional thinking.”